Info Requested

Overview

Your simultaneous assumption and Flex modification exception review request will be placed in an Info Requested status when additional information is needed from you in order for Freddie Mac to provide a decision.

Provide the requested information via the Borrower Profile Financial data fields or the Comments field and re-submit the request to Freddie Mac via the ACTIONS ![]() button in Resolve.

button in Resolve.

This step is applicable when the Info Requested status is triggered through either the Resolve® UI or Retention API. If the Servicer is an API user, this step must be performed only through the Resolve UI submission path. Note: If you are an API user and do not have access to the Resolve UI, you must request access to Resolve via Access Manager, a self-service system that allows you to create, manage, and provision administrator and user access to certain Freddie Mac technology tools.

Info Requested Status Workflow

Once you have submitted updated information, the simultaneous assumption and Flex modification exception review request will move back to In Review status. A Freddie Mac analyst will review the updated information you have provided as part of the review process.

Note: The request can move from Info Requested to In Review status multiple times throughout the review and decisioning process depending on the circumstances.

Cancelling a Request in an Info Requested Status

Simultaneous assumption and Flex modification exception review requests in an Info Requested status move to a Rejected status if you have contacted Freddie Mac to request a cancellation prior to a final decision being made on the request.

You can call your Freddie Mac analyst, or email [email protected] to request the cancellation.

What would you like to learn about?

Viewing Your Workout Request Details:

View the details of your simultaneous assumption and Flex modification workout request by using one of the following methods listed below.

Method 1:

From Resolve's Dashboard page, click the Freddie Mac Loan Number hyperlink to open up the simultaneous assumption and Flex modification Details page.

Method 2:

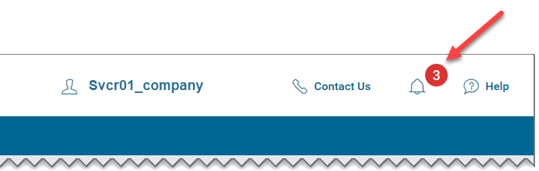

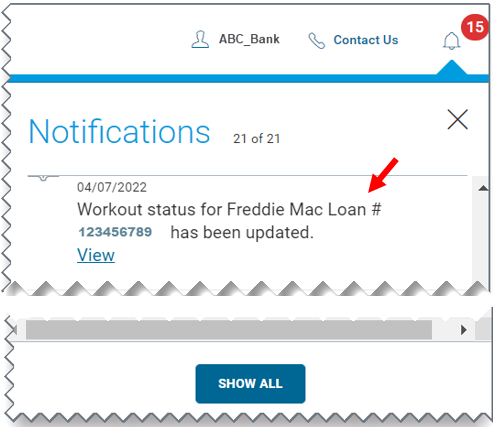

1. Click the ![]() icon, to open Notifications. Your Resolve notification messages will display.

icon, to open Notifications. Your Resolve notification messages will display.

2. Select the Resolve notification message that you would like to view from the list. Each message will contain the Freddie Mac Loan number and the updated status of the request.

3. Click the View link in the message to open up the simultaneous assumption and Flex modification Details page.

Using the Actions  Menu

Menu

When Freddie Mac places your simultaneous assumption and Flex modification request in Info Requested status, you will need to provide additional and/or updated information in order for the request to be decisioned.

You will only see the ACTIONS ![]() button at the top right corner of the simultaneous assumption and Flex modification Details page when your request is in Info Requested status.

button at the top right corner of the simultaneous assumption and Flex modification Details page when your request is in Info Requested status.

When the ACTIONS ![]() button is clicked, an editable view will open. You can then enter or edit the information in the Borrower Profile Financial data fields and the Comments field and submit the request back to Freddie Mac.

button is clicked, an editable view will open. You can then enter or edit the information in the Borrower Profile Financial data fields and the Comments field and submit the request back to Freddie Mac.

Refer to the Providing Updated Data section for step-by-step guidance on how to update the information in Resolve.

Access the Dashboard and simultaneous assumption and Flex modification Details page to review loan details including status, comments, history, etc.

For API users, subsequent actions can be done through API or UI submission paths(e.g.,settlement approval requests, etc.).

Learn more about:

Editing the Borrower Financials