Editing Borrower Financial Data Fields

Your Flex Modification exception review request will be placed in an Info Requested status when additional information is needed from you in order for Freddie Mac to provide a decision. Once the loan is in an Info Requested status, the Details page in Resolve® contains the borrower financial data fields that become editable to update or provide additional data.

This step is applicable when the Info Requested status is triggered either through Resolve UI or Retention API submission. However, if a Servicer is an API user, this step can only be performed through the UI submission path, via the . If you are an API user that does not have access to the Resolve UI, you must request access via Access Manager to perform this step.

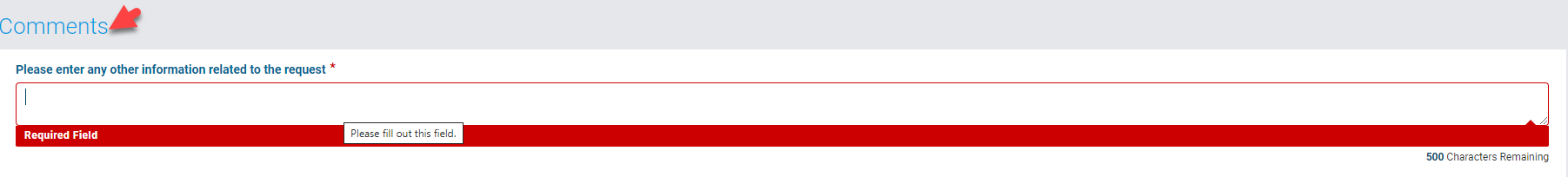

IMPORTANT: Required fields are identified with a red asterisk*. Ensure required fields are not left blank.

Update Request

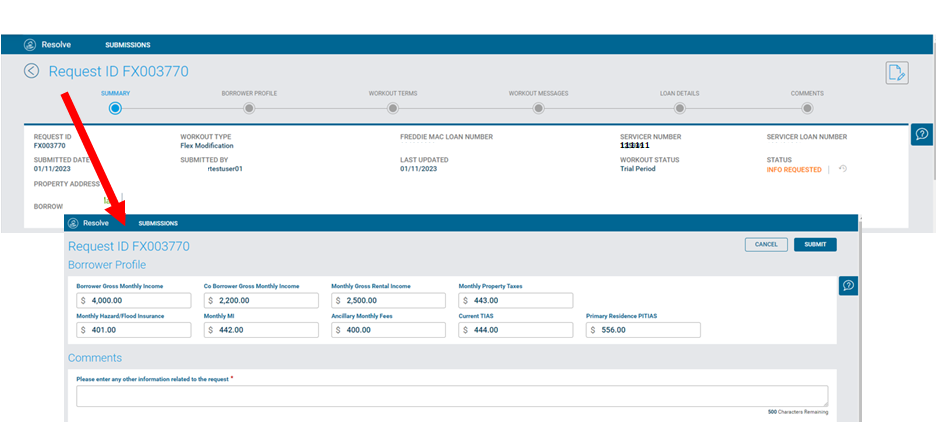

Provide the requested information via the editable fields for borrower financial information and/or additional comments, and re-submit the request to Freddie Mac via the Actions button ![]() in the Resolve UI.

in the Resolve UI.

Editable Fields

Refer to the table below for more information on each editable field.

| Editable Fields | Descriptions | ||||||||

| Borrower Gross Monthly Income | The amount of the borrower(s)' total household income before taxes. Includes employment income and additional sources of revenue, such as Social Security payments. | ||||||||

| Co-Borrower Gross Monthly Income | The monthly dollar amount received by the co-borrower as income before taxes. | ||||||||

| Monthly Gross Rental Income | The amount of revenue generated by the subject property from rent on a monthly basis. | ||||||||

| Monthly Property Taxes | The dollar amount of the monthly expense for property taxes on the subject property. | ||||||||

| Monthly Hazard/Flood Insurance | The dollar amount of the monthly expense to cover hazard/flood insurance premiums for the subject property. | ||||||||

| Monthly MI | The dollar amount of the monthly expense to cover the mortgage insurance premium. | ||||||||

| Ancillary Monthly Fees | The dollar amount of the monthly condominium or homeowner's association fees related to the subject property. | ||||||||

| Current TIAS | The borrower's monthly taxes, insurance and escrow shortage payment prior to the modification. | ||||||||

| Primary Residence PITIAS | The total dollar amount of monthly principal, interest, property tax, hazard insurance, ancillary fees (association dues), and escrow shortage payment, if applicable for the PRIMARY residence. | ||||||||

| Comments* |

This is an editable field when the loan is in an Info Requested status and additional information is required by the Servicer.

|

||||||||

The Comments field is a required data field which is identified by a red asterisk * and can not be left blank. You will not be able to submit updated information without completing the required Comments field.

When a loan is in an Info Requested status, follow the steps below to Update Request with additional information, as requested by a Freddie Mac analyst:

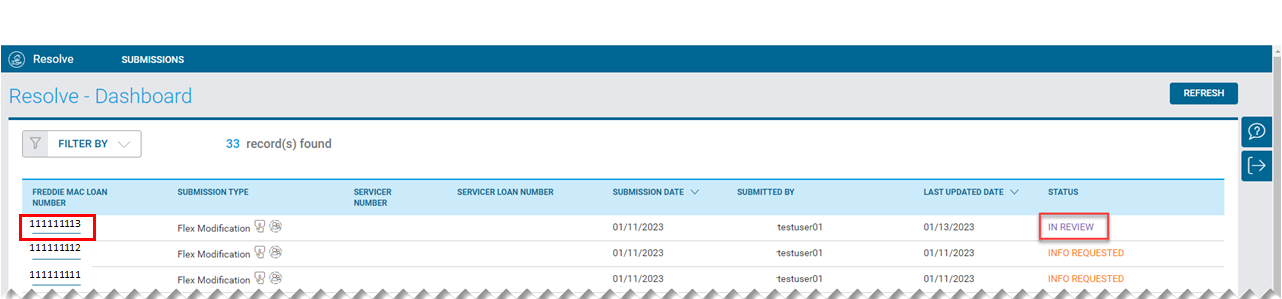

1. From the dashboard, click the Freddie Mac loan number hyperlink to navigate to the Details page.

Note the number of Notification alerts indicated by the bell icon in the upper right corner.

2. On the Details page, you can view the status progression of the loan by clicking the time clock next to the status field (i.e. "Info Requested").

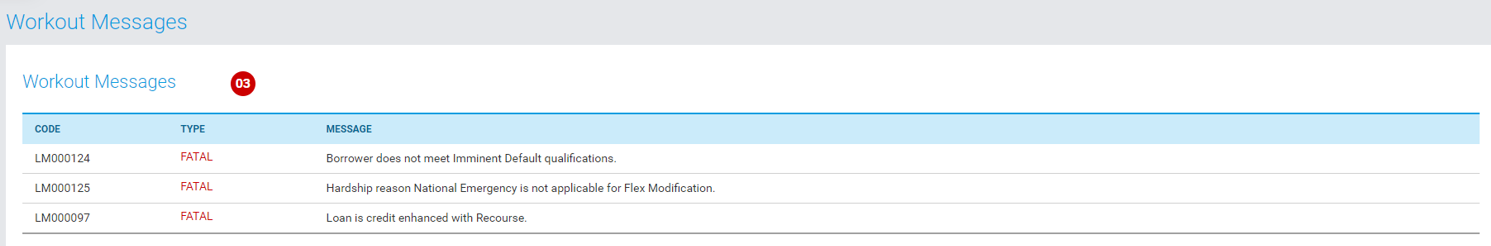

3. Scroll down the Details page to the Workout Messages section and review the workout error messages and the Comments section to determine the appropriate response to the Freddie Mac analyst. API users can review the Resolve Retention Request Validation Error Message Quick Reference for more details regarding error messages.

Note: Workout messages will remain on the list even after the request has been completed.

4. Navigate to the upper right corner of the Details page and click on the Update Request button  .

.

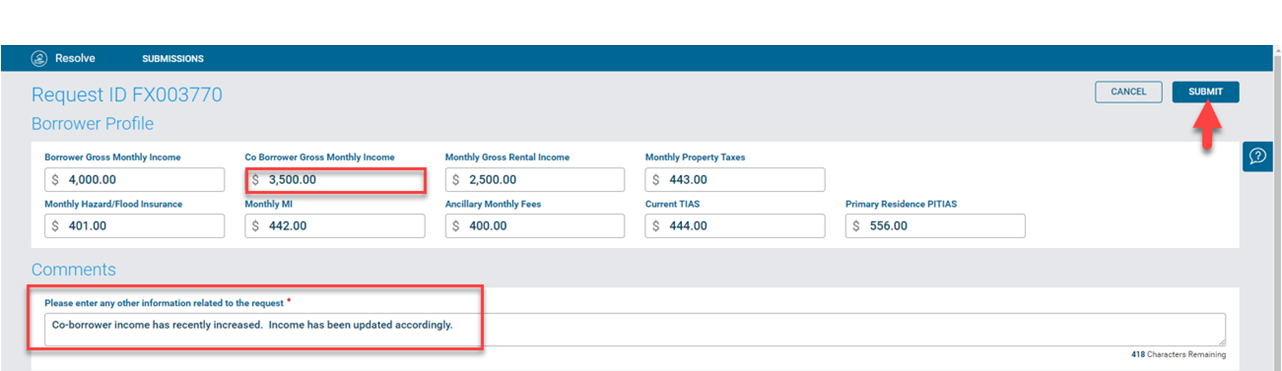

5.The Borrower Profile section opens, allowing you to edit the borrower's financial information.

6. In the editable fields, update the borrower's financial information, as applicable and provide additional comments relevant to the requested information. Click Submit or Cancel.

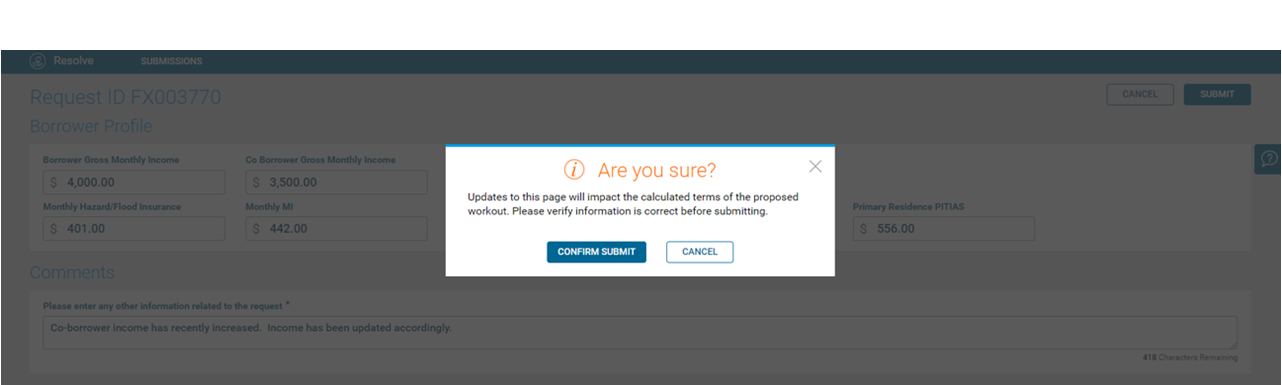

7. Upon clicking Submit, the "Are you sure?" pop-up box displays confirming your submission and a message that states the updates made to the page will impact the calculated terms of the proposed workout. Click Confirm Submit or Cancel.

8. The Details page reflects a successful green banner message verifying the updates have been saved. The status progression changes from Info Requested status to In Review status.

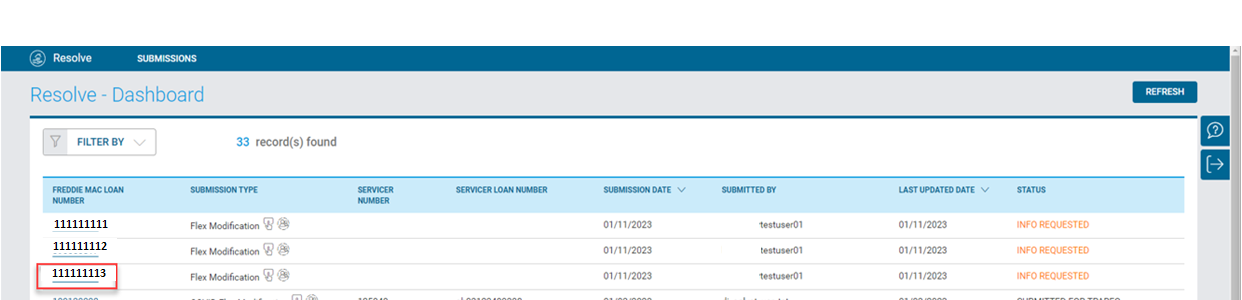

9. Navigate to the dashboard to view the loan's updated In Review status.

Note: Use the Refresh button in the upper right corner to refresh your dashboard pipeline, if necessary.