Providing Updated Data

Overview

If your Flex Modification request has been placed in an Info Requested status, additional information is needed from you for Freddie Mac to provide a decision on your request.

The Flex Modification Details page in Resolve® contains editable fields for borrower financial data and any additional comments. You can provide updated information via the Borrower Profile financial data fields and/or the Comments section of the Workout Details page and then submit the request back to Freddie Mac.

Updated borrower financial information and comments that you add in Resolve automatically updates in the Retention API and the Resolve UI after a final decision on the exception review request is made.

When your request is in an Info Requested status, you can only provide updated information and/or comments via the ACTIONS button ![]() through the UI.

through the UI.

What would you like to learn about?

How to Provide Updated Data in Resolve

How and When to use the Actions Button

How to Edit Borrower Financial Data

How to Provide Updated Data in Resolve

You can follow the steps below to provide updated data in Resolve and respond back to Freddie Mac:

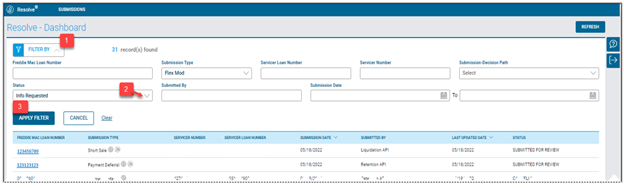

1. From the Resolve® Dashboard, click on FILTER BY.

2. In the Status field, select Info Requested from the drop-down menu.

3. Click the APPLY FILTER button to display all of your requests in Info Requested status. If needed, you can also filter by Submission Type to identify your Flex Modification submissions more quickly.

4. Select the Freddie Mac loan number hyperlink to open its corresponding Flex Modification Details page.

5. From the Flex Modification Details page, click the Update Request button ![]() .

.

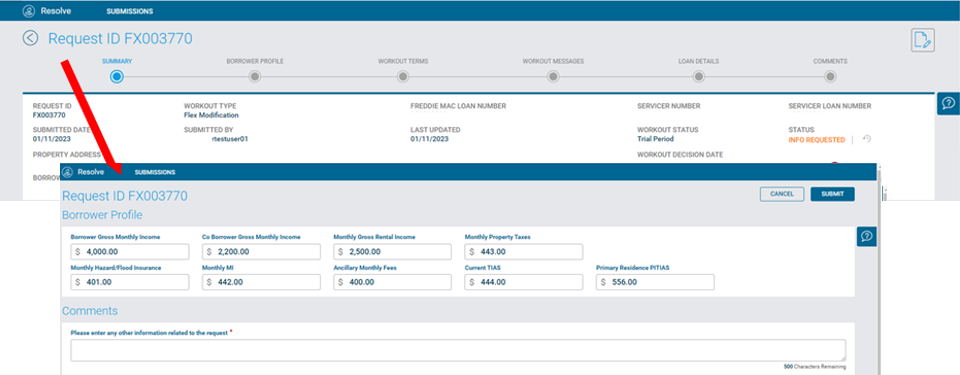

6. When the Update Request button ![]() is clicked, the Borrower Profile and Comments section opens to respond to the request for additional information. Prior to responding, review the Workout Messages and Comments sections to ensure that you are providing the necessary information.

is clicked, the Borrower Profile and Comments section opens to respond to the request for additional information. Prior to responding, review the Workout Messages and Comments sections to ensure that you are providing the necessary information.

7. Enter borrower financial information, loan data and any comments as necessary. The Comments field accepts up to 500 characters and has a counter under the bottom right corner of the box to track the number of characters you have entered. Click SUBMIT or CANCEL.

| Select: | To: |

|

The 'Are You Sure?' Confirmation box displays. Proceed to step 8. |

|

Return to the Workout Details page and any comments entered will not be saved. |

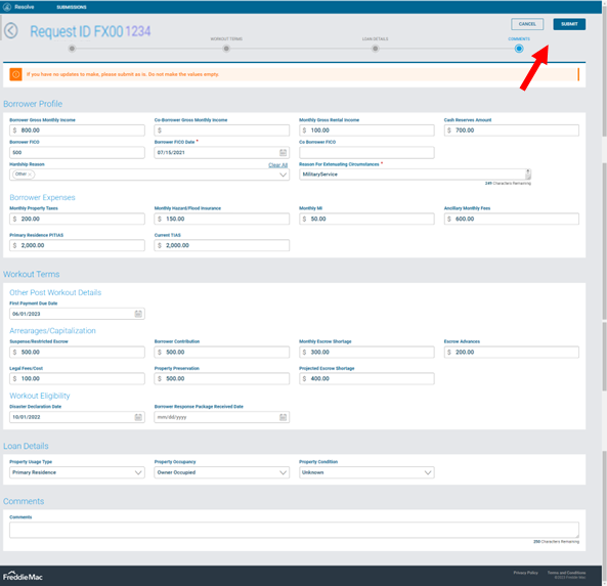

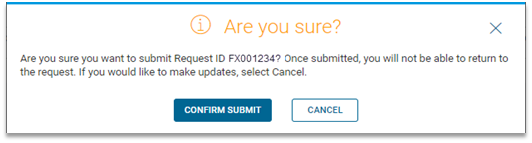

8. When you select Submit, the 'Are You Sure?' Confirmation box displays. Click Confirm Submit or Cancel.

| Select: | To: |

|

Proceed with submitting your updated information to Freddie Mac. Important: You must ensure that the data you are providing is accurate and complete prior to clicking Confirm Submit. You will not be able to edit your data once you have submitted it. |

|

| Return to the option of editing the comments or selecting Cancel to return to the Flex Modification Details page. |

9. When you click Confirm Submit, the Flex Modification Details page displays confirming the request was successfully updated and saved. The confirmation message will persist on the screen until another screen is accessed.The status of the request will change from Info Requested to In Review. Refer below to the Viewing Comments in Your Request section for additional details.

10. The Freddie Mac team will receive an internal notification alerting them that you have submitted the request. The review and decisioning process will continue for the request.

Viewing Comments and Edited Fields in Your Request

You can view comments and updated data fields in your request on the Flex Modification Details page. Comments made by Freddie Mac appear with an orange line and comments (limited to 500 characters) made by your organization appear with a green line.

Any comments that you have added appear in the Comment history.

How to Edit Borrower Financial Data

Once the loan is in an Info Requested status, the Details page in Resolve contains the borrower financial data fields that become editable to update or provide additional data.

This step is applicable when the Info Requested status is triggered either through the Resolve UI or Retention API submission paths. If a Servicer is an API user, this step must be performed only through the Resolve UI. If you are an API user that does not have access to the Resolve UI, you must request access via Access Manager in order to perform this step.

To learn more about how to edit the borrower's financial information, refer to the Editing Borrower Financial Data section.