Request a Cancellation

An approved request will move to a Cancelled status if you have submitted a cancellation request (via the Resolve user interface or the Resolve Liquidation API) to Freddie Mac prior to the settlement of the short sale.

Freddie Mac will process the cancellation and update the request's status on the dashboard page in Resolve.

Submitting a Cancellation Request through the Resolve Liquidation API

For API submissions, users have read-only access to the dashboard and Details page to review details including status, comments, history, etc. A cancellation request must be done through a subsequent API submission.

You should submit the cancellation request via the Resolve Liquidation API any time prior to the settlement of the short sale. If submitting the cancellation request through the API, you should include the Request ID and ensure that the Exception Indicator is a 'Y'.

Refer to the Resolve Liquidation API Reference Guide on the Developer Portal for additional details on submitting a cancellation request.

Submitting a Cancellation Request through Resolve

There are two methods that you can use to submit a cancellation request through Resolve's user interface:

- Use the file upload functionality on the Submissions page, or

- Use the Actions menu on the Details page.

Reminder: The workout request must be in an Approved status in order to submit a cancellation request. Cancellations cannot be completed on workouts in an Approved For Settlement or Closed status.

How to Upload a Cancellation Request into Resolve

The cancellation request can be uploaded into Resolve via the Short Sale Template as a stand-alone file, or submitted with other loan records even if those are workout approval requests and/or other settlement requests. In other words, you can co-mingle different types of workout requests in a single upload file.

The following five fields are required for uploaded cancellation requests:

| Liquidation Loan File Template Field Name: | Column: | Field Type: | Description: |

|

Freddie Mac Loan Number REQUIRED FIELD |

A | Numeric | Nine-digit unique Freddie Mac identifier assigned to the loan. |

|

Seller Servicer Number REQUIRED FIELD |

B | Numeric | Six-digit unique Freddie Mac identifier assigned to the organization servicing the loan. |

|

Workout Program Type REQUIRED FIELD |

D | Drop-down List |

Indicates the type of workout. Currently, the only option available to select for this field is 'SHRTSLE' (short sale). |

|

Workout Reporting Status Type REQUIRED FIELD |

E | Drop-down List |

Indicates what stage of the process that the workout is in. For short sale cancellation requests, select 'CXL Req' (cancellation request).

|

|

Cancellation Reason Type REQUIRED FIELD |

F | Drop-down List |

Indicates the reason a short sale cancellation is being requested. Select one of the following cancel reasons from the list below:

|

Follow the process steps listed in the Upload Short Sale Submissions help section for guidance on uploading various types of workout and settlement requests - including cancellation requests - to Freddie Mac for review and decisioning.

How to Submit a Cancellation Request via the Details Page

Follow the steps below to submit a cancellation request from the Details page in Resolve:

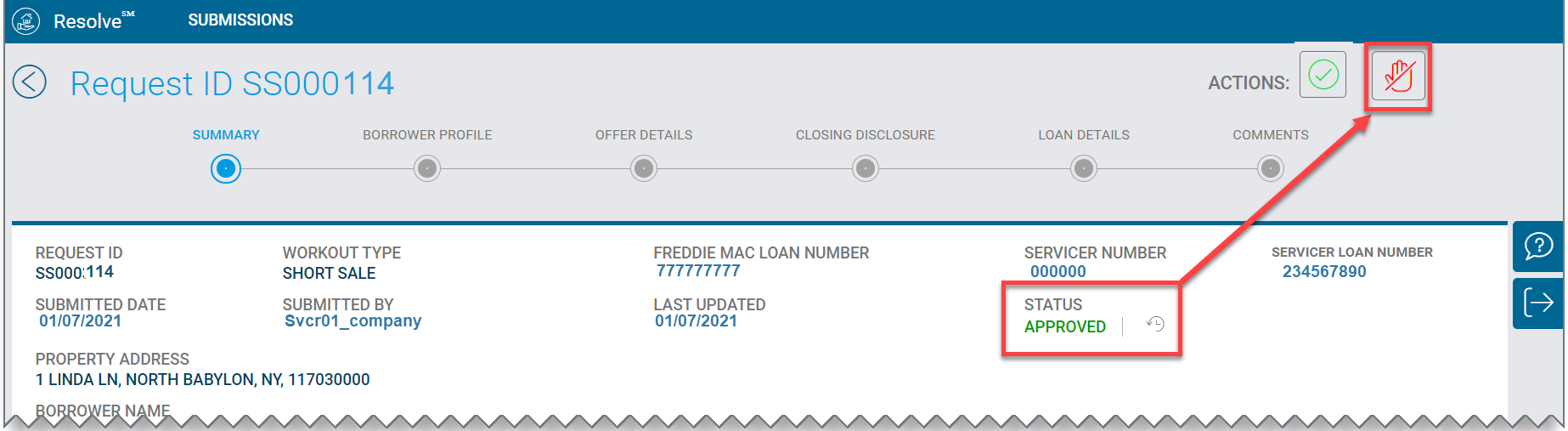

- From the dashboard page, locate the Approved request that you wish to cancel. Click the Freddie Mac loan number hyperlink and you will be redirected to the Details page.

- From the Details page, click on the Cancel Request

button in the Actions menu. The Cancel Request pop-up box displays. You will only see the Cancel Request

button in the Actions menu. The Cancel Request pop-up box displays. You will only see the Cancel Request  button at the top right corner of the page when your request is in an Approved status.

button at the top right corner of the page when your request is in an Approved status.

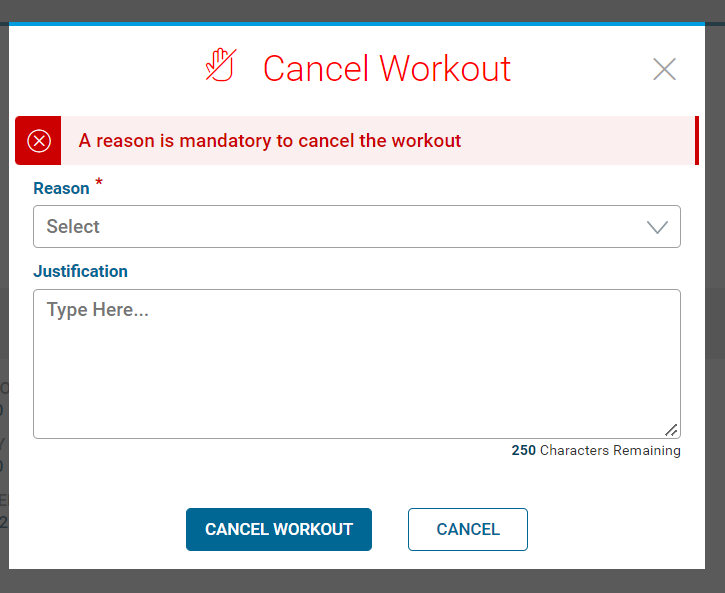

- From the Cancel Workout pop-up box, select a reason from the mandatory drop-down menu and, as an optional, provide justification.

Field Name: Field Type: Description: Reason

REQUIRED FIELD

Drop-Down List The reason for the short sale cancellation request.

Select from one of the following reasons:

- Other

- Data Entry Error

- Buyer Walked

- W/O Type Changed

- Previous Offer Expired

- Ineligible Mortgage

- Offer Not Accepted by Borrower/Request Withdrawn

- Request Incomplete/Incomplete File Provided

- Borrower Ineligible

Note: The Reason field is a required data field and is identified by a red asterisk *. You will not be able to submit the cancellation request unless a value is selected from the drop-down.

Justification Text An optional field where additional details can be added to support the short sale cancellation request. - From the Cancel Workout pop-up box, select either the Cancel Workout or Cancel button:

Select: To:

Proceed with submitting the short sale cancellation request.

Proceed to Step #5.

Discontinue the short sale cancellation request.

The Are You Sure? pop-up box displays prompting you to confirm that you want to leave the page.

Select: To:

Return to the Details page.

The request's status will stay Approved.

Return to Step #1 to submit another cancellation request if applicable.

Continue submitting the cancellation request.

The Are You Sure? pop-up box displays prompting you to confirm the cancellation. The Freddie Mac Loan Number along with the Reason and Justification (if provided) pre-populate in the box.

Proceed to Step #6.

- Upon selecting the Cancel Workout button in the Cancel Workout pop-up box, Resolve will validate that a value has been selected from the mandatory drop-down in the Reason field.

If the Reason Field is: Then: Empty The following error message will display:

Choose the applicable value from the drop-down menu for the Reason field and select the Cancel Workout button again to proceed with submitting your extension request.

Proceed to Step #6.

Contains a value The Are You Sure? pop-up box displays prompting you to confirm the cancellation. The Freddie Mac Loan Number along with the Reason and Justification (if provided) pre-populate in the box.

Proceed to Step #6.

- From the Are you Sure? pop-up box, select either the Confirm Cancellation or Cancel button.

Select: To:

Submit the short sale cancellation request to Freddie Mac.

Proceed to Step #7.

To discontinue cancelling the request.

An Are You Sure? pop-up box displays prompting you to confirm:

Select the action you would like to take from the table below:

Select: To:

Return to the Details page.

The request will remain in Approved status.

Return to Step #1 to submit another cancellation request, if applicable.

Return to the Cancel Workout pop-up window.

Return to Step #3.

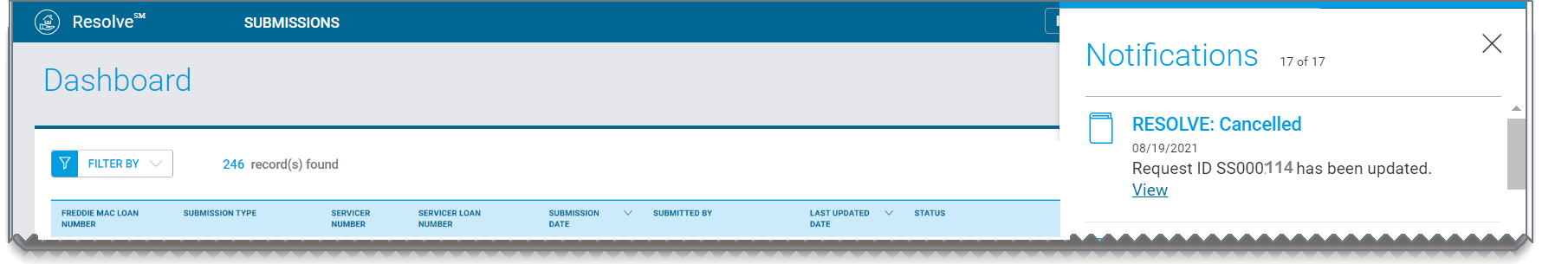

- Upon selecting the Confirm Cancellation button, you will be redirected to the dashboard page.

Once a cancellation request has been submitted successfully, the following will occur:

Notification Message:

You will receive a notification in Resolve once the request moves to a Cancelled status.

Refer to the Notifications section for additional details around accessing and viewing Resolve notifications.

Dashboard Page:

A green banner message will display at the top of the dashboard page confirming the cancellation request was successfully submitted.  The status of the request on the dashboard page updates to Cancelled.

The status of the request on the dashboard page updates to Cancelled.

Details Page:

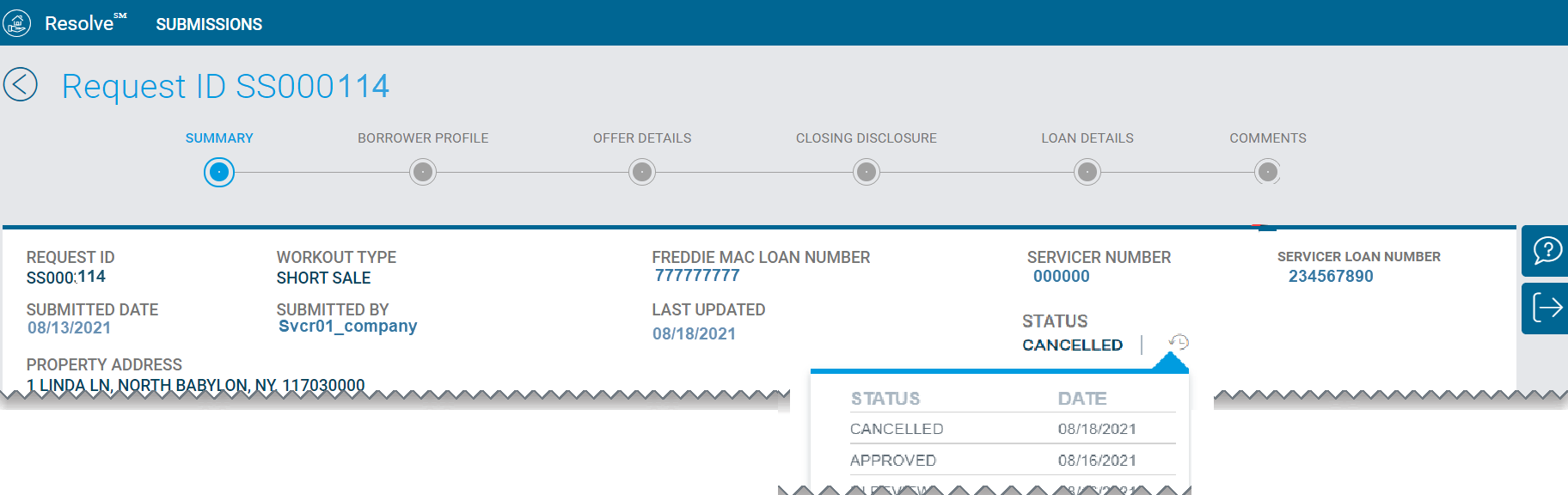

The current status and status history on the Details page shows updated to Cancelled.

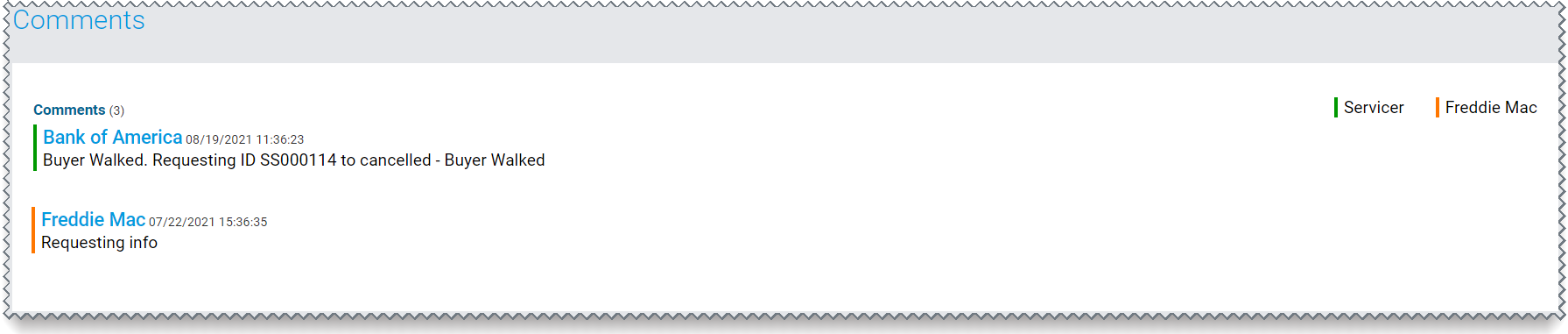

Details - Comments Section:

The Comments section of the Details page will show the reason and justification (if provided) for the cancellation request.