Request a Charge-Off

Overview

The Resolve® user interface (UI) provides the Servicer the capability to submit charge-off requests for processing via the exception review path. Charge-off requests can be submitted only through the Resolve user interface (UI). For application programming interface (API) users, you must access the Resolve UI to perform this functionality.

A charge-off request may be initiated by the Servicer or Freddie Mac:

- A charge-off request submitted by the Servicer will automatically route through the exception review path to be reviewed and decisioned by a Freddie Mac analyst.

- An alert notification via the bell icon will notify the Servicer that a charge-off request has been initiated by Freddie Mac (e.g., Pending Submission).

Important: During the processing of a charge-off request, there are servicing activities you will perform outside of the Resolve tool (e.g., report the payoff of a loan via Loan Level Reporting). In addition, refer to Guide Section 9210.5 for closing, reporting and remittance requirements for charge-offs (i.e., notifying the borrower that the Servicer will no longer service the mortgage, lien release requirements, etc.).

Upload a Charge-Off Request

Follow the process steps below to upload single or multiple loan records for a charge-off request through the Resolve UI submission path for decisioning.

1. From the Resolve dashboard, click SUBMISSIONS in the top blue navigation bar. The Submissions menu displays. Click Charge-Off under LIQUIDATION.

2. The Upload Charge-Off Submissions page displays. Click anywhere in the blue-dashed section to browse your computer for the file you want to upload. Browse and click Open or drag and drop the file in the blue-dashed section.

Important: The upload charge-off submissions page provides the charge-off template for you to download. Refer to Download Template section for further instructions on how to download the template to create your file.

3. The uploaded file will appear at the bottom of the page. Click SUBMIT or CANCEL.

Note: If a file has not been selected for upload, the SUBMIT or CANCEL buttons will not be visible.

| From the ACTION column, you can select: | To: |

|

Delete the uploaded file. The loan file will no longer display on the Upload Charge-Off Submissions page. Return to Step #2 to upload another loan file. |

| Select: | To: | ||||||||||||||

|

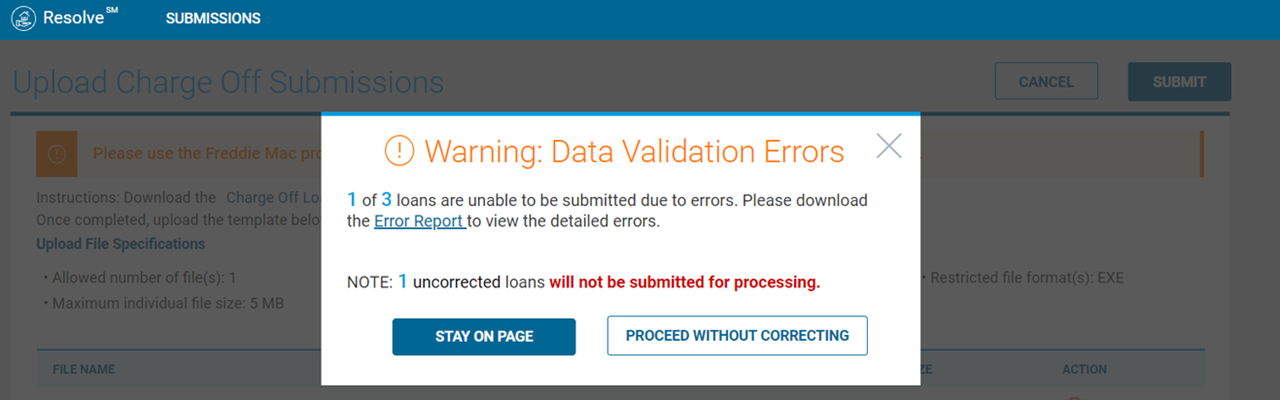

Continue uploading your loan file submission. Resolve will check the file for data validation errors. Refer to the Template Formatting Guidelines section for more information on how to avoid formatting and data validation errors.

|

||||||||||||||

|

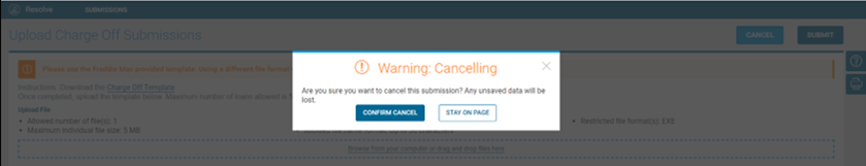

Cancel the upload of your file. A Warning: Cancelling pop-up box displays for you to confirm the cancellation. Click CONFIRM CANCEL or STAY ON PAGE.

|

4. The Confirm Servicer Agreement pop-up box displays for the Servicer to confirm that the data provided in Resolve complies with the Single Family Seller/Servicer Guide (Guide) requirements. Click Confirm & Submit or Cancel.

| Select: | To: |

|

Attests that the data provided is complete with all applicable requirements of the Guide. Any misrepresentation or falsification may lead to the charge-off request being denied. Proceed to Step #5. |

| Cancel upload of the file. |

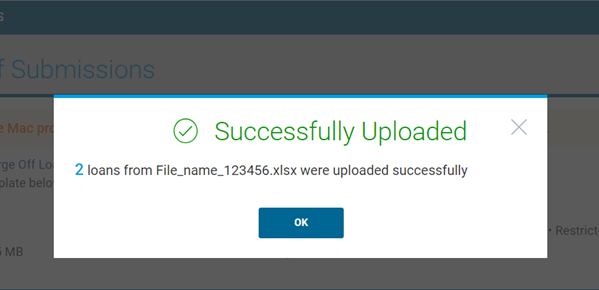

5.The "Successfully Uploaded" pop-up box appears displaying a message indicating 2 loan(s) from File_name_123456.xlsx were uploaded successfully. Click OK.

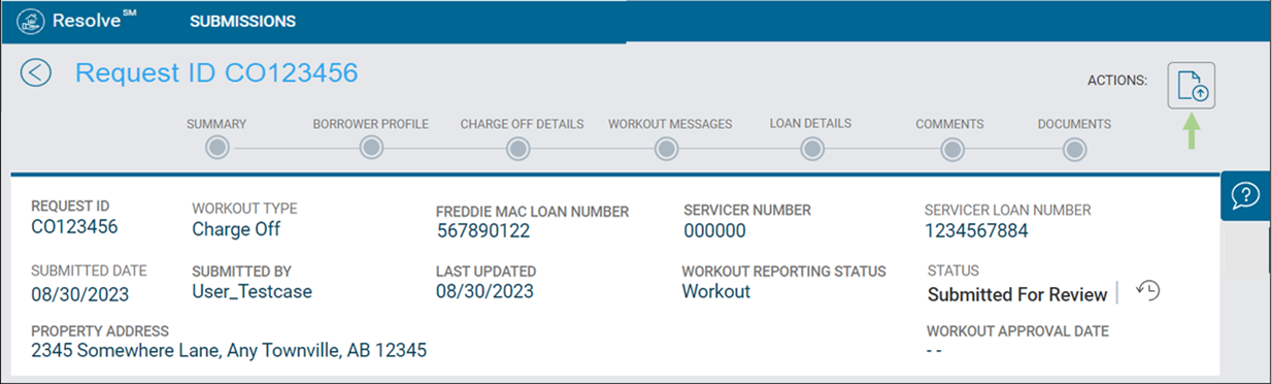

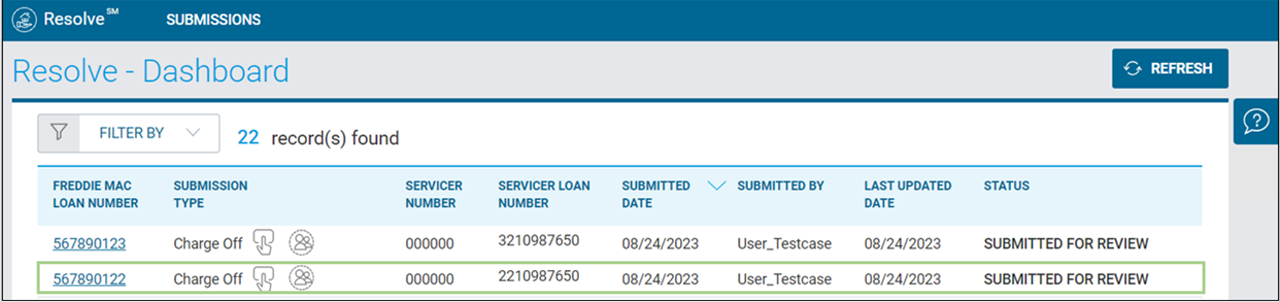

6. Resolve returns you to the dashboard pipeline to view the status of the two successfully uploaded loans as SUBMITTED FOR REVIEW.

Upload Charge-Off Documentation

An upload functionality is available via Resolve for the Servicer to upload supporting documentation for the charge-off request. This function eliminates the need for the Servicer to email supporting documentation to Freddie Mac.

Note: Refer to Guide Chapter 9210.3 for more information on the required supporting documentation (e.g., property inspection reports, payoff statement, etc.).

7. From the Resolve dashboard, open the Details page by clicking the Freddie Mac loan number hyperlink. Click the ACTIONS: Upload Files ![]() button on the upper right corner of the Details page to upload files.

button on the upper right corner of the Details page to upload files.

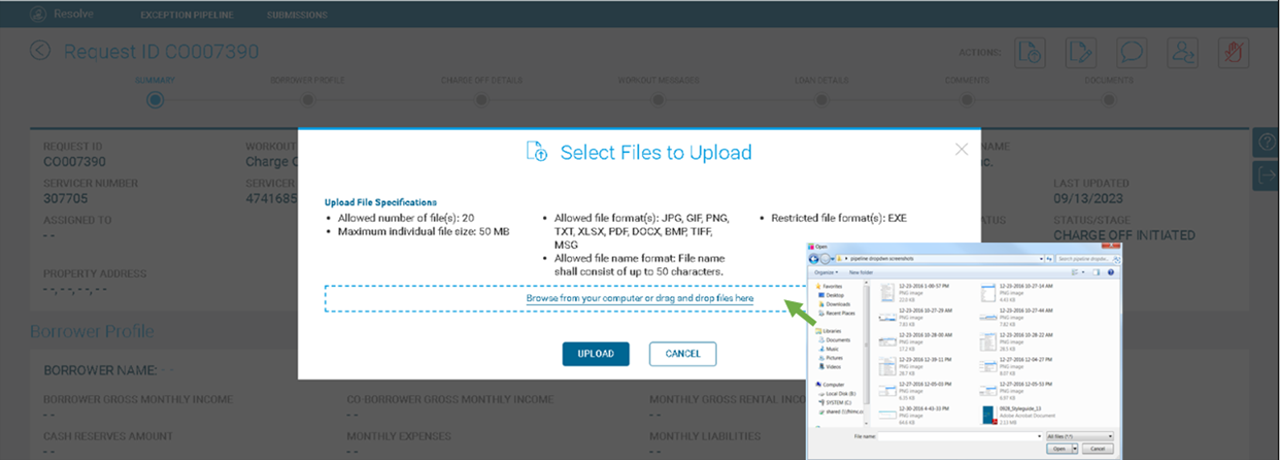

8. The Select Files to Upload page displays. Click anywhere in the blue-dashed section to browse your computer for the file(s) you want to upload. Browse and Open to select the file(s) or drag and drop the file(s).

9. The selected files will appear at the bottom of the page. Click UPLOAD or CANCEL.

| Select: | To: |

|

Upload supporting documentation (e.g., property inspection reports, payoff statement, etc.). |

|

Cancel the upload of the file(s). |

|

Delete the uploaded file. The loan file will no longer display on the Select Files to Upload page. |

10. View the uploaded files in the Document section at the bottom of the Details page, .

11. On the Resolve dashboard, the two successfully uploaded charge-off requests remain in a Submitted for Review status.

View Charge Off Details

In the Charge-Off Details section, on the Details page, the values showing for certain data elements may change throughout the processing stages depending on the workout reporting status (e.g., Workout or Settlement) and the submission status (e.g., Submitted for Review or Approved) of the request. When the charge-off request is submitted by the Servicer, values will display in two columns, the ESTIMATED and ACTUAL columns. You can refer to the Charge-Off Details table for descriptions of each data element (e.g., Payoff Amount) within the applicable column (e.g., ESTIMATED).

12. From the dashboard, navigate to the Details page by clicking the Freddie Mac loan number hyperlink. On the Details page, a Submitted For Review status displays.

13. Review the loan information in the ESTIMATED column on the Charge-Off Details section and the messages that displayed in the Workout Messages section to include the following data fields:

- Charge-Off Reason Type

- Hazard Insurance Claim Filed?

- Hazard Insurance Claim Status

- Payoff Good Through Date (indicated by dashes for a servicer initiated charge off request)

- Lien To Be Released?

- The populated ESTIMATED column data fields (Workout-Submitted For Review status) include the following values:

| TYPE | ESTIMATED |

| UPB | Generated from Freddie Mac system as of the last day of the prior month |

| Interest | Generated from Freddie Mac system as of the last day of the prior month |

| Payoff Amount | Calculated as unpaid principal balance (UPB) + Interest |

| Expenses | Servicer-projected expenses as provided via upload submission |

| Total Debt | Calculated as payoff amount + expenses (expenses projected by Servicer) |

| Total Proceeds |

Provided by Servicer via upload submission Note: This includes any insurance claim proceeds filed by the Servicer |

| Loss Amount | Calculated as Total Debt - Total Proceeds |

14. The charge-off request is assigned to a Freddie Mac analyst for review and decisioning. Once the request has been assigned to an analyst, the status will move from Submitted For Review to In Review.

15. The Freddie Mac analyst will review loan data provided by the Servicer and Freddie Mac's systems for decisioning. When the request has been decisioned, the status will change to one of the following:

- Approved

- Info Requested

- Rejected

| If the Status is: | Then: |

| APPROVED |

The Servicer will receive an alert notification

Note: At approval, the Freddie Mac analyst will determine if the mortgage lien should be released. Refer to When a charge-off request is in an Approved Status to continue with the next stages of the process through settlement and close. |

| INFO REQUESTED |

The Servicer must provide additional information in order for Freddie Mac to render a decision. It is recommended to review the Comments section of the Details page for additional comments provided by a Freddie Mac analyst to determine the information that needs to be updated.

Refer to the Providing Updated Data section for the process steps when the request is in an Info Requested status. |

| REJECTED |

A Rejected status indicates that a charge-off request through the exception review path was reviewed and decisioned (i.e., denied) by the Freddie Mac analyst. You will receive a Notification notifying you of the decision.

|

When the Charge-Off request is in an Approved Status

16. Navigate to the Details page, from the dashboard, by clicking the Freddie Mac loan number hyperlink. On the Details page an Approved status displays. Review the data fields in the ESTIMATED column of the Charge-Off Details section and the messages that display in the Workout Messages section:

The populated ESTIMATED column data fields (Workout-Approved status) include the following values:

| TYPE | ESTIMATED |

| UPB | Generated from Freddie Mac system |

| Interest | Generated from Freddie Mac system as of the last day of the prior month |

| Payoff Amount | Calculated as UPB + Interest |

| Expenses | Servicer projection as provided via upload submission |

| Total Debt | Calculated as payoff amount + expenses |

| Total Proceeds |

Provided by servicer via upload submission Note: This includes any insurance proceeds filed by the servicer. |

| Loss Amount | Calculated as Total Debt - Total Proceeds |

17. Upon approval, the Servicer must report the payoff of the loan in the Loan Level Reporting tool within two business days of the Workout Approval Date. In addition, the Servicer must complete the requirements outlined in Guide Section 9210.4(a), if applicable (e.g., release the lien, cancel the note, etc.).

18. The Servicer is required to remit any loan proceeds received on the mortgage within three business days of Workout Approval Date. Refer to Guide Section 9210.5 for the remittance requirement. Once the loan proceeds (including any insurance claims, etc.) have been received and verified by a Freddie Mac analyst, the charge-off request moves to settlement.

Note: The Servicer will not have to initiate a request for settlement approval as Resolve will perform this function for you. When the settlement approval has been initiated, the Servicer will not receive an alert notification.

Resolve Initiates Settlement Approval Request

19. Resolve will automatically initiate a Settlement request (SETReq) for an exception review. The status will change from Approved to Submitted For Review on the Resolve dashboard and Details page. A Freddie Mac analyst will be assigned to review the settlement approval request.

Note: The Upload Action button is available on the Details page at the Submitted For Review - Settlement processing stage, since the Servicer may need to upload additional documentation before settlement.

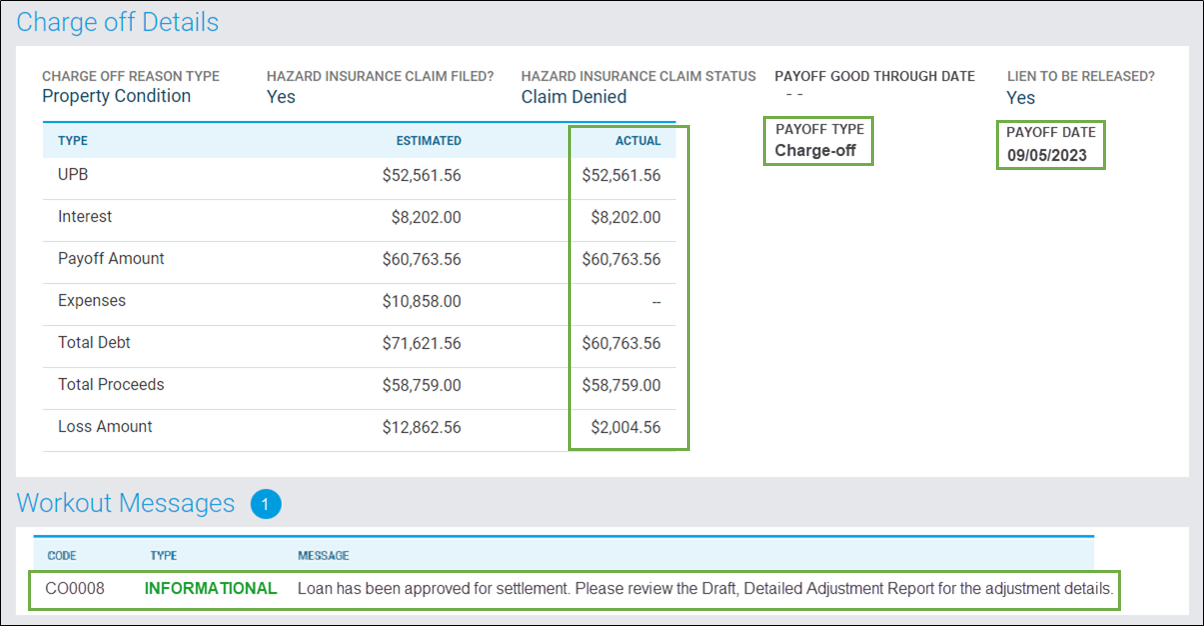

20. On the Details page, scroll to the Charge-Off Details section and the ACTUAL column displays for your review of the final loan terms based on the reported payoff amount. Review the following data fields in the Charge-Off Details section:

The ESTIMATED column data field values remain constant.

The populated ACTUAL column data fields display (Settlement-Submitted For Review status) and include the following values:

| TYPE | ESTIMATED | ACTUAL |

| UPB | Generated from Freddie Mac system | UPB based on payoff transaction processed via Loan Level Reporting |

| Interest | Generated from Freddie Mac system as of the last day of the prior month | Interest based on payoff transaction processed via Loan Level Reporting |

| Payoff Amount | Calculated as UPB + Interest | Calculated as UPB + Interest (based on payoff transaction processed via Loan Level Reporting) |

| Expenses | Servicer projection as provided via upload submission | Blank |

| Total Debt | Calculated as payoff amount + expenses | Calculated as payoff amount + expenses |

| Total Proceeds |

Provided by servicer via upload submission Note: This includes any insurance proceeds filed by the servicer. |

Shows '--' until proceeds are received from Servicer and confirmed by Freddie Mac |

| Loss Amount | Calculated as Total Debt - Total Proceeds | Calculated as Total Debt - Total Proceeds |

21. The Freddie Mac analyst will verify and confirm total proceeds have been received to include any insurance claims, etc. and approve the charge-off request for settlement. On the Resolve dashboard, the status will move from Submitted for Review to Approved For Settlement.

22. On the Details page, scroll down to the Charge-Off Details section to view the ESTIMATED and ACTUAL columns. The payoff type and date populate on the charge-off details section during this stage of processing. Review the following data fields for the final terms of the request.

The ESTIMATED column data field values remain constant.

The populated ACTUAL column data fields (Settlement-Approved For Settlement status) include the following values:

| TYPE | ESTIMATED | ACTUAL |

| UPB | Generated from Freddie Mac system | UPB processed by Freddie Mac as of payoff of the loan |

| Interest | Generated from Freddie Mac system as of the last day of the prior month | Interest processed by Freddie Mac as of payoff of the loan |

| Payoff Amount | Calculated as UPB + Interest | Calculated as UPB + Interest payoff amounts based on the payoff date (e.g., 09/05/2023) |

| Expenses | Servicer projection as provided via upload submission | Blank (servicer can access the Freddie Mac PAID system for reimbursement of expenses) |

| Total Debt | Calculated as payoff amount + expenses | Calculated as the Payoff Amount |

| Total Proceeds | Provided by servicer via upload submission | Proceeds that have been received and confirmed by a Freddie Mac analyst |

| Loss Amount | Calculated as Total Debt - Total Proceeds | Calculated as Total Debt - Total Proceeds |

Note: The amount that Freddie Mac has determined to be charged-off will be reflected on the Draft Report. A message will display in the Workout Messages section of the Details page upon Settlement approval that the Servicer can view the Detail Adjustment Report (DAR) for any adjustment details.

23. The charge-off request status will change from Approved For Settlement to Closed the following business day. You can view the status change on the dashboard and on the Details page.

Learn more about: