FHA/VA/RHS Workout Details

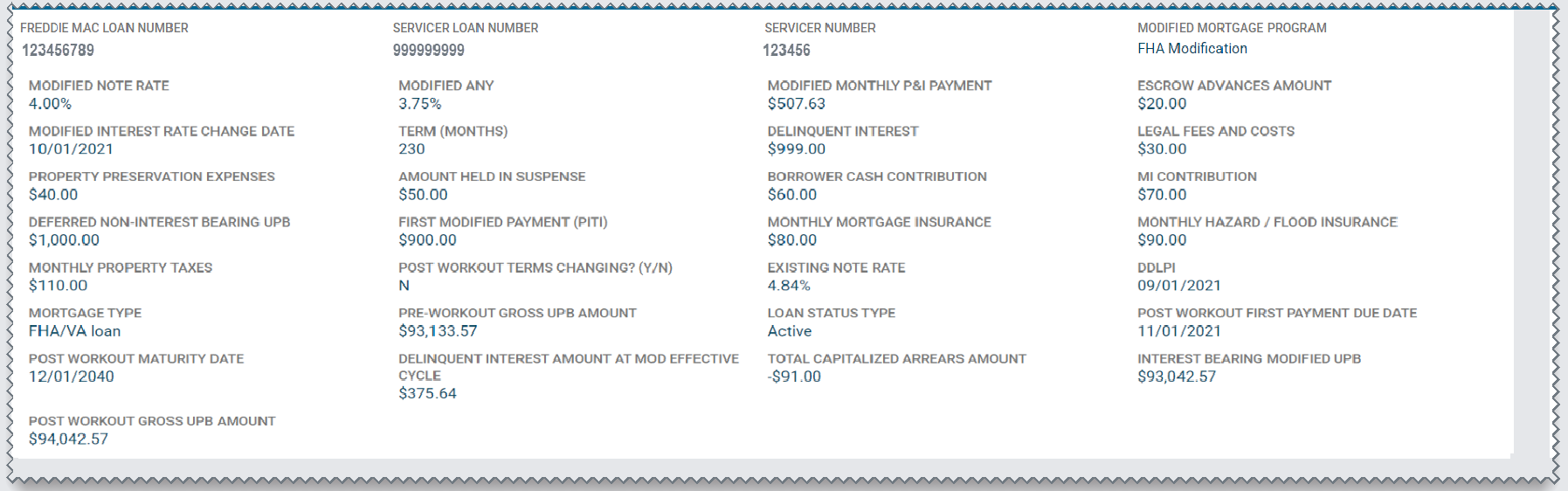

The FHA/VA/RHS Workout Details page provides additional detail around the modification settlement request.

The Freddie Mac loan number, request status, and submitted by date are displayed at the top of the page. Click on the left arrow next to the Freddie Mac loan number to return to the Dashboard page.

The FHA/VA/RHS Workout Details page has 33 read-only data fields that display values that are based upon the information that you provided for the agency loan in your settlement submission file.

Loan Details Data Fields

Refer to the table below for a detailed description of each data field on the Loan Details page.

|

|

Field Name |

Field Type |

Definition |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Loan Details: Header Section |

|||||||||||||

|

|

|||||||||||||

|

1. |

Freddie Mac Loan Number |

Numeric |

Nine-digit unique identifier assigned to the loan. |

||||||||||

|

2. |

Status |

Text |

Indicates the stage in the decisioning process. The Status field is dynamic and changes as the request moves through the decisioning process. There are four color-coded statuses for FHA/VA/RHS loans. Hover over the links below for a description of each settlement request status type.

|

||||||||||

|

3. |

Submitted On: |

Date (mm/dd/yyyy) |

The calendar date that the settlement request was uploaded and submitted to Freddie Mac. |

||||||||||

| Field Name | Field Type | Definition | |||||||||||

|

Loan Details: Body Section |

|||||

|

|

|

Freddie Mac Loan Number |

Numeric |

Nine-digit unique identifier assigned to the loan. |

|

Servicer Loan Number |

Numeric |

A unique identifier assigned by the Servicer to identify the loan. |

|

Servicer Number |

Numeric |

Six-digit unique Freddie Mac identifier assigned to the organization servicing the loan. |

|

Modified Mortgage Program |

Text |

Indicates the Modified Mortgage Type associated with the agency that owns and guarantees the loan. There are three Modified Mortgage Types: 1. Federal Housing Administration (FHA) |

|

Modified Note Rate |

Percentage |

The rate approved by the applicable agency and specified in the Borrower's Agreement. |

|

Modified ANY |

Percentage |

The difference between the Modified Note Rate and the Servicing Spread on the mortgage prior to the modification. |

|

Modified Monthly P&I Payment |

Currency |

The monthly dollar amount of principal and interest that is determined by modified rate, term, and unpaid principal balance. |

|

Escrow Advances Amount |

Currency |

The dollar amount of advanced escrow for real estate taxes, hazard insurance premiums and mortgage insurance premiums. |

|

Modified Interest Rate Change Date |

Date (mm/dd/yyyy) |

Date that is one month prior to the due date of the first modified installment due under the agreement. |

|

Term (Months) |

Numeric |

Term of the modified note (in months) as specified by the applicable agency in the Borrower's Agreement. |

|

Delinquent Interest |

Currency |

Dollar amount of delinquent interest reported by the Servicer for the modification to be settled. |

|

Legal Fees and Costs |

Currency |

Dollar amount of fees that have been paid for legal services associated with a delinquent loan. |

|

Property Preservation Expenses |

Currency |

Total dollar amount of all fees and costs incurred by the Servicer in order to protect and preserve the property. |

|

Amount Held in Suspense |

Currency |

Total dollar amount of funds that are currently being held in an account on behalf of the Borrower that have not yet been allocated. |

| Borrower Cash Contribution | Currency | Dollar amount that the borrower has contributed towards the delinquent UPB, interest and/or fees in a workout with Freddie Mac beyond closing costs and first payment due. |

| MI Contribution | Currency |

Dollar amount that the mortgage insurer will advance to reduce the amount of the modified balance. Note: The MI Contribution is only applicable for FHA loans. Both RHS and VA loans will show $0.00 in this field. |

| Deferred Non-Interest Bearing UPB | Currency | Dollar amount of the UPB that has been deferred until the property has either been sold, paid off, or has reached the modified maturity date. |

| First Modified Payment (PITI) | Currency | Monthly dollar amount of the monthly mortgage payment. Includes principal, interest, real estate taxes, and insurance (PITI). |

| Monthly Mortgage Insurance | Currency | Monthly dollar amount that is required by the Lender to cover the mortgage insurance premium. |

| Monthly Hazard/Flood Insurance | Currency | Monthly dollar amount to cover the cost of hazard/flood insurance premiums for the property. |

| Monthly Property Taxes | Currency | Monthly dollar amount that is allocated to cover the property tax on the subject property. |

| Post Workout Terms Changing?(Y/N) | Yes/No Indicator |

Indicates whether the post-workout terms are different than the pre-workout terms. This field reflects a 'Y' if the Modified Note Rate, Modified Monthly P&I Amount or the Modified Term (Months) is different from what Freddie Mac has on file, otherwise, the field reflects a 'N'. Note: You must indicate 'Y' or 'N' for this field when completing the FHA/VA/RHS Template. |

| Existing Note Rate | Percentage | The contractual interest rate on the loan at the time of workout eligibility submission. |

|

(Loan Last Paid Installment Date) |

Date (mm/dd/yyyy) |

The due date of the last fully paid monthly installment of principal, interest, and escrow (if any) on the loan. |

| Mortgage Type | Text |

A value which summarizes the characteristics of a mortgage purchased by Freddie Mac. Values for this field include:

|

| Pre-Workout Gross UPB Amount | Currency | The unpaid principal balance on the loan at the time of the workout eligibility determination. |

| Loan Status Type | Text |

The loan's status at the time of the workout. Values for this field include:

|

| Post Workout First Payment Due Date |

Date (mm/dd/yyyy) |

The date that the new payment of the modification is effective. |

| Post Workout Maturity Date |

Date (mm/dd/yyyy) |

The new maturity date on the loan after the modification. |

| Delinquent Interest Amount At Mod Effective Cycle | Currency | Dollar amount of the interest owed on a loan as a result of non-payment. It is calculated from the DDLPI through the Modification Effective Date. |

| Total Capitalized Arrears Amount | Currency |

Dollar amount of the cumulative delinquent payment amount - the total amount (sum) required to bring the loan current. Includes the following amounts:

|

| Interest Bearing Modified UPB | Currency | Dollar amount of the post workout interest-bearing, unpaid principal balance amount based on the post workout terms of the loan. |

| Post Workout Gross UPB Amount | Currency |

Dollar amount of the post workout unpaid principal balance. It is the sum of the interest-bearing and non-interest-bearing UPB amounts. |