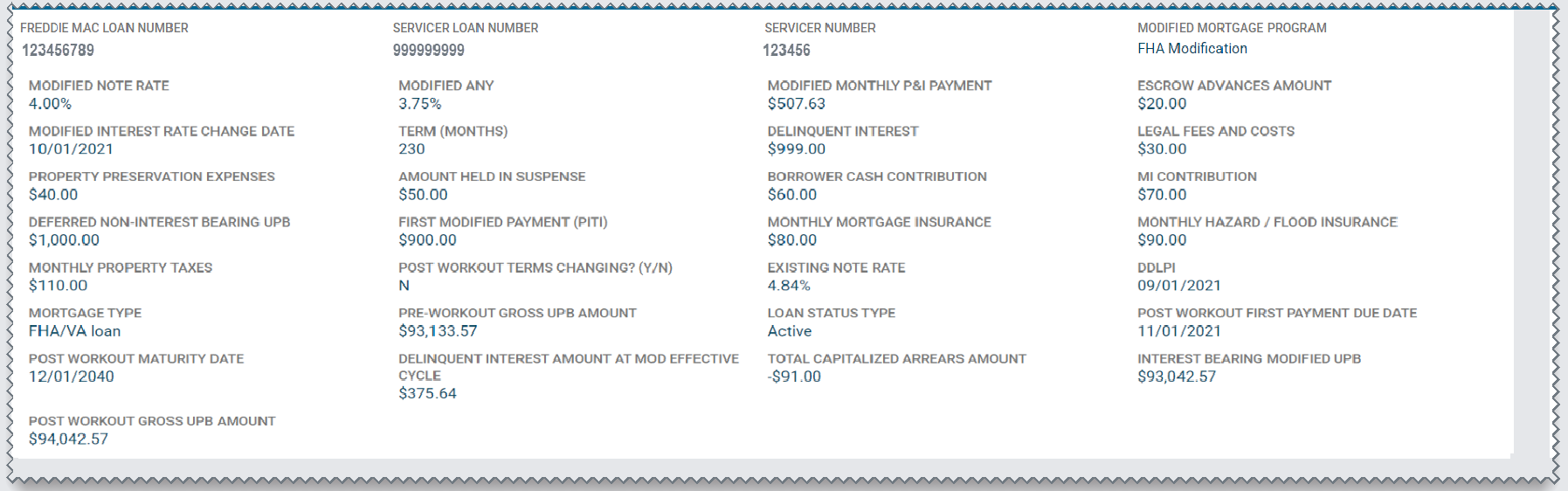

FHA/VA/RHS Details Data Fields

Refer to the table below for a detailed description of each data field on the FHA/VA/RHS Details page.

|

|

Field Name |

Field Type |

Definition |

||

|---|---|---|---|---|---|

|

Loan Details: Header Section |

|||||

|

|

|||||

|

1. |

Freddie Mac Loan Number |

Numeric |

Nine-digit unique identifier assigned to the loan. |

||

|

2. |

Status |

Text |

Indicates the stage in the decisioning process. The Status field is dynamic and changes as the request moves through the decisioning process. There are four color-coded statuses for FHA/VA/RHS loans. Hover over the links below for a description of each request status type. |

||

|

3. |

Submitted On: |

Date (mm/dd/yyyy) |

The calendar date that the settlement request was uploaded and submitted to Freddie Mac. |

||

| Field Name | Field Type | Definition | |||

|

Loan Details: Body Section |

|||||

|

|

|

1. |

Freddie Mac Loan Number |

Numeric |

Nine-digit unique identifier assigned to the loan. |

|

2. |

Servicer Loan Number |

Numeric |

A unique identifier assigned by the Servicer to identify the loan. |

|

3. |

Servicer Number |

Numeric |

Six-digit unique Freddie Mac identifier assigned to the organization servicing the loan. |

|

4. |

Modified Mortgage Program |

Text |

Indicates the Modified Mortgage Type associated with the agency that owns and guarantees the loan. There are three Modified Mortgage Types: 1. Federal Housing Administration (FHA) |

|

5. |

Modified Note Rate |

Percentage |

The rate approved by the applicable agency and specified in the Borrower's Agreement. |

|

6. |

Modified ANY |

Percentage |

The difference between the Modified Note Rate and the Servicing Spread on the mortgage prior to the modification. |

|

7. |

Modified P&I Payment |

Currency |

The monthly dollar amount of principal and interest that is determined by modified rate, term, and unpaid principal balance. |

|

8. |

Currency |

The dollar amount of advanced escrow for real estate taxes, hazard insurance premiums and mortgage insurance premiums. |

|

|

9. |

Date (mm/dd/yyyy) |

Date that is one month prior to the due date of the first modified installment due under the agreement. |

|

|

10. |

Term (Months) |

Numeric |

Term of the modified note (in months) as specified by the applicable agency in the Borrower's Agreement. |

|

11. |

Currency |

Dollar amount of delinquent interest reported by the Servicer for the modification to be settled. |

|

|

12. |

Currency |

Dollar amount of fees that have been paid for legal services associated with a delinquent loan. |

|

|

13. |

Currency |

Total dollar amount of all fees and costs incurred by the Servicer in order to protect and preserve the property. |

|

|

14. |

Currency |

Total dollar amount of funds that are currently being held in an account on behalf of the Borrower that have not yet been allocated. |

|

| 15. | Borrower Cash Contribution | Currency | Dollar amount that the borrower has contributed towards the delinquent UPB, interest and/or fees in a workout with Freddie Mac beyond closing costs and first payment due. |

| 16. | MI Contribution | Currency |

Dollar amount that the mortgage insurer will advance to reduce the amount of the modified balance. Note: The MI Contribution is only applicable for FHA loans. Both RHS and VA loans will show $0.00 in this field. |

| 17. | Deferred Non-Interest Bearing UPB | Currency | Dollar amount of the UPB that has been deferred until the property has either been sold, paid off, or has reached the modified maturity date. |

| 18. | First Modified Payment (PITI) | Currency | Monthly dollar amount of the monthly mortgage payment. Includes principal, interest, real estate taxes, and insurance (PITI). |

| 19. | Monthly Mortgage Insurance | Currency | Monthly dollar amount that is required by the Lender to cover the mortgage insurance premium. |

| 20. | Monthly Hazard/Flood Insurance | Currency | Monthly dollar amount to cover the cost of hazard/flood insurance premiums for the property. |

| 21. | Monthly Property Taxes | Currency | Monthly dollar amount that is allocated to cover the property tax on the subject property. |

| 22. | Post Workout Terms Changing? (Y/N) | Yes/No Indicator |

Indicates whether the post-workout terms are different than the pre-workout terms. This field reflects a 'Y' if the Modified Note Rate, Modified Monthly P&I Amount or the Modified Term (Months) is different from what Freddie Mac has on file, otherwise, the field reflects a 'N'. Note: You must indicate 'Y' or 'N' for this field when completing the FHA/VA/RHS template. |

| 22. | Existing Note Rate | Percentage | The contractual interest rate on the loan at the time of workout eligibility submission. |

| 23. |

(Loan Last Paid Installment Date) |

Date (mm/dd/yyyy) |

The due date of the last fully paid monthly installment of principal, interest, and escrow (if any) on the loan. |

| 24. | Mortgage Type | Text |

A value which summarizes the characteristics of a mortgage purchased by Freddie Mac. Values for this field include:

|

| 25. | Pre-Workout Gross UPB Amount | Currency | The unpaid principal balance on the loan at the time of the workout eligibility determination. |

| 26. | Loan Status Type | Text |

The loan's status at the time of the workout. Values for this field include:

|

| 27. | Post Workout First Payment Due Date |

Date (mm/dd/yyyy) |

The date that the new payment of the modification is effective. |

| 28. | Post Workout Maturity Date |

Date (mm/dd/yyyy) |

The new maturity date on the loan after the modification. |

| 29. | Delinquent Interest Amount At Mod Effective Cycle | Currency | Dollar amount of the interest owed on a loan as a result of non-payment. It is calculated from the DDLPI through the Modification Effective Date. |

| 30. | Total Capitalized Arrears Amount | Currency |

Dollar amount of the cumulative delinquent payment amount - the total amount (sum) required to bring the loan current. Includes the following amounts:

|

| 31. | Interest Bearing Modified UPB | Currency | Dollar amount of the post workout interest-bearing, unpaid principal balance amount based on the post workout terms of the loan. |

| 32. | Post Workout Gross UPB Amount | Currency |

Dollar amount of the post workout unpaid principal balance. It is the sum of the interest-bearing and non-interest-bearing UPB amounts. |