FHA/VA/RHS Template

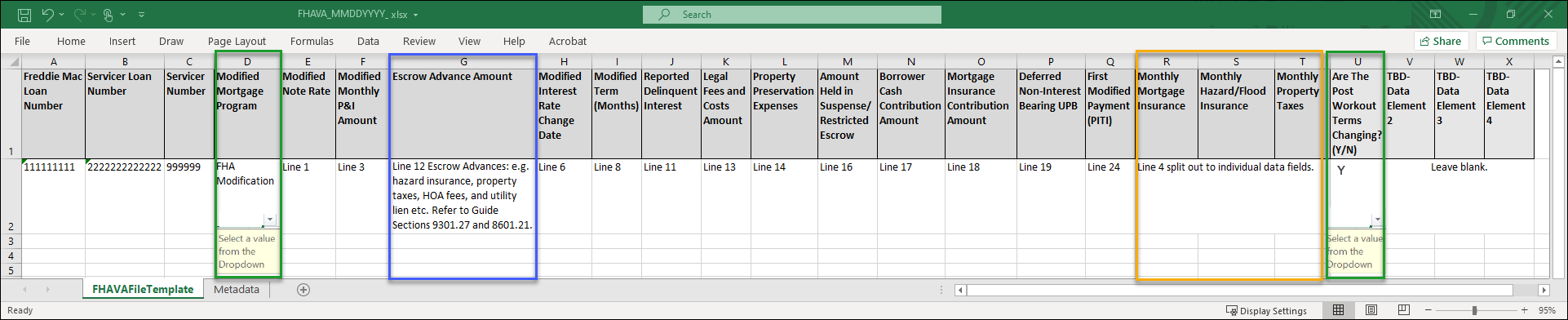

The FHA/VA/RHS Template that you download from Resolve is in an Excel (.xlsx) format and contains a total of 24 data fields. You can click here for a full list of the file template data fields and their corresponding definitions.

The FHA/VA/RHS Template allows for streamlined submission of a bulk loan file and settlement all in Resolve. You can use the template to upload one or more agency loan modification requests for Freddie Mac's approval and settlement.

The fields in the template will look similar to what you have entered on the Form 1128 (FHA and VA loans), or Workout Prospector (RHS loans) in the past.

Click on the links below to learn more about the FHA/VA/RHS Template:

Template Formatting Guidelines

FHA/VA/RHS Template Data Fields

Mapping Form 1128 to Resolve's FHA/VA/RHS Template

Mapping the Template to the FHA/VA/RHS Workout Details Page

Download the FHA/VA/RHS Template

In order to start uploading your FHA/VA/RHS modification settlement requests, you must first download and use the FHA/VA/RHS Template provided on the Upload FHA/VA/RHS Loans page.

Follow the steps below to download and save the template:

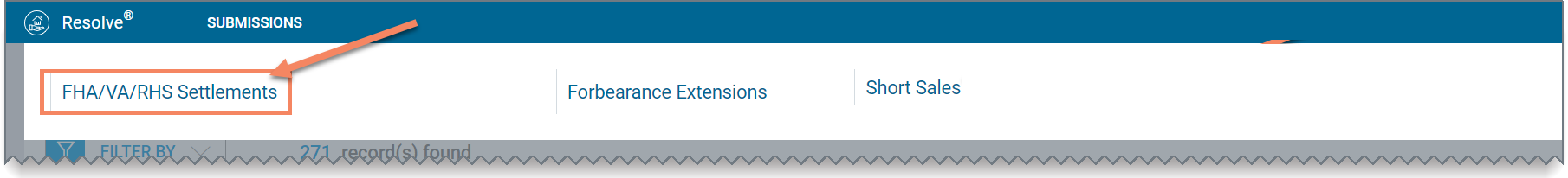

- From Resolve's Dashboard page, select Submissions from the top navigation bar. The Submissions section displays.

- Select the FHA/VA/RHS Settlements link from the menu. The Upload FHA/VA/RHS Loans page displays.

- From the Upload FHA/VA/RHS page, select the FHA/VA/RHS Template hyperlink. The template opens in .xlsx format.

- Save the template to your desktop or Local Area Network.

Metadata Tab

The Metadata tab in the FHA/VA/RHS Template contains a field definition, data type (percentage, date, etc.) and sample value for each data field included on the template.

Formatting Guidelines

Once you have downloaded and saved the FHA/VA/RHS Template, you should reuse it each time you wish to create your upload file.

IMPORTANT: Prior to uploading a file, ensure that the template downloaded and saved to your computer is the most up-to-date version. You can do this by comparing your saved template to the template version available in on the Upload FHA/VA/RHS Loans page.

In order to ensure a successful upload, note the following restrictions when uploading your file:

|

Template Data Fields

Refer to the table below for a detailed description of each data field on the FHA/VA/RHS Template. Fields that are named differently between the template and the FHA/VA/RHS Workout Details page are shaded in orange.

| Column: | FHA/VA/RHS Template Field Name: | Field Type: | Definition: | Workout Details Page Field Name: | ||||||

| A. | Freddie Mac Loan Number | Numeric | Nine-digit unique identifier assigned to the loan. | Freddie Mac Loan Number | ||||||

| B. |

Servicer Loan Number |

Numeric | A unique identifier assigned by the Servicer to identify the loan. | Servicer Loan Number | ||||||

| C. | Servicer Number | Numeric | Six-digit unique Freddie Mac identifier assigned to the organization servicing the loan. | Servicer Number | ||||||

| D. | Modified Mortgage Program | Text |

Indicates the Modified Mortgage Type associated with the agency that owns and guarantees the loan. There are three Modified Mortgage Types: 1. Federal Housing Administration (FHA) |

Modified Mortgage Program | ||||||

| E. | Modified Note Rate | Percentage | The rate approved by the applicable agency and specified in the Borrower's Agreement. | Modified Note Rate | ||||||

| F. | Modified Monthly P&I Amount | Decimal | The monthly dollar amount of principal and interest that is determined by modified rate, term, and unpaid principal balance. | Modified Monthly P&I Payment | ||||||

| G. | Escrow Advance Amount | Decimal | The dollar amount of advanced escrow for real estate taxes, hazard insurance premiums and mortgage insurance premiums. | Escrow Advances Amount | ||||||

| H. | Modified Interest Rate Change Date |

Date (mm/dd/yyyy) |

Date that is one month prior to the due date of the first modified installment due under the agreement. | Modified Interest Rate Change Date | ||||||

| I. | Modified Term (Months) | Numeric | Term of the modified note (in months) as specified by the applicable agency in the Borrower's Agreement. | Term (Months) | ||||||

| J. | Reported Delinquent Interest | Decimal | Dollar amount of delinquent interest reported by the Servicer for the modification to be settled. | Delinquent Interest | ||||||

| K. | Legal Fees and Costs Amount | Decimal | Dollar amount of fees that have been paid for legal services associated with a delinquent loan. | Legal Fees and Costs | ||||||

| L. | Property Preservation Expenses | Decimal | Total dollar amount of all fees and costs incurred by the Servicer in order to protect and preserve the property. | Property Preservation Expenses | ||||||

| M. | Amount Held in Suspense/Restricted Escrow | Decimal | Total dollar amount of funds that are currently being held in an account on behalf of the Borrower that have not yet been allocated. | Amount Held in Suspense | ||||||

| N. | Borrower Cash Contribution Amount | Decimal | Dollar amount that the borrower has contributed towards the delinquent UPB, interest and/or fees in a workout with Freddie Mac beyond closing costs and first payment due. | Borrower Cash Contribution | ||||||

| O. | Mortgage Insurance Contribution Amount | Decimal |

Dollar amount that the mortgage insurer will advance to reduce the amount of the modified balance. Note: The MI Contribution is only applicable for FHA loans. Both RHS and VA loans will show $0.00 in this field. |

MI Contribution | ||||||

| P. | Deferred Non-Interest Bearing UPB | Decimal | Dollar amount of the UPB that has been deferred until the property has either been sold, paid off, or has reached the modified maturity date. | Deferred Non-Interest Bearing UPB | ||||||

| Q. | First Modified Payment (PITI) | Decimal | Dollar amount of the monthly mortgage payment. Includes principal, interest, real estate taxes, and insurance (PITI). | First Modified Payment (PITI) | ||||||

| R. | Monthly Mortgage Insurance | Decimal | Monthly dollar amount that is required by the Lender to cover the mortgage insurance premium. | Monthly Mortgage Insurance | ||||||

| S. | Monthly Hazard/Flood Insurance | Decimal | Monthly dollar amount to cover the cost of hazard/flood insurance premiums for the property. | Monthly Hazard/Flood Insurance | ||||||

| T. | Monthly Property Taxes | Decimal | Monthly dollar amount that is allocated to cover the property tax on the subject property. | Monthly Property Taxes | ||||||

| U. |

Are the Post Workout Terms Changing? (Y/N) |

Yes/No Indicator |

Indicates whether the post-workout terms are different than the pre-workout terms.

|

Post Workout Terms Changing? (Y/N) | ||||||

| V. | TBD-Data Element 2 | N/A |

This column is reserved for potential future enhancements and should be left blank. Data provided in this column will not translate to Resolve. |

- | ||||||

| W. | TBD-Data Element 3 | N/A |

This column is reserved for potential future enhancements and should be left blank. Data provided in this column will not translate to Resolve. |

- | ||||||

| X. | TBD-Data Element 4 | N/A |

This column is reserved for potential future enhancements and should be left blank. Data provided in this column will not translate to Resolve. |

- |

Data Field Mapping

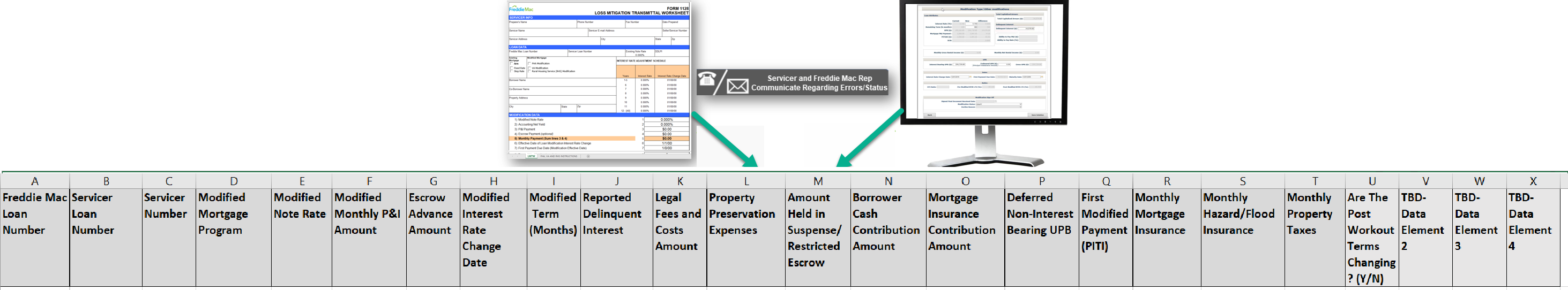

Mapping Form 1128 to Resolve's FHA/VA/RHS Template

Most of the data fields on the Loss Mitigation Transmittal Worksheet (LMTW) Form 1128 map to Resolve's FHA/VA/RHS Template.

Refer to the image below for more information on the data field mapping between the Form 1128 and the template.

Note: Not all fields on the template will be applicable for every loan. For example, the MI Contribution field applies only to FHA loans and the Deferred UPB field applies only to FHA and RHS loans.

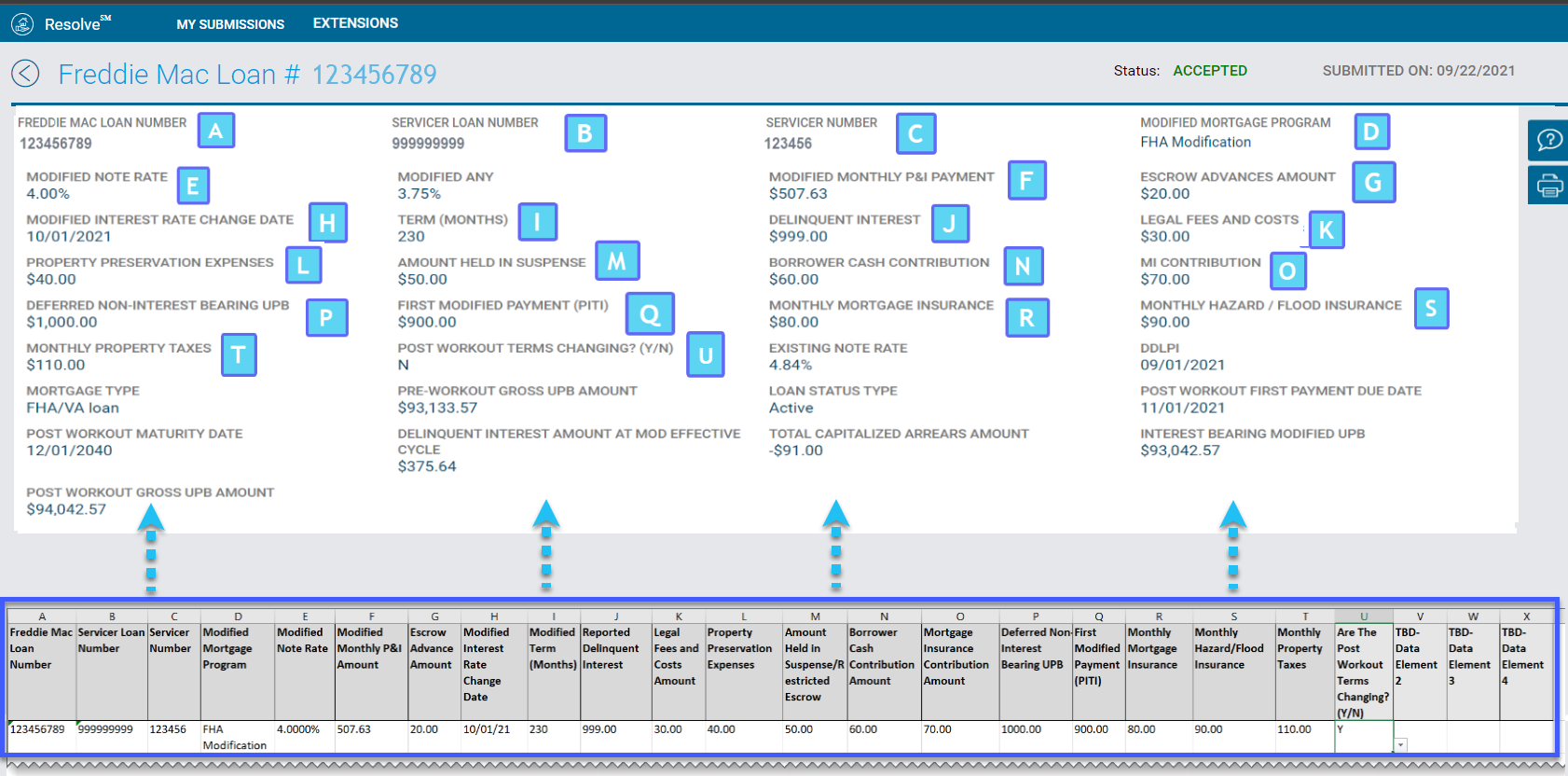

Mapping the Template to the FHA/VA/RHS Workout Details Page

The values that you enter into the FHA/VA/RHS Template will map to the FHA/VA/RHS Workout Details page in Resolve. Some of the data fields are named differently between the template and the page.

Refer to the image below to view the data field mapping between the template and the FHA/VA/RHS Workout Details page. You can also reference the FHA/VA/RHS Template Data Fields section for more details.