Retention Appeal Process

Overview

Resolve® provides the capability to appeal or restore Flex Modifications® and payment deferrals with denied Trial Period Plans or a previously Approved workout that was cancelled. The appeal process allows the Servicer to retrieve and retain the prior approved terms for a Flex Modification that was in a Trial Period Approved or Workout Approved status from the last 12 months. Appeal requests can be submitted via the user interface (UI) or application programming interface (API). All appeal requests are reviewed and decisioned through Freddie Mac's exception path.

Servicers can request an appeal of a denied workout or restore an unsettled workout for the following reasons:

- Resolve has denied the Trial Period Plan request.

- A previously approved trial or workout was cancelled in error.

- The borrower prefers the terms from a prior decision.

Important: Servicers can't request an appeal on a workout in a Closed status.

How to request an Appeal

Follow the process steps below to submit a request for an Appeal.

1. From the Resolve dashboard, click SUBMISSIONS on the blue navigation bar and select Modification Appeal from the drop-down menu.

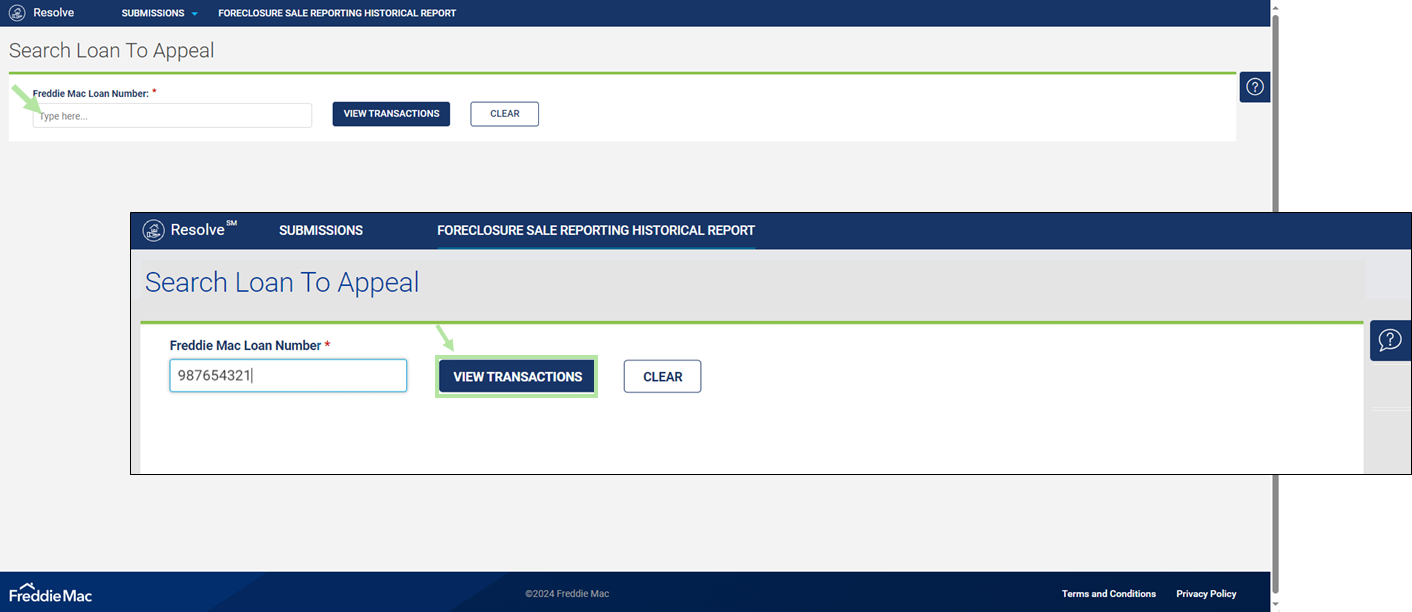

2. The Search Loan To Appeal page displays. Enter the Freddie Mac loan number (e.g., loan #987654321) and click the VIEW TRANSACTIONS button.

Note: The Servicer isn't required to use the upload template and will only need to provide the loan number on the Search Loan To Appeal page.

Note: An error message will display below the text box when the Freddie Mac Loan Number field is left blank or incorrect or invalid.

| Select: | To: |

|

View all eligible Retention workouts for the loan number in the past year that can be appealed (e.g., previously approved workout but now cancelled or a denied Trial Period Plan) |

|

Clear the data entered in the "Freddie Mac Loan Number Type here..." data field. |

3. The Search Loan To Appeal page re-displays with a list of all eligible transactions that are cancelled or denied for the associated loan (i.e., #987654321). The Eligible Workouts section shows all eligible workouts for appeal from the last 12 months with their post modification terms.

Most importantly to note are the:

- Request ID# (e.g., #FX111222), which is the Request Response Identifier;

- Prior Workout Status (e.g., Approved For Trial Period or Ineligible For Trial Period), which was the latest approved reporting status of the given workout prior to the cancellation; and

- Action column, which allows you to select the workout transaction to appeal. You can select only one workout transaction to appeal.

In the ACTION column, click Select corresponding to the workout transaction you want to appeal.

Note: The number of records found is provided at the top of the list of eligible transactions (i.e., 3 record(s) found).

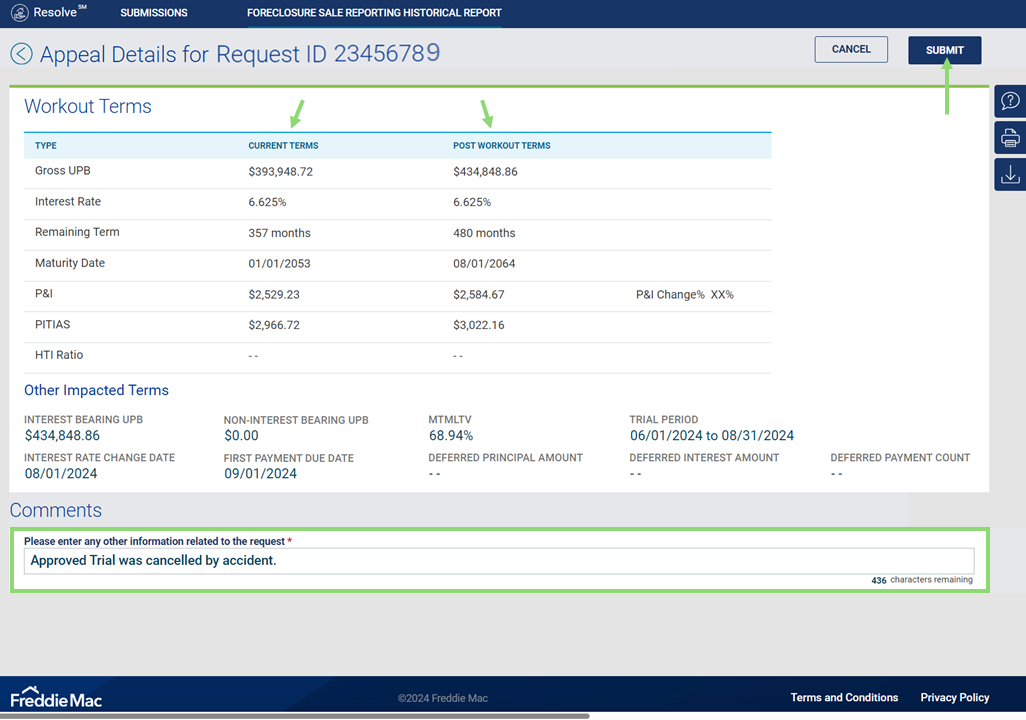

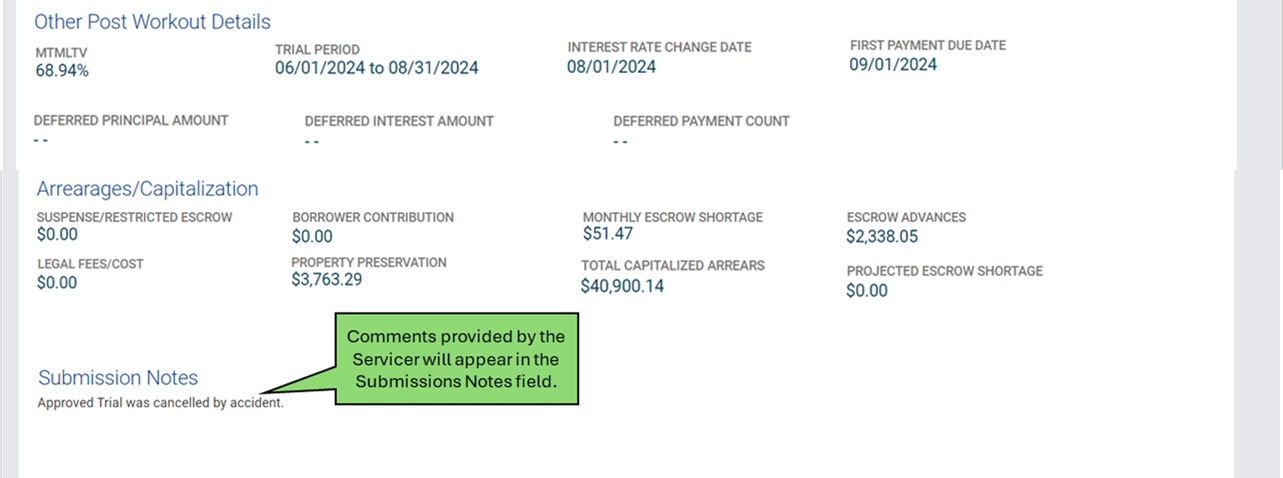

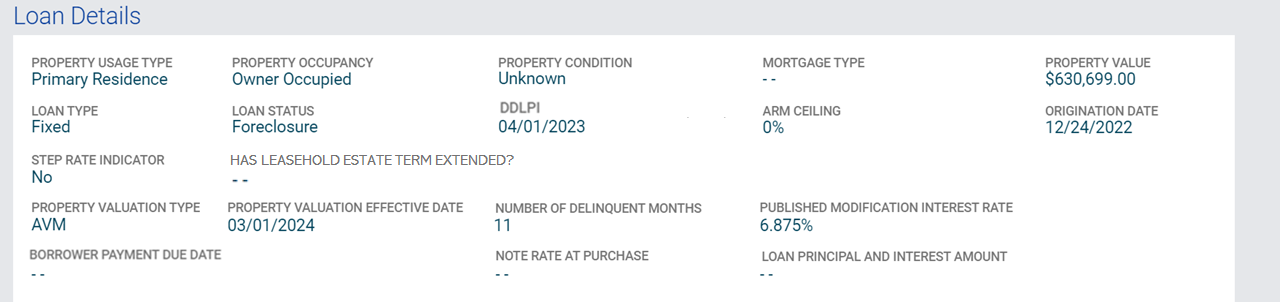

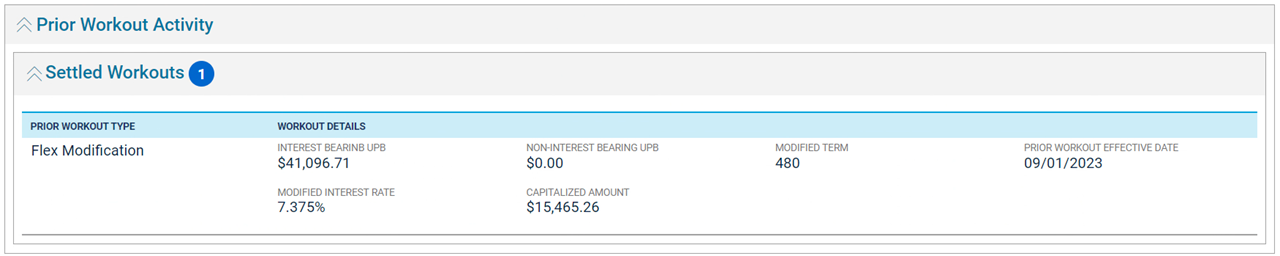

4. The Appeal Details page display the Request ID#, the current and post workout terms plus additional loan data for the selected transaction. The terms displayed on the Appeal Details page refer to the terms that were retained as of the original submission. The same terms will be recycled for the appeal submission.

Review the terms to ensure that the selected transaction is the workout you want to appeal or restore. For data field definitions, refer to the Flex Modification Details page, Workout Terms section.

In addition, you must provide a reason for the appeal in the comments field at the bottom of the page. If you don't provide a comment, an error message will trigger, and you won't be able to proceed.

Note: When an Appeal Review Request ID is populated, comments are mandatory. The Comments field is a required data field as noted by the red asterisk.

Click CANCEL or SUBMIT.

| Select: | To: |

|

Confirm the correct transaction, provide the additional comments and proceed with the appeal process. |

|

|

Cancel the selected transaction. Return to Step #2. |

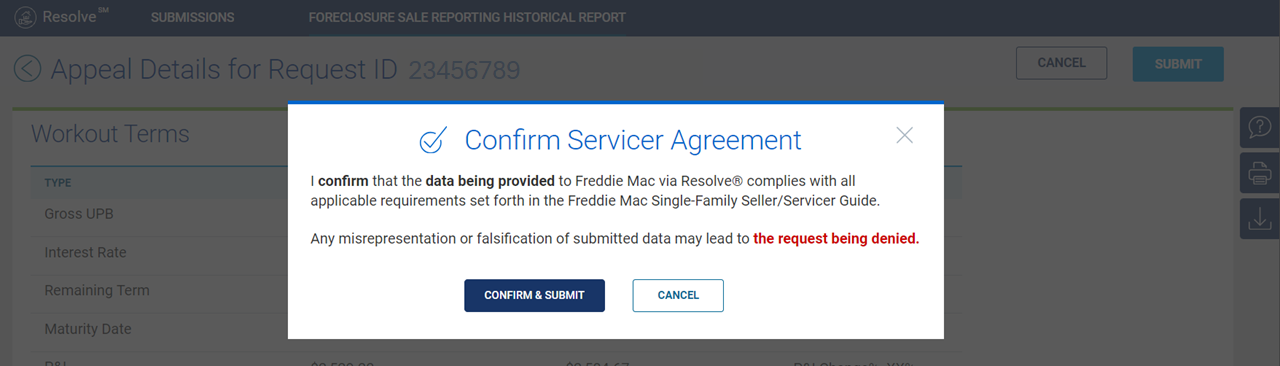

5. The Confirm Servicer Agreement pop up box displays. Click CANCEL or CONFIRM & SUBMIT.

| Select: | To: |

|

Submit the request and attests that the data provided is complete with all applicable requirements of the Single-Family Seller/Servicer Guide (Guide). Any misrepresentation or falsification may lead to the request being denied. |

|

Cancel the selected transaction. Return to Step #2. |

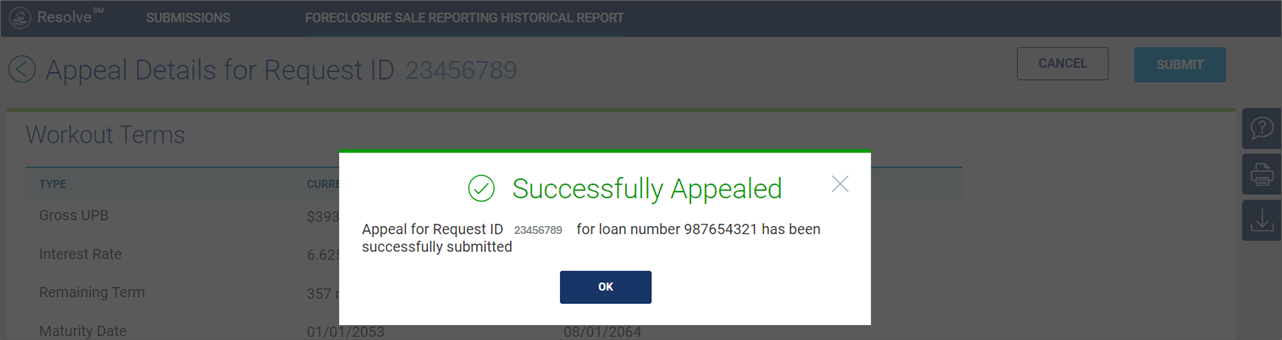

6. A "Successfully Appealed" pop-up box appears confirming the loan was successfully submitted to Resolve. Click OK.

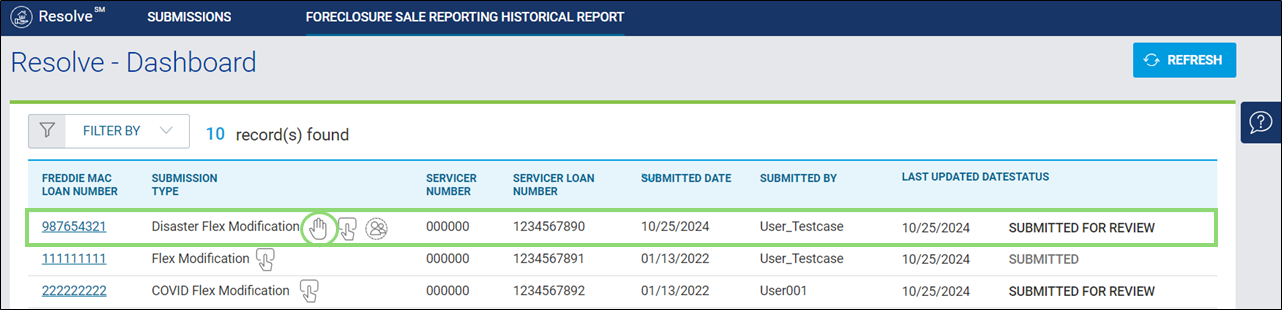

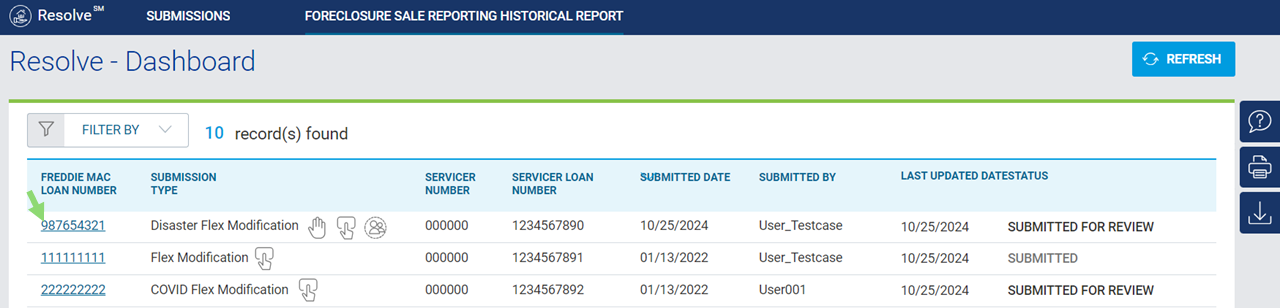

7. The Appeal request is automatically routed for exception review by a Freddie Mac analyst. You are re-directed to the Resolve dashboard which shows the submitted loan (i.e., #987654321) listed at the top of the pipeline in a Submitted for Review status.

The Appeal hand icon ![]() displays in the Submission Type field, indicating that an Appeal has been successfully requested.

displays in the Submission Type field, indicating that an Appeal has been successfully requested.

| If the request is: | Then: |

| Still in the same status | The hand icon indicator appears on the dashboard |

| Appealing under a prior status |

The hand icon indicator doesn't appear on the dashboard (appealed in the past) Refer to Request Details section to review decisioned appeals or From the dashboard, filter by Appeal and look for requests without the hand icon indicator. This shows historical appeals. The Request ID# shows '--' as the request has been decisioned. |

8. On the dashboard, click the Freddie Mac loan number hyperlink to view the Request Details page. Refer to the Flex Modification Details page or Payment Deferral Details page for data field definitions.

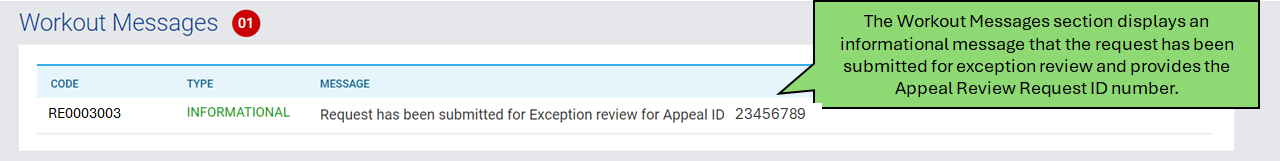

Note: To retrieve the Appeal Review Request ID number, you can navigate to the Details page.

9. The Request Details page displays. The Request Details page provides the Request ID#, submission information and loan details.

Once the appeal has been submitted the following fields display on the Summary section of the Request Details page. Refer to the Summary section for more information.

- Exception Request ID

- Appealed During

- Appeal Review Request ID (e.g., a Freddie Mac analyst starts reviewing the request)

Workout Status - reflects the prior workout status (i.e., Approved For Trial Period or Ineligible For Trial Period), which was the latest approved reporting status of the given workout prior to the cancellation

10. The exception review process continues. Once the analyst has been assigned to review the request, the status moves from Submitted for Review to In Review. The Freddie Mac analyst will review the data and render a decision (e.g., Approved or Rejected).

Learn more about: