Deed-In-Lieu of Foreclosure

Overview

A deed in lieu of foreclosure (DIL) is when a borrower voluntarily conveys clear and marketable title to the property to Freddie Mac in exchange for a discharge of the debt.

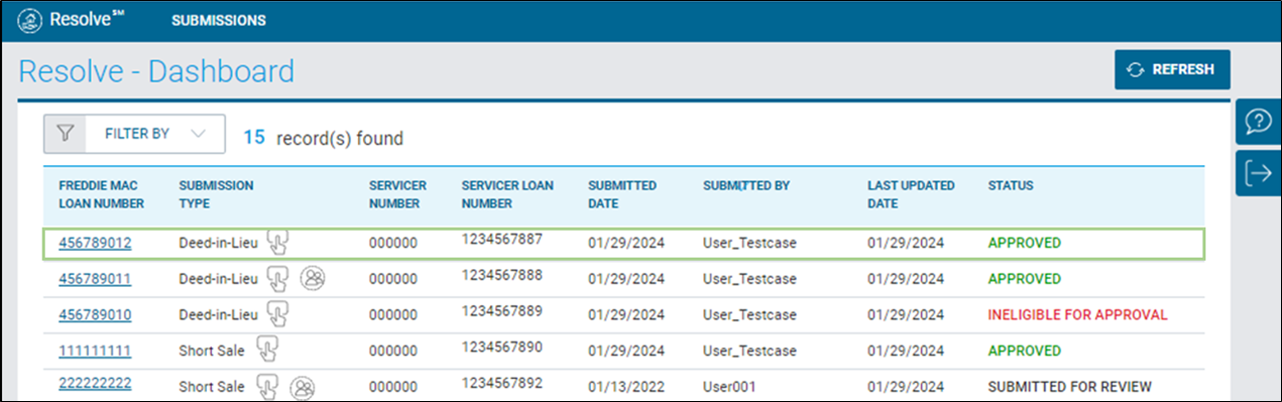

Resolve® provides the capability to request a deed in lieu of foreclosure through the user interface (UI) from submission to settlement. Servicers have the ability to track their deed-in-lieu submissions via the Resolve dashboard and notifications.

The applicable workout reporting status types:

- Workout Approval (WAReq)

- Cancellation (CXLReq)

Resolve will automatically initiate a request for Settlement Approval when the deed-in-lieu (Real Estate Owned (REO) property) has been reported and processed in Loan Level Reporting.

When a DIL approval request is submitted, Resolve interfaces with the broker price opinion (BPO) tool to retrieve existing interior and exterior BPO value which is used to determine eligibility. Additionally, if an existing BPO is not found, Resolve can place a new BPO order using specific Servicer information provided during the deed-in-lieu submission. Review the required data elements in the Template Data Fields section for a BPO order.

Note: Servicers will no longer receive an approval letter; decision, key data and workout messages are provided via Resolve's Export DIL Details functionality.

Resolve's capability to process deeds-in-lieu of foreclosure, provides the following benefits:

- Minimal data intake

- Ability to retrieve or place BPO orders

- Tracking in-progress DIL submissions

- Streamlined deed execution reporting

- Automated settlement by Resolve

- No email communications

Refer to the following Guide Sections for deed-in-lieu requirements:

Guide Section 9209.1 - What is a deed in lieu of foreclosure?

Guide Section 9209.2 - Deed in lieu of foreclosure eligibility requirements and Servicer approval authority

Guide Section 9209.3 - Borrower documentation for deeds in lieu of foreclosure

Guide Section 9209.4 - Deed in lieu of foreclosure borrower contribution and relocation assistance

Guide Section 9209.5 - Property valuation requirements for deeds in lieu of foreclosure

Guide Section 9209.6 - Borrower communication and execution timelines for deeds in lieu of foreclosure

Guide Section 9209.7 - Deed in lieu of foreclosure transaction and processing requirements

Guide Section 9209.8 - Closing, reporting and remittance requirements for deeds in lieu of foreclosure

Learn more about: