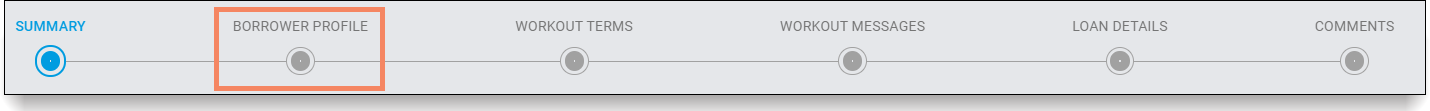

Borrower Profile Section

The Borrower Profile section of the Flex Modification Details page contains the borrower(s)' financial information and includes the following fields:

The table below provides a brief description of each data field in the Borrower Profile section:

| Field Name: | Field Type: | Description: |

| Borrower Name | Text | The primary borrower's first, middle initial and last name. |

| Borrower Gross Monthly Income | Currency | The amount of the borrower(s)' total household income. Includes employment income and additional sources of revenue, such as Social Security payments. |

| Co Borrower Gross Monthly Income | Currency | The monthly dollar amount received by the co borrower as income before taxes have been taken out. |

| Monthly Gross Rental Income | Currency | The amount of revenue generated by the subject property from rent on a monthly basis. |

| Cash Reserves Amount | Currency | The amount of the borrower(s)' total non-retirement liquid assets. Includes assets that can be instantly converted into cash without losing their value. |

| Borrower FICO | Numeric | The borrower's FICO score. |

| Borrower FICO Date |

Date (MM/DD/YYYY) |

The date the co-borrower's FICO score was obtained from the credit bureau. |

| Co Borrower FICO | Numeric | The co-borrower's FICO score. |

| Co Borrower FICO Date |

Date (MM/DD/YYYY) |

The date the co-borrower's FICO score was obtained from the credit bureau. |

| Monthly Net Rental Income | Currency | The monthly net rental income is derived by subtracting the post modification PITIAS from 75% of the monthly gross rental income. This is used to calculate HTI for investment properties. |

| Hardship Reason | Text |

The reason for the borrower's hardship. This data field will reflect the hardship that best corresponds to the borrower's situation. |

| BRP Date |

Date (MM/DD/YYYY) |

The date the Servicer receives the Borrower Response Package from the borrower. |

| QRPC Date |

Date (MM/DD/YYYY) |

The date the Servicer contacted the borrower prior to initiating the workout request. |

| Disaster Declaration Date |

Date (MM/DD/YYYY) |

The date the disaster was declared eligible. |

| Reason For Extenuating Circumstances | Text |

The comments provided by the Servicer describing the reason for the extenuating circumstances. This is a required field if the hardship is 'Other". |

| Is Borrower In Imminent Default? | Yes/No |

Indicates whether the borrower meets the business rules for imminent default. Imminent Default is applicable to loans that are less than 60 days delinquent. The field displays either a 'Y' or 'N' value. |

| Hardship Resolved? | Indicates whether the borrower's hardship has been resolved. | |

| Able to Make Contractual Payment? | Indicates if the borrower can continue making current contractual payments. | |

| Borrower Expenses: | ||

| Monthly Property Taxes | Currency | The dollar amount of the monthly expense for property taxes on the subject property. |

| Monthly Hazard/Flood Insurance | Currency | The dollar amount of the monthly expense to cover hazard / flood insurance premiums for the subject property. |

| Monthly MI | Currency | The dollar amount of the monthly expense to cover the mortgage insurance premium. |

| Ancillary Monthly Fees | Currency | The dollar amount of the monthly condominium or homeowner's association fees related to the subject property. |

| Primary Residence PITIAS | Currency |

The total dollar amount of monthly principal, interest, property tax, hazard insurance, ancillary fees (association dues), and escrow shortage payment (if applicable) for the PRIMARY residence. This field will contain a value only when the workout request applies to a non-owner-occupied property. |

| Current TIAS | Currency | The borrower's monthly taxes, insurance and escrow shortage payment, prior to modification. |