New Expense Code Workflow Process

A notification and approval process for new expense codes has been added into the Total MI Claims tool. This workflow process enables MI companies to review and confirm the details around the new expense code via the Total MI Claims tool.

Note: While Servicers can view expense codes and categories within Total MI Claims, they do not have access to the new expense code workflow functionality in the Total MI Claims tool.

New Expense Code Workflow

Freddie Mac sends the MI Company an email notification once a new expense code has been created and is ready for review. The email notification contains the Request ID Number and a link to view the new expense code information in Total MI Claims.

MI Companies can contact [email protected] with any questions or comments during the review process

How to Review and Submit New Expense Code Information

MI Companies should follow the steps below to review and submit new expense code information to Freddie Mac:

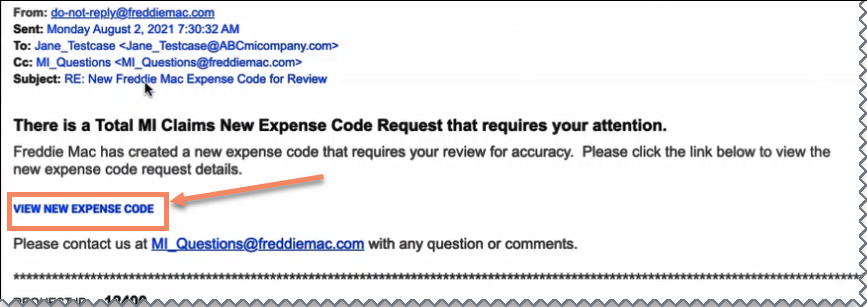

- Click the VIEW NEW EXPENSE CODE link provided in the email. An editable view of the Expense Code Details page displays:

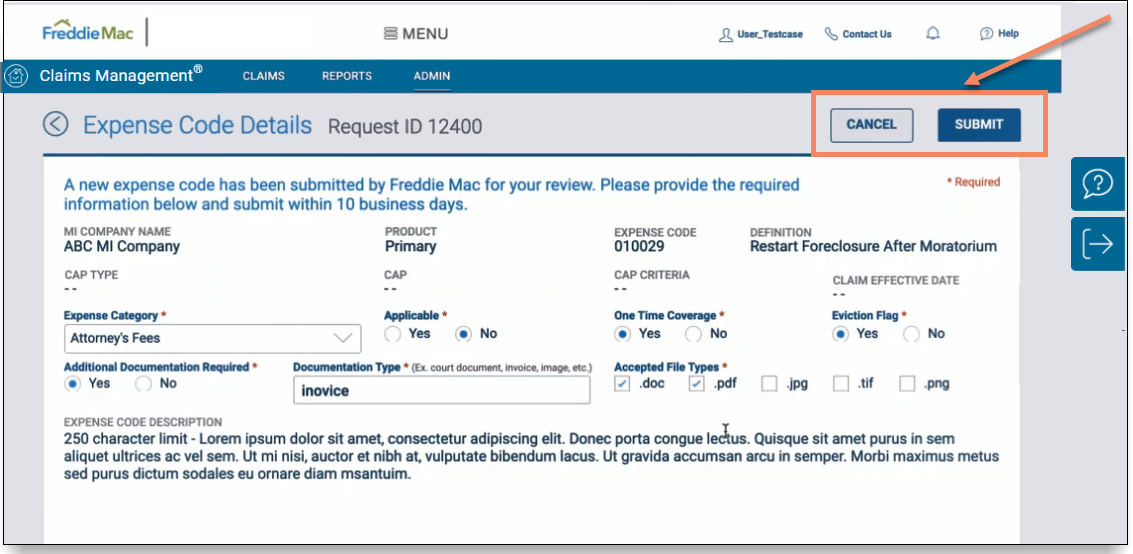

- Review all of the expense code information displaying on the Expense Code Details page for accuracy.

- Update the required fields on the page. NOTE: A red asterisk * indicates the field is required. Click here for a detailed description of each required data field on the page.

- Select either the SUBMIT or CANCEL button from the top-right of the page:

| Select: | To: |

|

SUBMIT |

Send the new expense code information to Freddie Mac. The Justification for Request pop-up box displays. Proceed to step #5. |

| CANCEL | Remain on the Expense Code Details page. |

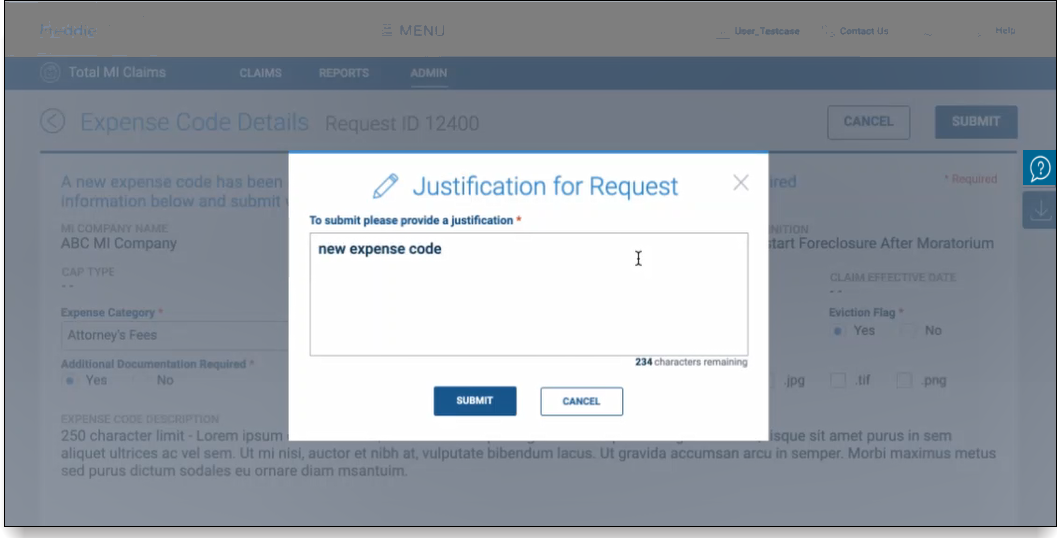

- Enter a justification for the new expense code into the pop-up box and select either the SUBMIT or CANCEL button:

| Select: | To: |

|

SUBMIT |

Complete the process and send the new expense code information to Freddie Mac. The request will be reviewed by Freddie Mac within two business days. |

| CANCEL | Close the Justification for Request pop-up box and remain on the Expense Code Details page. |

Expense Code Details Required Data Fields

Refer to the table below for a detailed description of the required/editable data fields found on the Expense Code Details page.

Note: The Expense Code Details page is only editable for MI Companies submitting new expense code information. Click here for a detailed description of the read-only data fields included on the page.

| Required Field: | Field Type: | Description: | ||||||||||||||||||||||||

| Expense Category | Drop-Down List |

Specifies the broad category into which individual expense claim types may be grouped. Select an expense category from the drop-down list. Values that may display include: Values that display in the drop-down list include:

|

||||||||||||||||||||||||

| Applicable | Yes/No Radio Button |

Indicates whether the expense code is claimable with the MI company. This field displays either a Yes or a No.

|

||||||||||||||||||||||||

| One Time Coverage | Yes/No Radio Button | Details whether an expense code will only be covered once by an MI company, regardless of there being multiple line items with the same expense code. | ||||||||||||||||||||||||

| Eviction Flag | Yes/No Radio Button | Determines whether an expense code is applicable for calculation dependent on the eviction status of the loan. | ||||||||||||||||||||||||

| Additional Documentation Required | Yes/No Radio Button |

Indicates whether additional documentation is required. This field displays either a Yes or a No.

|

||||||||||||||||||||||||

| Documentation Type | Text | Indicates the type of document being attached - i.e., court document, invoice image, etc. | ||||||||||||||||||||||||

| Accepted File Types | Checkbox |

Indicates the type of file that is being attached. Accepted file types include:

|