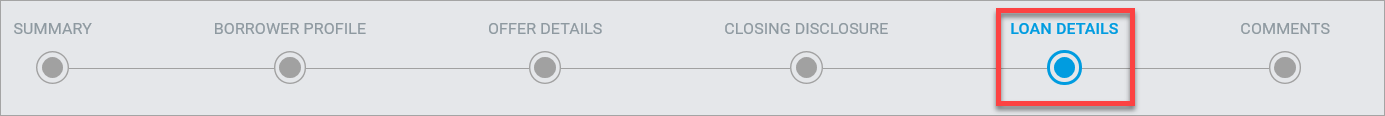

Loan Details

The Loan Details section of the Details page contains information specific to the loan and includes the following fields:

The table below provides a brief description of each data field in the Loan Details section:

|

|

Field Name |

Field Type |

Definition |

|---|---|---|---|

|

1. |

Property Usage Type |

Text |

Reflects the purpose for purchasing the loan. This field will reflect one of the following statuses:

|

|

2. |

Property Type |

Text |

Specifies the type of dwelling or structure on the property (i.e. single family, detached, etc.). |

| 3. | Property Occupancy Type | Text | Describes the occupancy status of the property (i.e., vacant, occupied, etc.). |

|

4. |

Mortgage Type |

Text |

Summarizes the characteristics of a mortgage purchased by Freddie Mac (i.e. FHA, VA, Conventional First Lien Mortgage, etc.). |

|

5. |

Current Loan Status |

Text |

The current status of loan. This field will reflect one of the following statuses:

|

|

6. |

DDLPI (Freddie Mac Value) |

Date (MM/DD/YYYY) |

The due date of the last paid installment on the loan. |

|

7. |

2nd Lien UPB |

Currency |

The dollar amount of the second lien unpaid principal balance. |

|

8. |

Company Name |

Text |

Name of the organization that holds the second lien, if applicable. |

| 9. | Current Loan Gross UPB | Currency | Dollar amount of the gross unpaid principal balance on the current loan. |

| 10. | Loan Delinquent Month Count | Numeric | The number of months that the loan has been reported as delinquent. |

| 11. | In-flight Workout Type | Text | Describes the type of in-flight workout. |

| 12. | In-flight Workout Status Type | Text | Describes the status type of the in-flight workout. |

| 13. | In-flight Workout Source | Text | Describes the source of the in-flight workout. |

| 14. | Scheduled Foreclosure Sale Date |

Date (mm/dd/yyyy) |

The scheduled foreclosure sale date for the property. |

|

PITIAS: |

|

15. |

Current PITIAS |

Currency |

Dollar amount to cover principal, interest, property taxes, hazard insurance, ancillary fees and the escrow shortage (if applicable). Note: This currency value is calculated in Resolve. |

|

16. |

P&I |

Currency |

Dollar amount of the monthly principal and interest payment (principal and interest constant) on a mortgage. |

|

17. |

Monthly Property Taxes |

Currency |

The portion of the monthly mortgage that is allocated to the property tax on the subject property. |

|

18. |

Monthly Hazard/Flood Insurance |

Currency |

Average monthly cost to cover Hazard/Flood insurance premiums for the property. |

|

19. |

Ancillary Monthly Fees |

Currency |

Dollar amount of HOA/condominium fees assessed for the property. |

|

20. |

Monthly Escrow Shortage Amount |

Currency |

Dollar amount that the borrower is currently required to pay each month for the actual escrow shortage. |