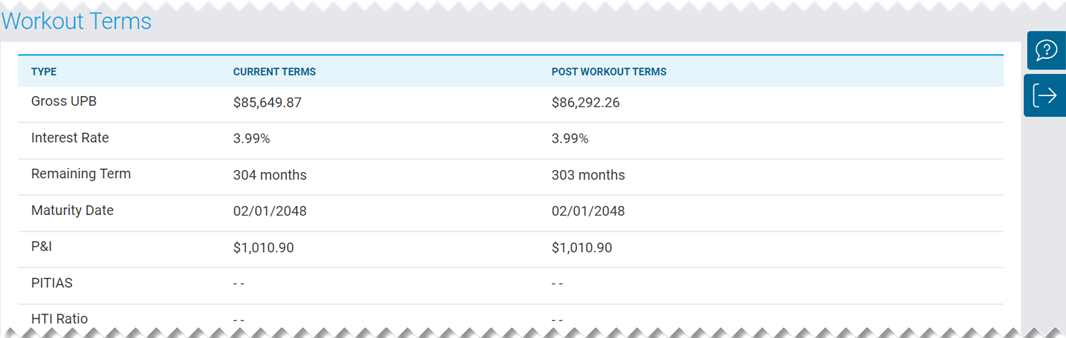

Workout Terms Section

The Workout Terms section of the Flex Modification Details page contains information around the modification's terms and includes the following fields.

The table below provides a brief description of each data field in the Workout Terms section:

| Field Name | Field Type |

Description |

||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Workout Terms: | ||||||||||||||||||||

| Type | Text |

Describes the type of workout term. Values that appear under this section include:

|

||||||||||||||||||

| Current Terms | Displays the current mortgage terms prior to the workout. | |||||||||||||||||||

| Post Workout Terms | Displays the post workout mortgage terms. | |||||||||||||||||||

| Other Post Workout Details: | ||||||||||||||||||||

| Interest Bearing UPB | Currency |

The dollar amount of the post workout interest-bearing unpaid principal balance amount based on the post workout terms of the loan. |

||||||||||||||||||

| Non-Interest Bearing UPB | Currency |

The dollar amount of the portion of the gross UPB that is not amortized and will not produce interest. It is still part of the outstanding balance that the borrowers owe to Freddie Mac post workout. |

||||||||||||||||||

| MTMLTV | Numeric | The post workout Loan to Value (LTV) ratio expressed as a rate that is adjusted for Mark to Market analysis. | ||||||||||||||||||

| Trial Period (From/To) |

Date (MM/DD/YYYY) |

The date range for the Trial Period. The Trial Period From Date indicates when the Trial Period goes into effect; also referred to as the beginning of the Loan Modification Trial Period or Trial Period Start Date. The Trial Period To Date indicates the scheduled end date for the modification trial period. Note: The Trial Period range can be three or four months depending on whether a interim month has been inserted. |

||||||||||||||||||

| Interest Rate Change Date |

Date (MM/DD/YYYY) |

The date that the new interest rate of the modification is effective. This is one month prior to the Modification Effective Date |

||||||||||||||||||

| First Payment Due Date |

Date (MM/DD/YYYY) |

The date that the new payment of the modification is effective. Upon evaluation, Resolve uses the first payment due date (month after the interest rate effective date) of prior settled workouts with deferred principal and interest (P&I) payments to determine eligibility. |

||||||||||||||||||

| Deferred Principal Amount | Currency |

The total principal portion of the borrower's modified Principal and Interest (P&I) payments. Note: The deferred amounts will become due and payable at the earlier of the Mortgage maturity date, payoff date or upon transfer or sale of the Mortgaged Premises. |

||||||||||||||||||

| Deferred Interest Amount | Currency |

The total interest portion of the borrower's modified Principal and Interest (P&I) payments. Note: The deferred amounts will become due and payable at the earlier of the Mortgage maturity date, payoff date or upon transfer or sale of the Mortgaged Premises. |

||||||||||||||||||

| Deferred Payment Count | Numeric |

The cumulative number of the prior and the current cycle payments that were deferred at the time of the approval for the life of the loan. Deferred Payment Allowable Limit - When the deferred payment count exceeds the allowable limit for the total number of deferred payments, as of the evaluation month or when inserting an interim month, the workout will be conditionally approved, with the expectation that the Servicer will collect and report the payment(s) from the borrower before settlement to remain within the allowable limits. Settlement - The Servicer must ensure the borrower's payment was received and reported via your technology reporting system (e.g., loan level reporting-LLR) in the month of evaluation (or the interim month, if applicable) prior to submitting a settlement request (SETReq). If the payment is not received (and reported via LLR) prior to settlement, Resolve returns an ineligible status. |

||||||||||||||||||

| Arrearages/Capitalization: | ||||||||||||||||||||

| Suspense/Restricted Escrow | Currency |

The total dollar amount of funds that are currently being held in an account on behalf of the borrower that have not yet been allocated. |

||||||||||||||||||

| Borrower Contribution | Currency |

The dollar amount that the borrower has contributed towards the delinquent UPB, interest and/or fees in a workout with Freddie Mac. |

||||||||||||||||||

| Monthly Escrow Shortage | Currency |

The dollar amount that the borrower is currently required to pay each month for the Actual Escrow Shortage at the time of evaluation. |

||||||||||||||||||

| Escrow Advances | Currency |

The dollar amount of advances made by the Servicer prior to evaluation and any advances that will be made during the Trial Period to pay property taxes or insurance premiums. |

||||||||||||||||||

| Delinquent Interest | Currency |

The dollar amount of the interest owed on a loan as a result of non-payment--calculated from the DDLPI through the end of a set period. Note: Delinquent interest is a conditional data field on the template and becomes an editable field for Workout Approval requests (WAReq) for the servicer to edit when the value is different from what Resolve has calculated. |

||||||||||||||||||

| Legal Fees/Cost | Currency |

The dollar amount of fees that have been paid or are due for legal services associated with a delinquent loan. |

||||||||||||||||||

| Property Preservation | Currency |

The dollar amount of all outstanding fees and costs incurred by the Servicer in order to preserve and protect the property. |

||||||||||||||||||

| Total Capitalized Arrears | Currency |

The cumulative dollar amount required to bring the loan current. Includes Legal Fees, Property Preservation Costs, Escrow Advances, Delinquent Interest, Suspense/Escrow Balances and Borrower Contributions. |

||||||||||||||||||

| Projected Escrow Shortage | Currency | Total estimated escrow amounts due once the loan has been modified that cause the balance to drop below the targeted escrow balance. | ||||||||||||||||||

| Miscellaneous Amount | Currency |

This field will not display an amount. Note: Field is reserved for future updates. |

||||||||||||||||||

| Work Eligibility: | ||||||||||||||||||||

| Hardship Resolved | Yes/No |

Indicates whether the borrower's hardship has been resolved. |

||||||||||||||||||

| Date of Disaster |

Date MM/DD/YYYY |

The date the disaster was declared eligible. | ||||||||||||||||||

| Disaster County Code | Numeric | The 2-digit county code where the disaster occurred. | ||||||||||||||||||

| Able to Make Contractual Payment | Yes/No | Indicates if the borrower can continue making current contractual payments. | ||||||||||||||||||

| Reinstatement Viable | Yes/No | Indicates if reinstatement was a viable option for the borrower. | ||||||||||||||||||

| Repayment With Active Offer | Yes/No | Indicates if the mortgage is subject to an unexpired offer to the borrower for a repayment plan or if the borrower has a repayment plan in progress. | ||||||||||||||||||

| Right Party Contact Indicator | Yes/No | Indicates whether the Servicer contacted the borrower prior to initiating the workout request. | ||||||||||||||||||

| Right Party Contact Date |

Date MM/DD/YYYY |

The date when the Servicer contacted the borrower prior to initiating the workout request. | ||||||||||||||||||

| Willing to Retain Property | Yes/No | Indicates whether the borrower is willing to retain the home. | ||||||||||||||||||

| Has Leasehold Estate Term Extended? | Yes/No | Indicates whether the lease does not terminate earlier than 5 years after the maturity date of the proposed modified mortgage. This applies if the mortgage is secured by a leasehold estate. | ||||||||||||||||||

| Borrower Response Package Received Date |

Date MM/DD/YYYY |

The date the Servicer receives the Borrower Response Package from the borrower. | ||||||||||||||||||

| Solicitation Letter Transmittal Date |

Date MM/DD/YYYY |

The date the Servicer sent out the solicitation letter to the borrower. | ||||||||||||||||||

| Submission Notes: | ||||||||||||||||||||

| Submission Notes | Text | Notes entered by the Servicer in the workout Comments data field providing further details about the workout (e.g., submitted with an exception review request). | ||||||||||||||||||

Note: Odd Due Date Loans - If a loan submitted via Resolve has a contractual due date other than the first of the month, Resolve will reset the requested first payment due date, interest rate change date (modification effective date) and the requested trial period start and end dates to the first of the month.

Note: Daily Simple Interest (DSI) Loans - For DSI loans, Resolve calculates the delinquent interest based on the number of delinquent days instead of delinquent months.

Note: For Biweekly loans, contact 800 Freddie or your Freddie Mac representative for assistance.