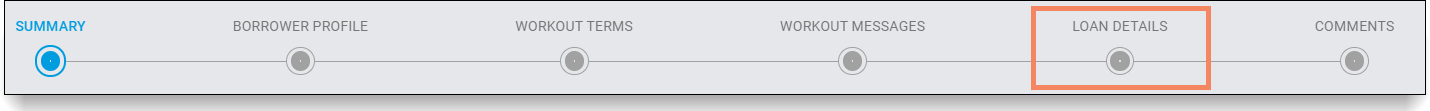

Loan Details

The Loan Details section of the Flex Modification Details page contains information specific to the loan and includes the following fields:

The table below provides a brief description of each data field in the Loan Details section:

| Field Name: | Field Type: | Description: |

| Property Usage Type | Text |

Reflects the purpose for purchasing the loan. This field will reflect one of the following statuses:

|

| Property Occupancy | Text | The occupancy status of the property (i.e., vacant, occupied, etc.). |

| Property Condition | Text | The physical condition of the property. |

| Mortgage Type | Text |

Summarizes the characteristics of a mortgage purchased by Freddie Mac (i.e. FHA, VA, Conventional First Lien Mortgage, etc.). |

| Property Value | Currency | The value of the property. |

| Loan Type | Text | The type of loan (i.e., fixed, adjustable rate, etc.) |

| Loan Status | Text | The current status of loan.

This field will reflect one of the following statuses:

|

| Last Paid Installment Date (DDLPI) |

Date (MM/DD/YYYY) |

The due date of the last paid installment on the loan. |

| ARM Ceiling | Percentage |

The stated maximum rate to which the interest rate can increase over the life of the loan. |

| Origination Date |

Date (MM/DD/YYYY) |

The date on which the mortgage was originated. |

| Step Rate Indicator | Yes/No | Indicates whether the loan is a step rate loan. |

| Has Leasehold Estate Term Extended? | Yes/No | |

| Credit Enhancement Type | Text | A mortgage sold to Freddie Mac with recourse or indemnification. |

| Property Valuation Type | Text | A discrete set of values that specifies the nature of the property valuation (e.g., AVM or BPO). |

| Property Valuation Effective Date |

Date (MM/DD/YYYY) |

The effective date for the information presented on the property valuation, or the date when the information is valid. |

| Number of Delinquent Months |

Numeric |

The number of months delinquent for a loan calculated from the loan's due date of last paid installment (DDLPI) as of submission date through the interest rate change date. Resolve determines delinquency by checking the DDLPI in Loan Level Reporting (LLR). The number of delinquent months that Resolve calculates to determine eligibility will be based on the DDLPI movement that has been reported in LLR. Review the section on how Resolve calculates the Number of Delinquent Months. |

| Published Modification Interest Rate | Percentage | The Freddie Mac published interest rate at the time of workout eligibility determination. |

| Borrower Payment Due Date | Date (MM/DD/YYYY) | The scheduled due date for the borrower's principal and interest payment. |

| Note Rate At Purchase | Percentage | The loan interest note rate at origination. |

| Principal and Interest Amount | Currency | The monthly amount of principal and interest that is due on the loan from the borrower. |

| Lien Type | Text |

This field will not display data. Field is reserved for future updates. |

| Bankruptcy Type | Text | Indicates the bankruptcy chapter. |

| Confirmation Date | Date (MM/DD/YYYY) |

The date that a bankruptcy plan was confirmed. The date can't be a future date. |

| DDLPI At Confirmation Date | Date (MM/DD/YYYY) | The due date of the last paid installment as of the confirmation date of the bankruptcy plan. |

| Gross UPB At Confirmation Date | Currency | The UPB as of the confirmation date of the bankruptcy plan. |

| Contested Indicator | Y/N | Indicates if the court mandated terms were contested by the Servicer. |

| Prior Settled Workouts: | ||

| Prior Workout Type | Flex Modification or Payment Deferral | Indicates the prior workout program type on the loan (e.g. Flex Modification or Payment Deferral). |

| Prior Workout Status |

Text |

Indicates the settled prior workout status as "Closed' for Flex Modifications or Payment Deferrals. |

| Interest Bearing UPB | Currency | The interest bearing UPB on the prior modification. |

| Non-Interest Bearing UPB | Currency | The non-interest bearing UPB on the prior modification |

| Modified Term | Numeric | The modified term in months if applicable (e.g. 480 months for a prior modification). |

| Prior Workout Effective Date | Date (MM/DD/YYYY) |

The effective date of the prior workout. Note: For a modification this is irrespective of whether the Trial Period failed or was successfully completed. |

| Modified Interest Rate | Percentage | The modified interest rate for the prior workout. |

| Capitalized Amount | Currency | The amount capitalized for the prior settled workout. |