Request Custom Modification or Bankruptcy Cramdown Workout

Custom Modification requests are reviewed and decisioned through Freddie Mac's exception path in Resolve's UI.

Servicers can process:

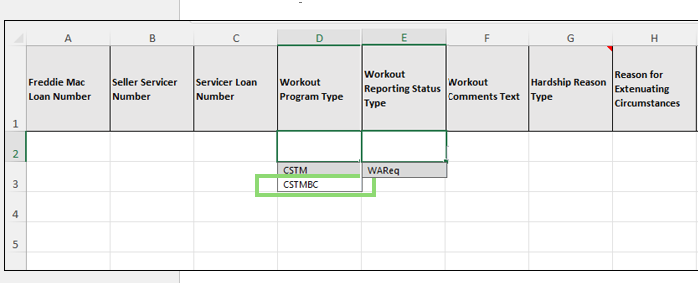

- Custom Modifications (CSTM)

- Bankruptcy Cramdowns (CSTMBC)

Note: Custom Modifications can't be appealed.

Request Custom Modification

Follow the process steps below to upload single or multiple requests through the Resolve UI submission path:

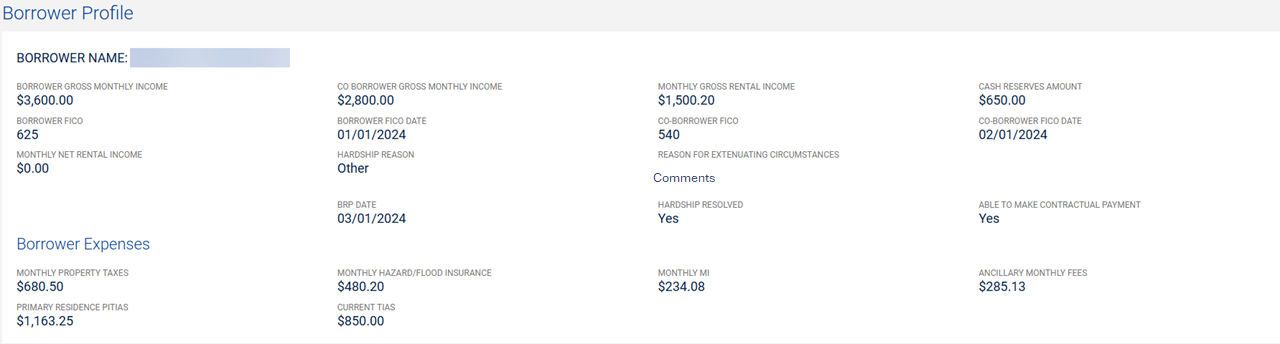

1. From the Resolve dashboard, select SUBMISSIONS from the top navigation bar. The SUBMISSIONS menu displays. Click the Custom Modification link under RETENTION on the SUBMISSIONS menu

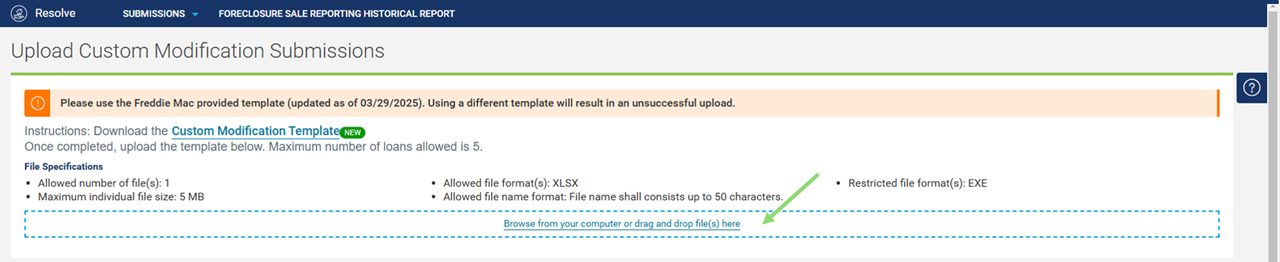

2. The Upload Custom Modification Submissions page displays, click anywhere in the blue-dashed section to browse your computer for the upload file.

Note: Prior to upload, click the Custom Modification Template hyperlink on the Upload Custom Modification Submissions page to download the template and create your upload file for Custom Modifications or Bankruptcy Cramdowns. Review the Download Template section for more information. To ensure a successful upload, refer to the Template Formatting Guidelines section for more details on formatting restrictions.

3. Browse and Open or drag and drop your loan file to upload.

4. The file appears at the bottom of the page. Click CANCEL or SUBMIT.

| Select: | To: |

|

Delete the upload file. The loan file will no longer display on the Upload Custom Modification Submissions page. Return to Step #2 to upload another loan file. |

| Select: | To: | ||||||||||||

|

|

Submit the request. Resolve runs validation checks of the loan data within the upload file.

|

||||||||||||

|

Stop uploading your current file and remain on the Upload Custom Modification Submissions page. Return to Step #2 to upload another loan file submission, if applicable. Note: Upon clicking CANCEL, the loan file will be permanently removed from Resolve. |

5. The Confirm Servicer Agreement pop-up box displays, click CONFIRM & SUBMIT or CANCEL.

| Select: | To: |

|

Submit the request and attests that the data provided is complete with all applicable Guide requirements. Any misrepresentation or falsification may lead to the request being denied. Proceed to Step #6. |

|

Cancel the upload of the file. |

6. A pop-up box appears displaying the message "Successfully Uploaded" and confirms the number of loans that were successfully uploaded to Resolve. Click OK.

7. Resolve redirects you to the dashboard. The uploaded loans show a SUBMITTED FOR REVIEW status. Click the applicable Freddie Mac loan number hyperlink (i.e., #456789002) to view the Details page.

View the Details Page and Proposed Terms

8. The Custom Modification Details page displays. View the loan attributes and terms from calculated data, data derived from internal sources and data provided on the Servicer's upload file. For data field definitions, refer to the Custom Modification Details page, Workout Terms section.

- Review the table in the Workout Terms section of the current, proposed, and post workout terms.

- Proposed non-interest bearing UPB

- Proposed principal and interest (P&I)

- Proposed interest rate

- Proposed term

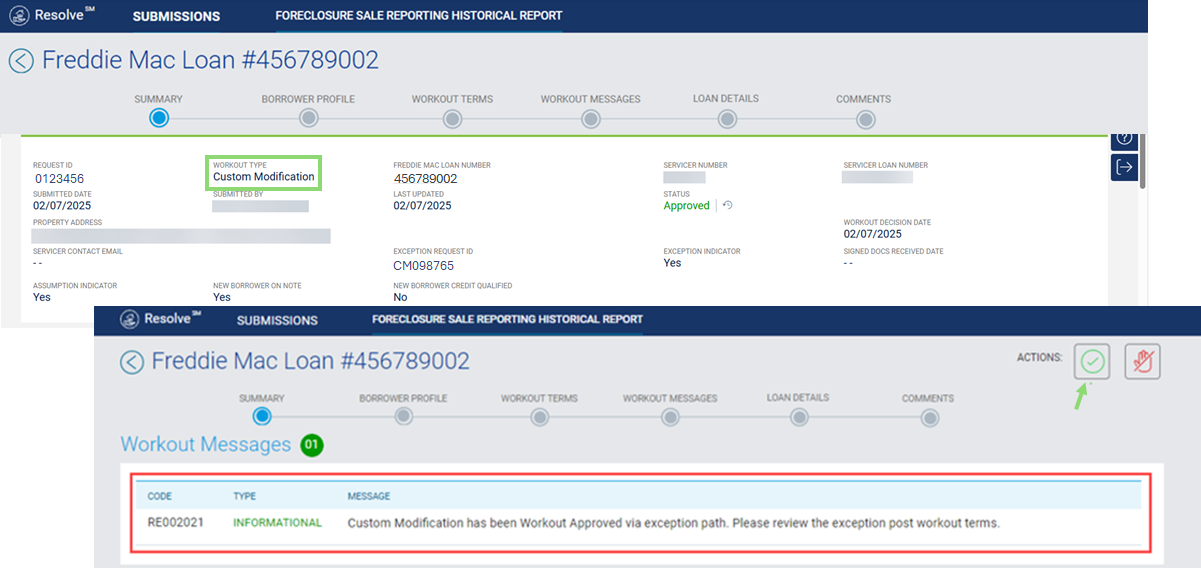

- View the messages in the Workout Messages section noting that the workout has been routed to the exception review process for decisioning by a Freddie Mac analyst.

9. The request will move from Submitted For Review to In Review status when it's assigned to a Freddie Mac analyst to review and decision. Once the analyst has approved the Custom Modification workout request, the status moves from In Review to Approved on the dashboard. A bell icon notification will alert you once the loan moves to an Approved status.

Important: If Freddie Mac needs additional information from you regarding the Custom Modification workout request, the loan's status will move to Info Requested and you will receive a bell icon notification of the Info Requested status. To provide updated or additional information regarding your workout request, refer to the Info Requested section for the process steps.

Request Settlement Approval

10. The Details page displays the loan in an Approved status with the updated workout message, "Custom Modification has been Workout Approved via the exception path. Please review the exception post workout terms." When the request is in an Approved status, you can either request settlement approval or cancel the request. Click the settlement icon ![]() to proceed to settlement.

to proceed to settlement.

| Select: | To: |

|

Proceed with the settlement request. Click the ACTIONS button |

|

|

Cancel the request via Resolve. Refer to the Request Cancellation section for process steps. |

11. The Settlement Request pop-up box displays. In the Signed Final Doc Date field, you're required to enter the applicable date of the final signed documents (e.g., this is a required data field as noted by the red asterisk).

Note: In the case of a bankruptcy cramdown, use the confirmation date of the court order as the Signed Final Doc Date.

Click SUBMIT or CANCEL.

| Select: | To: |

| Continue the processing of settlement approval. | |

| Cancel the settlement request. |

12. The Confirmation pop-up box displays. Click CONFIRM SUBMIT or CANCEL.

| Select: | To: |

|

Attests that the data transmitted complies with all applicable requirements set forth in the Freddie Mac Single-Family Seller/Servicer Guide (Guide) and applicable purchase documents. Proceed to Step #13. |

|

Cancel the settlement request. |

|

Edit signed final document date. |

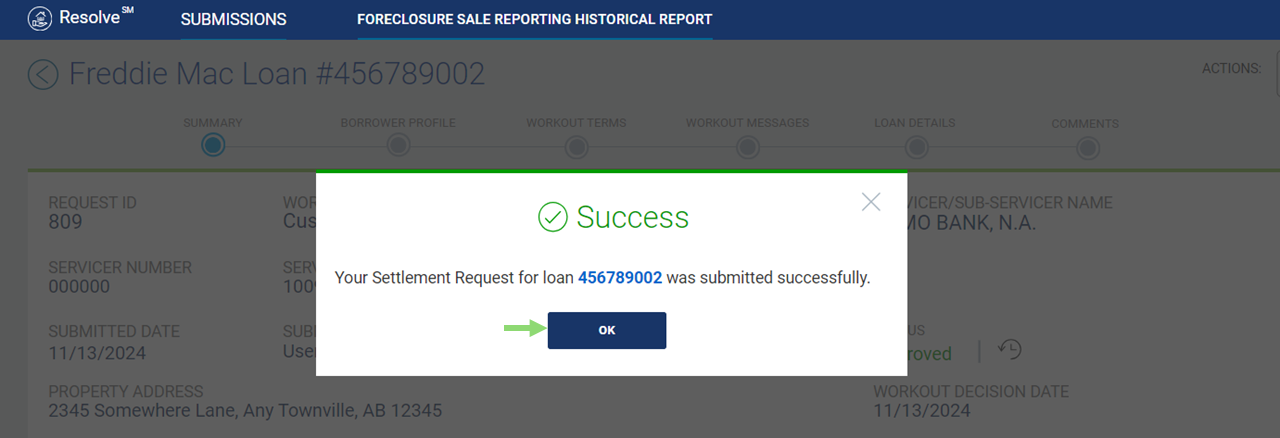

13. When you click Confirm Submit,

| And the loan... | Then... |

| Has no eligibility validation errors |

The Success pop-up box displays indicating the settlement request was successfully submitted in Resolve. Click OK.

You are returned to the Resolve dashboard which shows the submission status has been updated from Approved to APPROVED FOR SETTLEMENT.

|

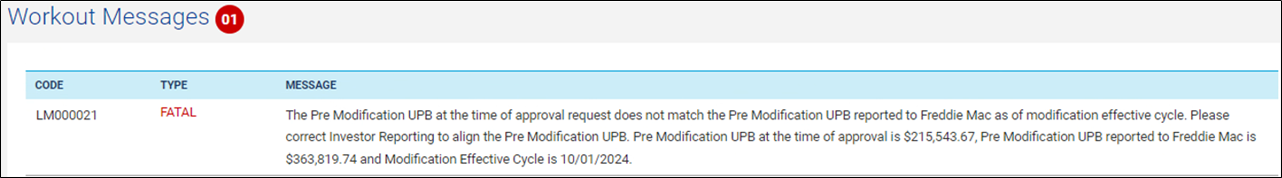

| Has eligibility validation errors |

An Ineligible pop-up box displays indicating the loan was ineligible for settlement due to validation errors. 1. Click Review Errors to view the fatal message(s) in the Workout Messages section of the Modification Details page that resulted in an ineligible settlement request (i.e., pre modification UPB upon submission of settlement request does not match pre-modification UPB reported to Freddie Mac as of effective cycle date). 2. Cancel the original custom modification submission request via Resolve's cancellation (CXLReq) functionality. Refer to Request Cancellation section for process steps. 3. Per the instructions of the error message(s), correct the loan data based on the fatal error and re-upload the loan via the upload submissions functionality. Return to Step #2. Note: You can't re-upload the same loan that is in an Ineligible for Settlement status.

|

Request Bankruptcy Cramdown Workouts

Bankruptcy Cramdowns are a type of custom modification where the bankruptcy court mandates the terms of the modification. Do not initiate a bankruptcy cramdown in Resolve until you have received confirmation of the modification terms from the court. When you populate the custom modification template, the court mandated terms will be key required data points. Like a custom modification, there is no trial period.

Request bankruptcy cramdown workouts via the upload submission functionality using the Custom Modification template. Refer to the above-mentioned process steps 2 through 7.

1. Select the Workout Program Type as Bankruptcy Cramdown (CSTMBC) from the drop-down menu on the upload submission file template.

2. After a successful file upload, view the Details page which displays the loan attributes for the bankruptcy cramdown workout. There are specific data elements that populate (as shown in the Workout Terms and Loan Details sections) when the workout program type is bankruptcy cramdown:

- Pre-Cramdown Modified Gross UPB

- Total Write Off

- UPB Write Down

- Bankruptcy type

- Confirmation date

- DDLPI at confirmation date

- Gross UPB at confirmation date

- Contested indicator

On the Bankruptcy Cramdown Details page, view the loan attributes and terms from calculated data, data derived from internal sources and data provided on the Servicer's upload file.

- Review the table in the Workout Terms section for the current, proposed, and post workout terms.

- Proposed non-interest bearing UPB

- Proposed principal interest (P&I)

- Proposed interest rate

- Proposed term

- View the messages in the Workout Messages section.

Note: For data field definitions, refer to the Bankruptcy Cramdown Details page, Workout Terms section.

3. Request settlement approval for bankruptcy cramdowns via the settlement process. Refer to the above-mentioned process steps 10 through 13 in the Request Settlement Approval section.

Learn more about: