Cash Contract Fulfillment and Settlement

Contents

- Overview and Requirements

- Settlement Details

- Delivery Requirements

- Calculate Servicing Retained Cash Proceeds

- Calculate Cash-Released XChange Proceeds

- Understand the Amount Funded/Total Disbursement

- Funding Adjustments

- Escrow Funds

- Unapplied Temporary Buydown Subsidy Funds

- Accrued Interest/Interest Adjustment

- Servicing Spread Adjustment

- Tax Service Fee

- Transaction Fee

- Settlement Statements

- Export Funding Details

Overview and Requirements

This section addresses finalizing a contract for delivery and funding. For Cash executions, the Settlement Date, also known as the Funding Date, occurs on the day that Freddie Mac purchases the mortgages.

Settlement Details

Once loans have been added to a contract, the settlement details of any loan(s) (both allocated and unallocated) may be entered or updated, but the only time you will do this is if you:

-

Select a Requested Settlement Date that is on or before the contract expiration date. If you do not select a date, the system defaults to ASAP funding which lets (individual) loans fund as soon as the requirements for sale are met.

-

Assign Warehouse Lender Wiring Instructions (allocated loans only).

-

Assign a Servicer other than the default Servicer. If you select a Servicer Identifier that is different from the Designated Servicer number, you will receive a critical edit if the validation of the Servicing Option and Designated Servicer selected for the contract fails.

-

Assign a Custodian other than the default Document Custodian.

If you only have one set of wiring instructions, Freddie Mac defaults to that set, and the system follows this behavior with Servicers and Document Custodians (henceforth referred to simply as Custodians), as well. Cash-Released XChange® Sellers may select Bank of New York Mellon (The Bank of New York Mellon) as their designated custodian or U.S. Bank (U.S. Bank, National Association) as their preferred Document Custodian.

You can enter settlement details from the Settlements menu or from the Contract Details page. The steps below illustrate how to enter settlement details from the Settlements menu.

-

From the main menu, click Settlements, and then click Enter Settlement Details.

-

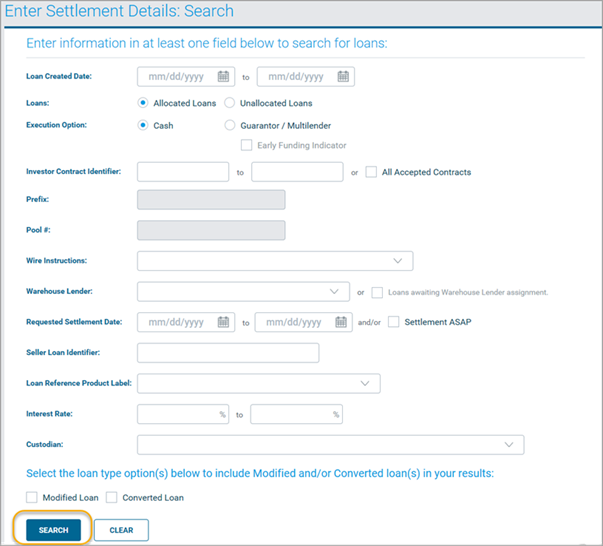

The Enter Settlement Details: Search page displays. Enter your search criteria and then click SEARCH.

-

The Enter Settlement Details: Cash page displays. Choose a Requested Settlement Date and/or Wire Instructions for your Warehouse Lender (if applicable), a Servicer Identifier (not applicable for Cash-Released XChange Sellers), and a Custodian.

-

Check the boxes of the loan(s) you want to update, and then click UPDATE LOANS.

-

The Enter Settlement Details: Results page displays, confirming your selections.

Delivery Requirements

To ensure timely settlement, you must comply with Freddie Mac’s delivery requirements, all of which must be completed no later than 12:30 p.m. ET on the business day before the Purchase Contract Expiration Date or the Requested Settlement Date, whichever occurs first. Additionally, Sellers must ensure that:

-

All contract and Uniform Loan Delivery Data (ULDD) delivery data is complete and accurate.

-

All the mortgage critical edits and allocation errors identified by Loan Selling Advisor have to be cleared in accordance with Freddie Mac requirements.

-

Cash Wire instructions, including the Warehouse Lender Name, if applicable, are correct and have been assigned.

-

The Notes for all mortgages in the contract have been delivered to the Custodian.

-

Form 996E, if applicable, is executed by the Seller and processed by the Warehouse Lender.

-

Form 996E, Warehouse Provider Release and Transfer, if applicable, is recorded by Freddie Mac by 12:30 p.m. ET on the business day before the Funding Date, but no later than 12:30 pm ET the business day before the Purchase Contract Expiration Date or the Requested Settlement Date, whichever occurs first.

-

The Document Custodian must certify the mortgages in Loan Selling Advisor by 12:30 p.m. ET on the contract expiration date or the requested settlement date, whichever occurs first.

Also review the Deliver Accurate Data for Loans Sold Through Co-Issue XChange®.

Calculate Servicing Retained Cash Proceeds

Cash proceeds Servicing-Retained the total disbursement, is the amount the Seller receives for mortgages sold to Freddie Mac. To calculate this figure, use the contract price and the net price of the loan, where par is equal to 100 percent of the Unpaid Principal Balance (UPB). Prices are shown in Loan Selling Advisor as a percentage (%) of par, where the amount above par is known as a premium price, and the amount below par is known as a discount price.

When calculating cash proceeds, Freddie Mac reimburses accrued interest. After Freddie Mac purchases your mortgages, the first principal and interest payment Freddie Mac receives from your Servicer will include one month’s interest, regardless of when Freddie Mac purchases the mortgages; therefore, we reimburse you interest for the number of days in the purchase month that we do not own the mortgage.

Your cash proceeds may include deductions and credits, if applicable, as disclosed in the Freddie Mac Single-Family Seller/Servicer Guide (Guide) Exhibit 19, Credit Fees. To view the applicable Credit Fees, or credits for Credit Fees, for individual loans prior to funding, click the Total Delivery Fee link in the loan search results section of the Loan Pipeline page. Additionally, you may export this data by using the Export function with the Delivery Fee dataset.

Note: On Exhibit 19, Credit Fees in Price are displayed in basis points that must be deducted or credited from the contract price to determine the net price for the loan. Credit Fees in Fixed Dollars are a one-time set dollar amount that must be deducted or credited from the contract price to determine the net price for the loan. Additionally, multiple Credit Fees may be assessed on a loan depending on the loan characteristics and borrower attributes.

For reference, please review the following formulas and example calculations:

|

Term |

Formula |

|

Premium or Discount |

Premium (or Discount) Price = Price x UPB |

|

Accrued Interest |

Accrued Interest = (Loan Acquisition Scheduled UPB) x (days in month that Freddie Mac did not own the mortgage) x (Accounting Net Yield) /360 |

|

Credit Fees in Price |

Credit Fees in Price = Basis Points x Loan Acquisition Scheduled UPB1 |

|

Total Disbursement |

Total Disbursement = Loan Acquisition Scheduled UPB + Premium Price (or - Discount Price) + Accrued Interest - Credit Fees in Price |

1Refer to Exhibit 19 of the Guide.

|

Example 1 For this example, assume the following parameters:

Outcome:

|

Example 2 For this example, assume the following parameters:

Outcome:

|

Calculate Cash-Released XChange Proceeds

When mortgages are sold under a Mandatory or Best Efforts Cash Contract through Cash-Released XChange, Freddie Mac arranges for a Transferee Servicer to accept a transfer of the Seller’s/Transferor Servicer’s Servicing Contract and related Servicing Contract Rights simultaneously with the sale of mortgages to Freddie Mac. The requirements applicable to the sale of mortgages under Cash-Released XChange are set forth in Guide Section 6101.7 and Exhibit 28A, Loan Servicing Purchase and Sale Agreement for Cash-Released XChange.

Freddie Mac disburses the proceeds of sale to the Seller on the Funding Date, for mortgages purchased. The total disbursement includes the cash price and the Servicing-Released Premium (SRP), net of funding adjustments on mortgages sold through Cash-Released XChange using the Freddie Mac net funding process.

Net funding is the process by which Freddie Mac adds or deducts credit fees, premium or discount pricing and / or other applicable amounts in addition to funding adjustments (such as, escrow funds, unapplied temporary subsidy buydown funds, interest adjustments, the Servicing Spread, tax service fees, transaction fees and other funds due the Transferee Servicer) from the proceeds of sale for each mortgage sold through Cash-Released XChange. The amount of all funding adjustments is transferred by Freddie Mac from the Transferor Servicer to the Transferee Servicer on the Funding Date. See Guide Section 6101.7 and the rest of this section for additional information regarding funding adjustments.

Understand the Amount Funded/Total Disbursement

The tables below illustrate the components used to fund mortgages under the Net Funding process. These components are listed in the Settlement Summary (amount wired to Seller) and the Servicing-Released Proceeds Summary (amount transferred to Servicer).

|

Assumption: Freddie Mac Funding Date is in the month prior to the Last Paid Installment Due Date. |

||

|

Name of Data Field |

Add, Subtract or Equal |

Total Amount |

|

Principal Purchased |

+ |

128,868.49 |

|

Accrued Interest |

+ |

241.62 |

|

Total Fees |

- |

455.84 |

|

Premium (+) or Discount (-) |

+ |

10,392.46* |

|

Servicing Released Proceeds Summary* |

- |

1,429.85 |

|

Total Disbursement to Seller |

= |

137,616.88 |

|

Breakdown of Proceeds to Servicer - See Servicing-Released Proceeds Summary |

||

|

Name of Data Field |

Add, Subtract, or Equal |

Total Amount |

|

Escrow Funds collected at Closing |

+ |

578.78 |

|

Buydown collected at Closing (Unapplied Buydown Subsidy) |

+ |

0.00 |

|

Interest Adjustment |

+ |

604.07 |

|

Servicing Spread Adjustment |

+ |

17.00 |

|

Tax Fee |

+ |

80.00 |

|

Transaction Fee |

+ |

150.00 |

|

*Total Funding Adjustments Transferred to Servicer |

= |

1429.85 |

*The Premium (Discount) in the example above, was calculated as follows:

|

Calculate Premium/Discount |

||

|

Data Component |

Add, Subtract, or Equal |

Total Amount |

|

Base Price |

+ |

108.064 |

|

Loan SRP |

- |

1.140 |

|

Sub total |

= |

106.924 |

|

Par |

- |

100.000 |

|

Sub total |

= |

.06924 |

|

Principal Purchased |

x |

128,868.49 |

|

Sub total |

= |

8,922.854 |

|

SRP Amount |

+ |

1,469.610 |

|

Total Premium |

= |

10,392.464 |

The Loan SRP which displays in the Servicing Released Proceeds Summary section, may be truncated and/or rounded. To view the Loan SRP as a rate (before it is rounded and/or truncated), create a custom export. For step-by-step instructions on how to export data and create custom exports, access the job aids shown below:

Funding Adjustments

Funding adjustments include escrow funds (formerly known as the escrow deposit), interest adjustment, Servicing Spread, tax service fee, transaction fee and unapplied Temporary Buydown Subsidy funds.

Funding adjustments display on the settlement statements and are calculated as follows:

- The Seller/Transferor Servicer delivers the amounts held as Escrow funds and Temporary Buydown Subsidy funds for each mortgage sold through Cash-Released XChange.

- Freddie Mac calculates the interest adjustment, Servicing Spread, tax service fee and transaction fee. See the sections below for more information on how to calculate funding adjustments.

Any reconciliation, correction or adjustment to the amount of escrow funds or Temporary Buydown Subsidy funds transferred to the Transferee Servicer is the responsibility of the Seller/Transferor Servicer and the Transferee Servicer. Freddie Mac will not adjust, calculate, refund or pay any amounts with respect to the escrow funds or Temporary Buydown Subsidy funds after the Funding Date. See Guide Section 6101.7(c) for additional information.

Escrow Funds

Escrow funds are entered into Loan Selling Advisor by the Seller. Note, Freddie Mac does not validate the amounts entered. If the borrower’s monthly mortgage payment includes escrow amounts, you will enter the total amount of escrow funds collected from the borrower at closing, less the aggregate amount in the Other Funds Collected at Closing Detail section of the Create/Modify loan page. The aggregate amount represents any disbursements due to the collection authority 60 days after the servicing transfer.

Unapplied Temporary Buydown Subsidy Funds

Unapplied temporary buydown subsidy funds are entered into Loan Selling Advisor by the Seller, and the accuracy of these amounts is not validated by Freddie Mac. If the mortgage was originated with a temporary subsidy buydown, Seller must enter the amount of the unapplied temporary buydown subsidy in the Other Funds Collected at Closing Detail section of the Create/Modify Loan page.

Accrued Interest/Interest Adjustment

The Seller is due accrued interest for each mortgage sold to Freddie Mac except when the Funding Date is the first (1st) of the month. When the Transferee Servicer is due the interest, it is identified as an Interest Adjustment. The accrued interest is due the Seller and the Interest Adjustment is due the Transferee Servicer under the following circumstances:

-

When the Freddie Mac Funding date is not the first of the month and occurs in the same month as the Due Date Last Paid Installment (DDLPI) date, the Seller is due the accrued interest. Refer to the table below on how to calculate.

-

When the Funding Date occurs in the month prior to the DDLPI date, the Transferee Servicer is due the interest adjustment. Refer to the table below on how to calculate.

|

Scenario A = Seller is due the Accrued Interest |

Scenario B = Transferee Servicer is due the Interest Adjustment |

|

Loan Details |

Loan Details |

|

Loan Acquisition UPB Amount $137,000 |

Loan Acquisition UPB Amount $137,000 |

|

Note Rate Percent 7.500% |

Note Rate Percent 7.500% |

|

Accounting Net Yield 7.250% |

Accounting Net Yield 7.250% |

|

Servicing Spread .250% |

Servicing Spread .250% |

|

Note Date 10/01/2019 |

Note Date 10/01/2019 |

|

Funding Date 10/01/2019 |

Funding Date 10/12/2019 |

|

LPIDD (DDLPI) 10/01/2019 |

LPIDD (DDLPI) 10/01/2019 |

|

Scheduled First Payment Due Date 11/02/2019 |

Scheduled First Payment Due Date 12/01/2019 |

|

No interest is due the Transferee Servicer because the Funding Date occurred between the first and 10th of the month, so there is no (zero-dollar) funding adjustment. The Transferor Servicer collects a payment from the borrower prior to their first reporting cycle to Freddie Mac; therefore, the Seller does not owe any interest to the Transferee Servicer. |

Calculation $137,000 x .0725 / 12 = $827.71 |

Servicing Spread Adjustment

The servicing spread adjustment is compensation for servicing mortgages for Freddie Mac. This amount is calculated by Freddie Mac as follows:

-

When the Funding Date occurs in the same month as the DDLPI date, the Seller is due the servicing spread adjustment. Refer to the table below on how to calculate.

-

When the Funding Date occurs in the month prior to the DDLPI date, the Transferee Servicer is due the servicing spread adjustment. Refer to the table below on how to calculate.

|

Scenario A = Seller is due the Servicing Spread Adjustment |

Scenario B = Transferee Servicer is due the Servicer Spread Adjustment |

|

Loan Details |

Loan Details |

|

Loan Acquisition UPB Amount $137,000 |

Loan Acquisition UPB Amount $137,000 |

|

Note Rate Percent 7.500% |

Note Rate Percent 7.500% |

|

Accounting Net Yield 7.250% |

Accounting Net Yield 7.250% |

|

Servicing Spread .250% |

Servicing Spread .250% |

|

Note Date 10/01/2019 |

Note Date 10/01/2019 |

|

Funding Date 10/05/2019 |

Funding Date 10/11/2019 |

|

LPIDD (DDLPI) 10/01/2019 |

LPIDD (DDLPI) 10/01/2019 |

|

Scheduled First Payment Due Date 11/02/2019 |

Scheduled First Payment Due Date 12/01/2019 |

|

Calculation $137,000 x .0250 x 4-days/360 = $3.81 |

Calculation $137,000 x .0250 x 21-days/360 = $19.98 |

Tax Service Fee

The tax service fee is $80 and is subject to change without notice at the Transferee Servicer’s discretion. This fee is a funding adjustment deducted from your sales proceeds, and it is transferred to the Transferee Servicer by Freddie Mac.

Transaction Fee

The transaction fee of $150 (which is subject to change without notice at the Transferee Servicer’s discretion) is due the Transferee Servicer. The transaction fee is associated with the initial costs of setting up a mortgage for servicing. It is deducted from your sales proceeds and transferred to the Transferee Servicer by Freddie Mac.

Settlement Statements

The Loan Purchase Statement and the Funding Details Report are referred to as “settlement statements”. They confirm loan funding and the total disbursement to the Transferor Servicer and the Transferee Servicer. The statements are available in Loan Selling Advisor on the Funding Date:

-

Loan Purchase Statement - discloses the total amount disbursed to the Seller for the mortgages sold. It also summaries pertinent data included in the amount funded to the Seller such as price information, accrued interest, etc.

-

Funding Details Report - provide detailed loan information that is used for servicing, accounting, and investor reporting purposes.

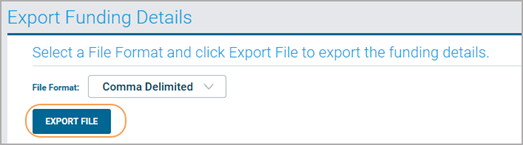

Export Funding Details

To export a funding details report, do the following:

-

From the main menu, click SETTLEMENTS, and then click View Settlement Statements.

-

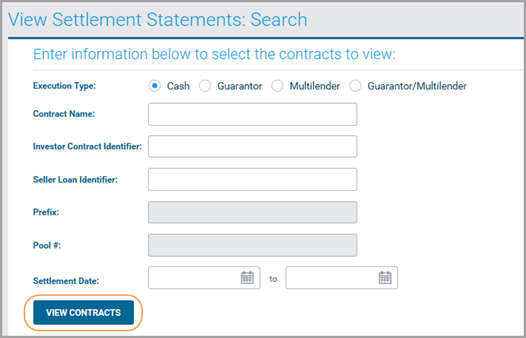

The View Settlement Statements: Search page displays. Enter your search criteria and click VIEW CONTRACTS.

-

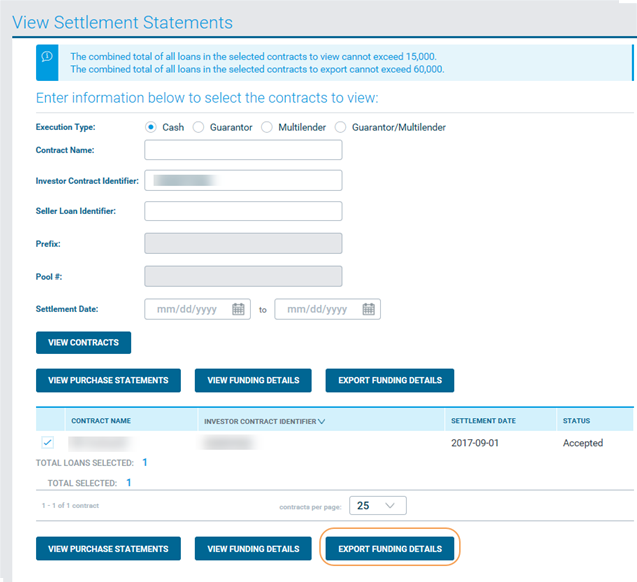

The View Settlement Statements page displays. Select the contract(s) you want to export by checking the boxes to their left. Then click EXPORT FUNDING DETAILS.

-

The Export Funding Details page displays. Select a File Format for the exported file and then click EXPORT FILE.

-

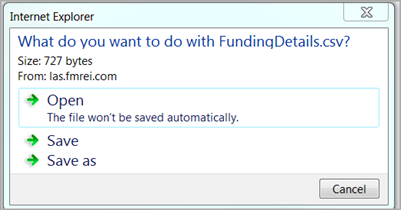

When the next window displays, choose whether you want to view the exported file or to save it.