Loan Pipeline Functions and Options

Contents

Create a Custom View

If you want to view specific loan result columns, you have the option to create a customized view. You must first search for loans and then follow the steps below:

-

From the Loan Pipeline results, click MANAGE button.

-

The Manage Search Results View window displays.

-

To create a custom view, click the Search Result Views drop down and select Create New View.

-

Next, make your selections for the custom view by:

-

Select the field name in the Available Columns box then

-

Click > icon to move it to the Selected Columns box

-

Enter a name in the Search Results View Name field

-

Click SAVE

-

-

A message will display confirming the file name was saved.

![]()

-

Close the window and you can now select the custom view from the drop down menu. Note: You can click the trash can to delete a custom view or click the default checkbox to default to this view.

Some columns contain hyperlinks which, when clicked, may lead you to a different page, status, and/or fee information. Here is additional information about columns with clickable links and their results:

-

Click the Seller Loan Identifier link to go to the Modify Loan page.

-

Click the Investor Contract Identifier to go to the Contract Details page.

-

Click the Certification Status of Certified to view the certification history for the loan.

-

Click the R&W Relief Co Status to view the collateral representation and warranty relief status message.

-

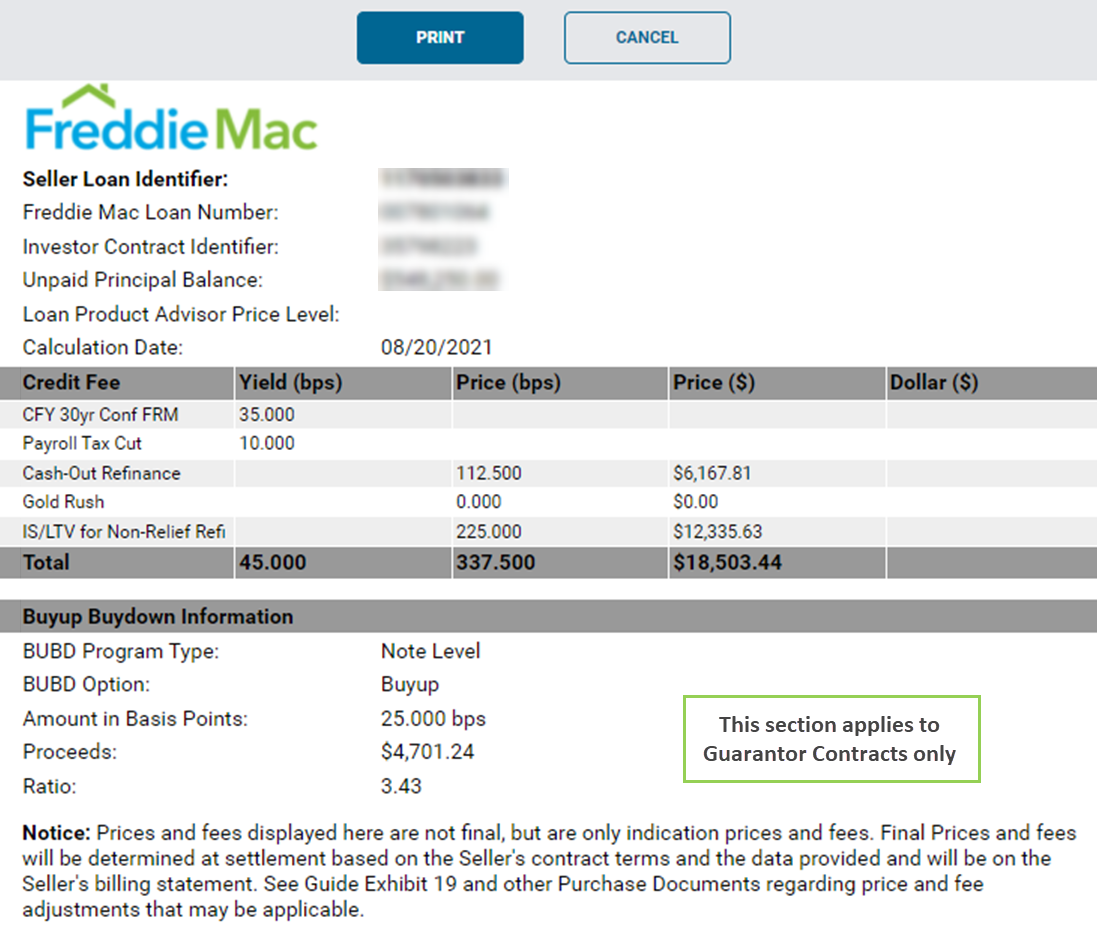

Click the value (a hyperlink) in the Credit Fees Yield (BPS), Credit Fees Price (BPS), Credit Fees Dollar ($), Total GFEE Add-On or Total Delivery Fees column to view a fee breakdown window, as in the figure that follow:

Loan Status

The following chart lists all possible loan statuses, along with their characteristics:

|

Loan Status |

|

|

Status |

Description |

|

New |

A loan has been created in Loan Selling Advisor but has not been certified. |

|

Certification Released |

A loan has been created in the system and has been successfully certified, but must be re-assessed. Changes cannot be made to certified data fields. In addition, if using a warehouse lender, Freddie Mac must receive the executed Form 996E, if applicable, before the loan can be funded. |

|

Ready to Fund |

A loan has been allocated to a contract, successfully certified, and from which purchase edits have been cleared. You can make modifications to fields that are not included in the certification process, and you can remove loans from the contract. |

| Settlement Locked |

A loan has been allocated to a contract and has been successfully certified, purchase edits have been cleared, and funding will occur based on the requested settlement date by the seller. Loan modifications cannot be made, and the loan cannot be removed from the contract. Guarantor/MultiLender Contracts may be voided with a contract status of “Accepted, Ready to Fund or Settlement Locked”. Contracts with a Settlement Locked status must be voided by the business day before the Settlement Date. Contracts that are forward sold (swap and sell) and voided after the contract has entered the settlement cycle (Settlement Locked status) (occurs after 8 PM on the final delivery date), may be subject to costs due the investor. |

|

Funded |

The loan has funded. |

Function/Action buttons

Access the Loan Pipeline: Action/Function Buttons tutorial to learn how to efficiently perform tasks on allocated and unallocated loans, across multiple contracts.

View/Modify Loans

With the exception of Best Efforts loans, you can view and/or modify loans after they are saved in Loan Selling Advisor by doing the following:

-

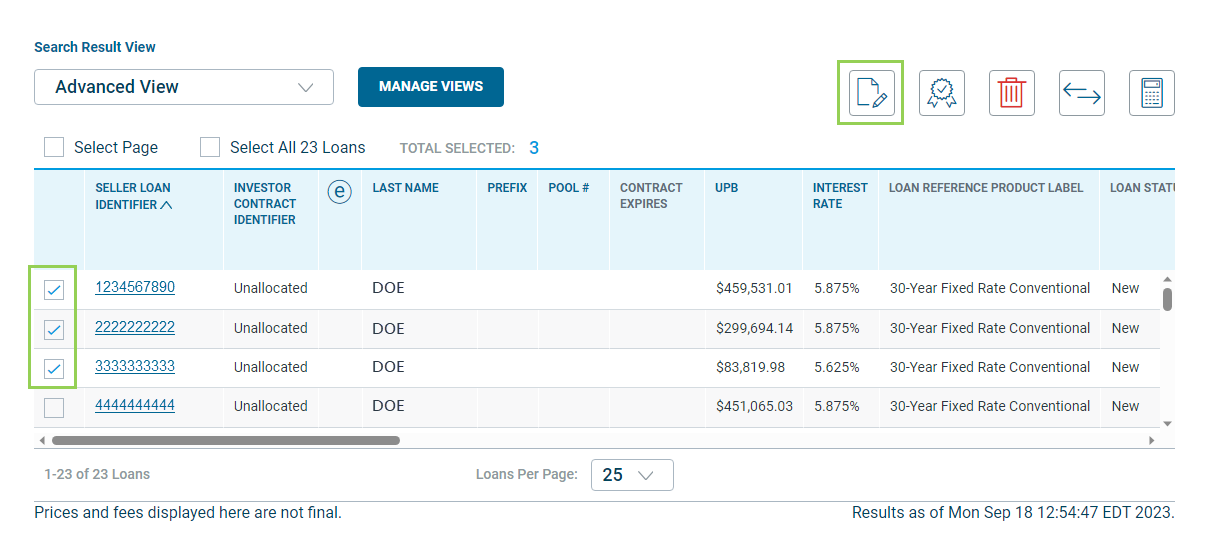

Once you have completed your search, the Loan Pipeline page re-displays with a list of loans that meet your criteria.

-

Select the loans you want to view and/or modify by checking the box next to the loan.

-

Click the View/Modify

icon

icon

-

The Modify Loan page displays with the loans you selected. Locate the data field you want to edit, and make your modifications. Note: Click the + symbol to expand and view all the fields in a section. Click the green circles in the image below to understand how to navigate the page and layout.

After you complete all of your modifications, click FINISH button or Finished at the top right of the screen. Note: for all Cash contracts, except Best Efforts contract, if you modify loan data, any associated price change will occur immediately upon re-saving the loan and/or data change. In Loan Selling Advisor, this happens when you click the FINISH button or when you re-import and overwrite loans.

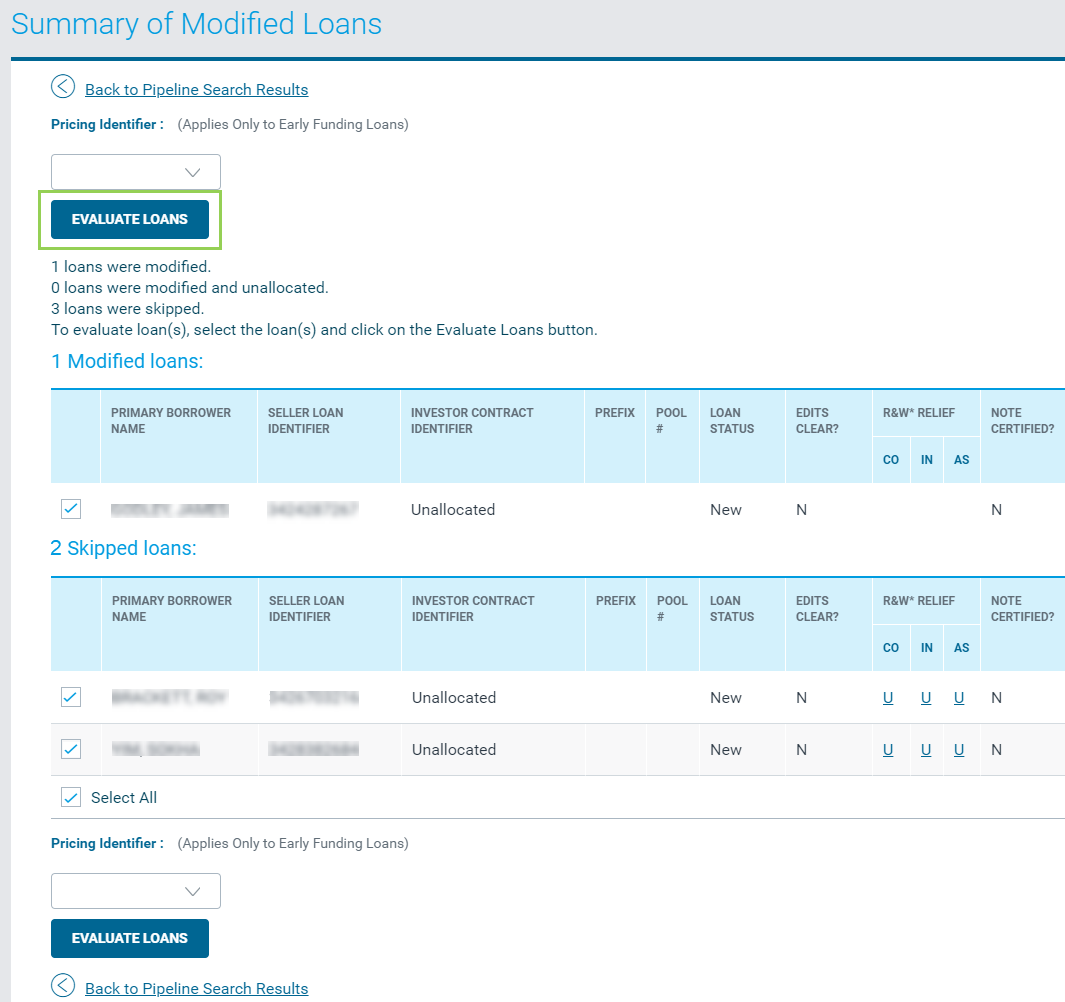

The Summary of Modified Loans page displays and displays a summary of the loans you just modified. To assess all the loans that you just modified, check the Select All box and then click EVALUATE LOANS. If you don’t need to assess all the loans, click Back to Pipeline Search Results to return to the Loan Pipeline Search Results page.

Note:

-

You can only modify Best Efforts loans from Contract Details page, not the Loan Pipeline page.

-

To modify a Best Efforts loan where the 1034E has not been built, you must modify it via the Contract Details page, by clicking the Modify Best Efforts Contract link in the Options section.

-

You can see the results of Loan Product Advisor assessments in the Loan Product Advisor Details section of the Modify Loan page. The LPA indicator shows whether the loan is determined to be LPA, Non LPA, or LPA Exclude.

Evaluate/Assess Loans

Loans must be assessed and all critical edits cleared before funding can occur. Loans are assessed for accuracy, completeness, and alignment with Freddie Mac requirements and your terms of business. While loan edits can be cleared any time after the loan is saved in the system, we recommend assessing loans after they are allocated to a contract.

Follow these steps to assess loans in Loan Selling Advisor:

- From the LOANS menu, click View Loan Pipeline.

- The Loan Pipeline page displays. Enter search criteria and click SEARCH.

- The Loan Pipeline page refreshes and displays your results.

- Select the loan(s) you want to evaluate by clicking the checkbox next to each loan or by clicking the box Select Page or Select All Loans. Then, click the Evaluate icon. Note: if you have a Master Commitment/Pricing Identifier (in the Seller/Servicer Guide, this is called a Pricing Identifier), the system lets you select which one you want loans evaluated against.

- The Evaluate Loan page displays loans in Seller Loan Identifier order. If you evaluated multiple loans, click the Next Loan (No Save) arrow to navigate to the next loan. Refer to the screenshot and table below to understand the layout and how to navigate the page.

| Number | Name | Description |

|

1 |

Loan Data Tab |

The Loan Data tab, when clicked, expands and reveals loan information, as shown in the example below:

Note: Click the double arrows to collapse the tab. |

|

2 |

Calculated Values Tab |

The Calculated Values tab, when clicked, expands and displays system calculated values for the loan as shown in the example below: Click the field name to access field level

Note: Click the double arrows icon to collapse the Calculated Values tab. |

|

3 |

Next Loan (No Save) |

The Next Loan (No Save) link lets you navigate to the next loan without saving edits on the loan you are currently viewing. |

|

4 |

Finished |

Click Finished when you have completed reviewing and editing the loans. |

|

5 |

Error Type |

There are three types of errors/edits: Critical Errors. These errors prevent the loan from moving to a Ready to Fund status. They must be corrected before the contract and loan can fund/settle. Be sure to review the error messages carefully as they provide guidance on how to resolve them. R&W Relief. Loan Selling Advisor confirms the loan's overall representation and warranty relief status for each relief type. In addition to the relief status, each loan receives relief messages to clarify the overall status. Warnings. Warning messages do not have to be corrected and do not prevent funding/settlement from occurring. However, Freddie Mac recommends that you review the messages to determine whether data is accurate and complete and take appropriate steps to clear them if necessary. |

|

6 |

LIST | DETAILS |

The LIST view defaults to the Critical Errors tab. The number of errors displays in each tab title. The LIST view provides a listing of the error message Compliance Type and a comprehensive description of the error for Critical Errors, R&W Relief, and Warning messages. Click each tab to view the error messages. The DETAILS button to view one error message at a time. Click the left or right arrow buttons to navigate to the previous or next message. Tip: Use CTRL + F to quickly search for the data field name to make loan edits. |

|

7 |

SAVE AS DRAFT |

Click SAVE AS DRAFT button to save your edits without evaluating the loan. |

|

8 |

SAVE & EVALUATE |

Once you have finished editing the data, click the SAVE & EVALUATE button to save your edits and re-evaluate the loan. |

- Once you cleared the critical errors for all of the loans, click Finished.

- The Summary of Evaluated Loans page displays. Review the EDIT CLEAR? column for a Y, which indicates that the edits have cleared. If an N displays, you must return to the loan and clear the remaining critical edits by first clicking Back to Pipeline Search Results and then repeat steps 3 through 6.

Note: If you evaluated five or more loans, the evaluation will run in the background and the system will prompt you to name the file if desired otherwise the system will name it for you. We recommend naming the file.

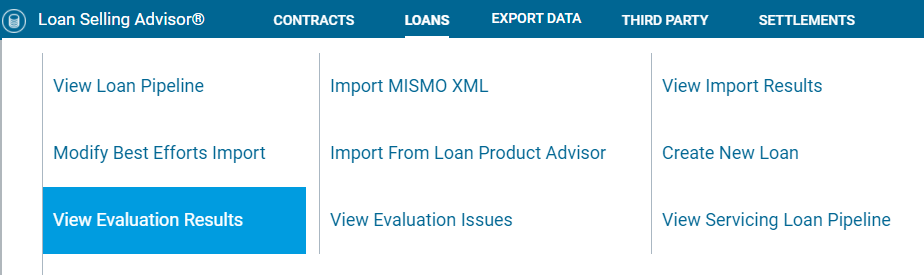

- To access the file, go to the LOANS menu and click View Evaluation Results.

- The View Evaluation Results page displays. Next, click the Evaluation Record Name link.

See the View Evaluation Issues - from View Evaluation Results Page topic for more details.

Deleting Loans

Loan Selling Advisor provides you with the ability to delete loans. If the loan is allocated to a contract, however, and if Form 996E (if applicable) and Form 1034E were built, you must first remove the loan(s) from the form and then remove it from the contract before it can be deleted from the loan pipeline. To delete loans, do the following:

-

From the Loan Pipeline page, enter your search criteria. You must select at least one field in your search request.

-

Click Search.

-

The Loan Pipeline page re-displays with loans that meet your search criteria. Check the boxes next to the loan(s) you want to delete and click Delete icon.

-

A confirmation message displays, asking if you are sure you want to delete the loans. Click OK to delete the selected loan(s).

-

The Summary of Deleted Loans page displays with a confirmation message.

Compare With Loan Product Advisor® (LPA)

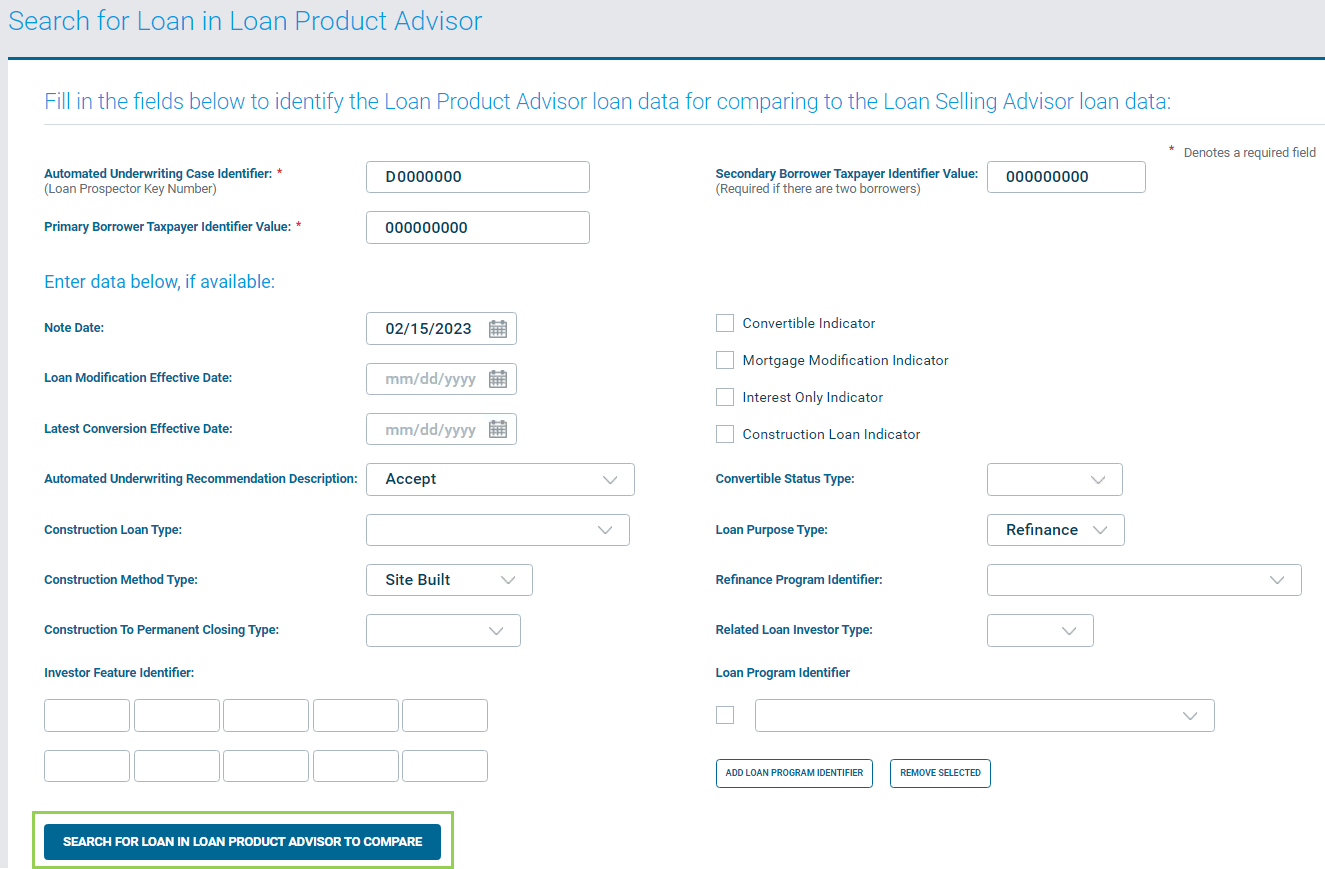

Loan Selling Advisor lets you compare its data with the corresponding data in LPA. The comparison allows for up to five borrowers per loans. When the data does not match, you have the option to overwrite data in Loan Selling Advisor with data from LPA. To perform the comparison, you must first search for the loan by using the following search criteria:

-

Automated Underwriting Case Identifier (LPA Key Number)

-

Primary Borrower Taxpayer Identifier Value

-

Secondary Borrower Taxpayer Identifier Value (required if there are two borrowers)

When a matching transaction is found, a comparison is performed and identifies values that do not match. You may then select which values you want to overwrite in Loan Selling Advisor. Use the following steps to compare in Loan Selling Advisor with the companion data in Loan Product Advisor:

-

From the main menu click LOANS and then click View Loan Pipeline.

- In the Loan Pipeline page, enter your search criteria. You must enter search criteria in at least one search field.

- Click Search.

- The Loan Pipeline page redisplays with a list of loans that meet your search criteria.

- Select the loan(s) you want to compare by checking the checkbox next to each loan. (You can select all loans on the page by checking the Select Page box. Click the Compare with Loan Product Advisor icon.

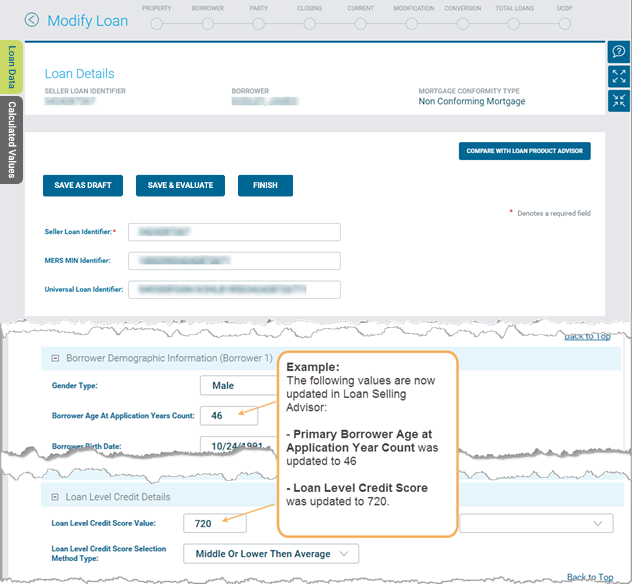

- The Modify Loan page displays. Click COMPARE WITH LOAN PRODUCT ADVISOR.

-

A Confirmation message displays. Click OK if you saved loan edits.

-

The Search for Loan in Loan Product Advisor page displays. Make sure the pre-populated data in the required (*) fields match your loan. If they do not, modify the data.

- Click SEARCH FOR LOAN IN LOAN PRODUCT ADVISOR TO COMPARE. The Search for Loan in Loan Product Advisor page redisplays with results.

- Review the results and click the value(s) you want to overwrite in Loan Selling Advisor.

Note:

-

Only values that do not match exactly will display under the search area of the page. Values that match will not display.

-

If you do not want to update any changes to Loan Selling Advisor, click Return to Modify Loan (no Save).

- Click UPDATE FORM.

-

The Modify Loan page redisplays with the overwritten data.

-

Click FINISH.

Calculate Loan Acquisition Scheduled UPB Amount

Freddie Mac Single-Family Seller/Servicer Guide, Sections 6302.2, 6302.3, 6302.4, 6302.22, and 6302.26, require that you calculate and deliver the Loan Acquisition Scheduled Unpaid Principal Balance (UPB) Amount for the month of funding. Loan Selling Advisor makes it easy for you to comply with these requirements by calculating the scheduled UPB for you from the Loan Pipeline page. This functionality is available for fixed-rate mortgages only. If your user role permits you to modify loans, you have access to this functionality.

When using Loan Selling Advisor to calculate the Loan Acquisition Scheduled UPB Amount, you have the option of updating the loan’s existing Loan Acquisition Scheduled UPB Amount and Last Paid Installment Due Date fields with the newly calculated amount and date. Keep in mind that the Current UPB and Settlement Date are used to calculate the Loan Acquisition Scheduled UPB Amount; therefore, it is important for you to provide data in Loan Selling Advisor that is complete and accurate. If a loan contains inaccurate data for values such as the original P&I, this will result in an incorrect calculation. We encourage you to confirm the calculated Loan Acquisition Scheduled UPB Amount against the loan’s amortization schedule.

Mortgages sold through Cash-Released XChange, or under the Guarantor and MultiLender programs, receive a critical edit if they do not meet the scheduled UPB requirements. You must clear this edit by using Loan Selling Advisor to calculate the Loan Acquisition Scheduled UPB Amount or by manually updating the current information in the Loan Acquisition Scheduled UPB Amount and the Last Paid Installment Due Date fields in order for your loan to move into a Ready to Fund status. For all other contract types, you will receive a warning message. When delivering Best Efforts loans, you can use Loan Selling Advisor to calculate the scheduled UPB after Form 1034E is built.

To calculate the Loan Acquisition Scheduled UPB Amount and Last Paid Installment Due Date, do the following:

-

From the Loan Selling Advisor main menu, click LOANS, and then click View Loan Pipeline.

-

In the Loan Pipeline page, enter your search criteria. You must enter data in at least one search field. Then click Search.

-

The Loan Pipeline page redisplays with a list of loans that meet your search criteria. Select the loans you want to perform calculations on by checking the box next to the Seller Loan Identifier. (Select all loans on the page by checking the Select Page box.

-

Click the Calculate Loan Acquisition Scheduled UPB Amount icon.

-

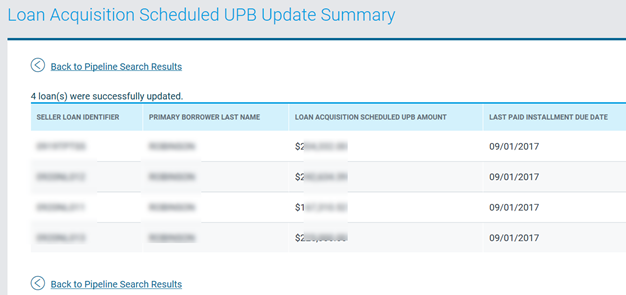

The Loan Acquisition Scheduled UPB Results page displays. To update the Loan Acquisition Scheduled UPB Amount and Last Paid Installment Due Date, select the loan(s) to be updated and click Update Loans. (Note: You can select up to 700 eligible loans to have the system perform the calculations upon).

-

The Loan Acquisition Scheduled UPB Update Summary page displays, showing the loans that were successfully updated. To return to the Loan Pipeline page, click Back to Pipeline Search Results.