Request Draft

Overview

Although optional, you may submit a DRAFTReq (Draft Request) through the Resolve® user interface (UI) and the Retention application programming interface (API) with limited data to determine whether the loan is eligible for review of a Payment Deferral workout. Draft requests are optional.

When sending a Draft Request, the borrower is under consideration for a Payment Deferral however, additional information is required. This request can be leveraged as a "test" to determine if the requested workout is a viable option for a borrower.

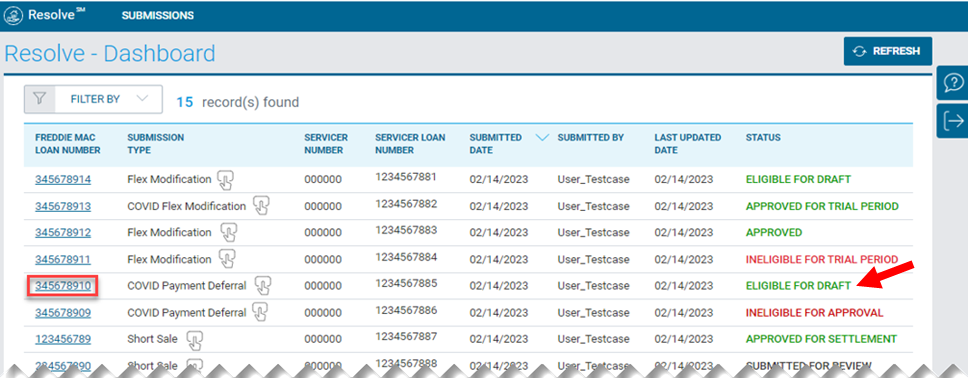

Once a draft request has been submitted, Resolve will render an Eligible for Draft or Ineligible for Draft status.

| If Resolve renders: | Action: |

| Eligible for Draft | Proceed with a request for Workout Approval once all required data has been obtained. |

| Ineligible for Draft | Update the file and re-submit or Cancel |

Any subsequent actions (e.g., WAReq) can be completed through the API or the UI submission paths.

Submit loan data through the Resolve UI upload submissions functionality using the Freddie Mac provided Payment Deferral Template. Refer to the Request Payment Deferral Workout section for the process steps to submit a Draft Request.

Use the metadata tab of the Payment Deferral Template to identify the required, conditional, or optional as well as non-applicable data fields to build your file. (e.g., the Freddie Mac loan is a required field for the submission of a DRAFTReq).

Note: Exception Review does not apply to a DraftReq (Draft Request). If the user submits a draft request with an exception review indicator populated with a 'Y' (Yes) to indicate that it is an exception review request, a message is returned directing the user to submit an exception review request, if applicable, beginning with the 'WAReq (Workout Approval).

Insert a interim month during a DRAFT Request

Resolve® provides the capability to determine the impacts of inserting a interim month when submitting a Draft request (DraftReq) by providing the Requested First Payment Due Date on the Retention File Template. While optional with a Draft request, to settle a payment deferral with a interim month, the Requested First Payment Due Date must be submitted with the Workout Approval request (WAReq) submission. Resolve does not retain the interim month even when submitted via a Draft request. For more details, refer to the Insert Interim Month section.

Proactive Solicitation for a Payment Deferral

When evaluating borrowers for a proactive Payment Deferral offer, Servicers must ensure the terms included in the proactive offer do not change before the time for acceptance of the offer has elapsed. To this end, Servicers must use Workout Approval Request (WAReq) to determine the terms of the proactive offer.

Should a borrower not accept the proactive offer, Servicers must ensure they cancel the workout in Resolve on or before the third business day of the month following the month of the trial period start date.

The terms of a proactive offer for Payment Deferrals must be established using WAReq. Servicers must not use draft request (DRAFTReq) when evaluating borrowers for a proactive Payment Deferral offer. Should Servicers base a proactive Payment Deferral offer using draft request and the terms change prior to settlement, the Servicer must settle the workout as an exception using the terms provided in the proactive offer. Servicers may leverage DraftReq to determine if a requested workout is a viable option for the borrower.