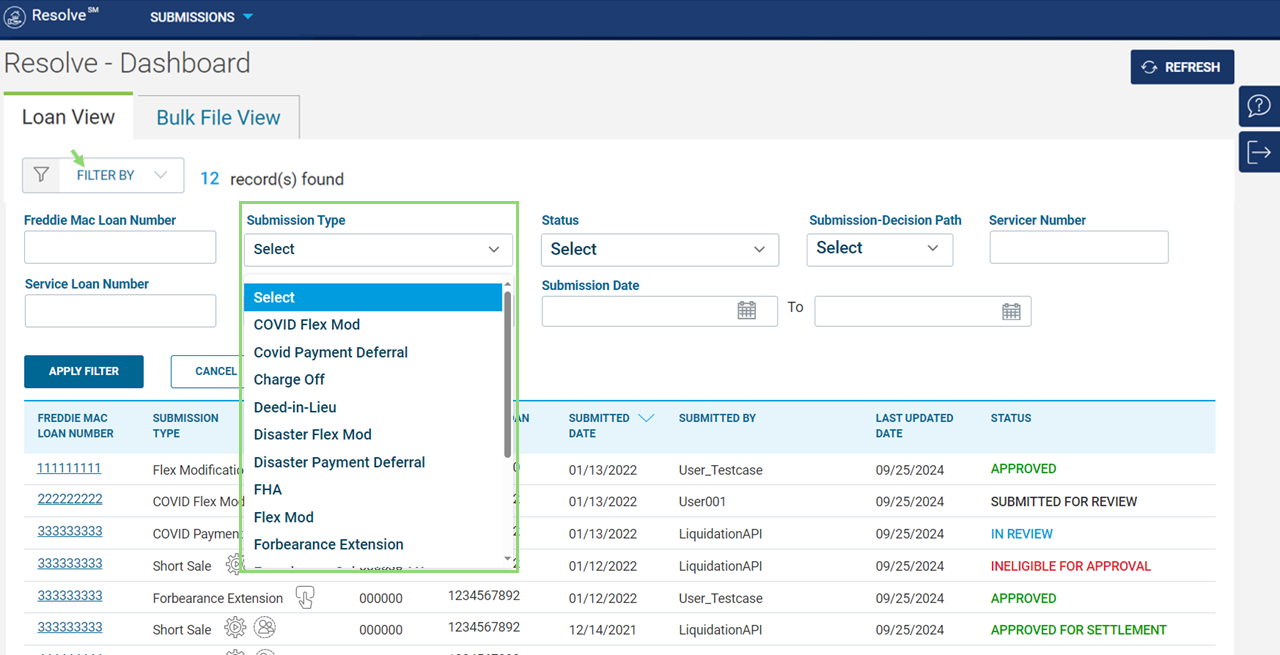

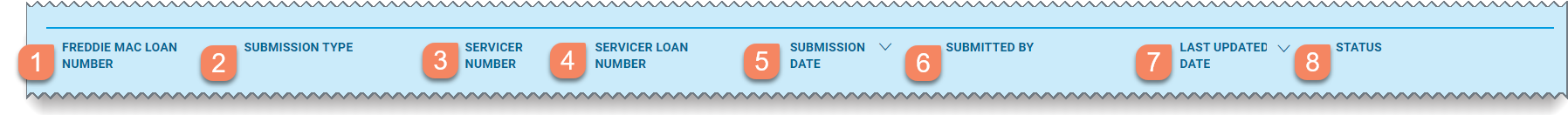

Dashboard Data Fields

Resolve's Dashboard has eight data fields which provide summary information for each request. All of the data fields have sort capabilities.

The table below provides a brief description of each data field.

| Data Field Name | Type | Description |

|---|---|---|

| Freddie Mac Loan Number | Numeric |

Nine-digit unique Freddie Mac identifier assigned to the loan. Note: The Freddie Mac loan number becomes a hyperlink when the workout request has been submitted and decisioned. This includes all workout status types submitted through the Resolve user interface (UI) or Retention application programming interface (API). |

| Submission Type | Text |

Identifies the non-performing loan remediation request type. Currently, the following types of workout programs are available in Resolve:

Submission types are listed alphabetically on the dashboard. FILTER BY the Submission Type drop down list.

Submission Icons: Icon(s) display next to each submission type providing additional detail. Refer to the table below for a list of icons and what they mean:

|

| Servicer Number | Numeric |

Six-digit unique Freddie Mac identifier assigned to the organization servicing the loan. |

| Servicer Loan Number | Numeric or Alpha-Numeric |

A unique identifier assigned by the Servicer to identify the loan. |

| Submission Date | Date (mm/dd/yyyy) |

The date the workout request was submitted to Freddie Mac. |

| Submitted By | Text |

The ID of the Resolve user who submitted the request.

Exception workout requests submitted through the Resolve® Liquidation API will be identified as "Liquidation API".

For retention workouts submitted via the API, the field displays "Retention API" For liquidation workouts submitted via the API, the field displays "Liquidation API". When the workout is submitted through the user interface (UI), the dashboard reflects dashes ( -- ) in this field for a prior workout on a loan that has been transferred from the Transferor to the Transferee Servicer.

|

| Last Updated | Date (mm/dd/yyyy) |

The date the request status was last updated. |

| Status | Text |

Statuses are listed alphabetically on the Dashboard. FILTER BY the Status drop down list.

The Status indicates the stage in the decisioning process. The Status field is dynamic and changes as the request moves through the decisioning process. Charge-Off There are 9 color-coded statuses. Hover over each status name to view a description

Deeds-in-Lieu of Foreclosure There are 14 color-coded statuses. Hover over each status name to view a description.

FHA/VA/RHS Modification There are 4 color-coded statuses. Hover over each status name to view a description. . Modifications (Flex Modification, Disaster Flex Modification, Custom Modification, Bankruptcy Cramdown) There are 20 color-coded statuses. Hover over each status name to view a description. Forbearance ExtensionThere are 4 color-coded statuses. Hover over each status name to view a description.

Foreclosure Sale Reporting (Third Party, REO, HUD/VA) There are 10 color-coded statuses for Foreclosure Sale Reporting submissions. Hover over each status name to view a description.

Payment Deferrals (Payment Deferral, Disaster Payment Deferral) There are 17 color-coded statuses for Payment Deferral workouts. Hover over each status name to view a description. Short SalesThere are 14 color-coded statuses for short sale workouts and settlements. Hover over each status name to view a description.

Simultaneous Assumption and Flex Modification There are 19 color-coded statuses for simultaneous assumption and Flex modification. Hover over each status name to view a description.

|